Mayer Brown Revenue Jumps as Firm Boosts New York Practice, International Work

The firm grew revenue for the sixth straight year on the back of a boost in its New York office and client work across borders.

March 11, 2019 at 03:45 PM

4 minute read

Mayer Brown's offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM.

Mayer Brown's offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM.

Mayer Brown in 2018 enjoyed one of its strongest financial performances in recent years, driven by nearly doubling its corporate practice in New York and more cross-border legal matters.

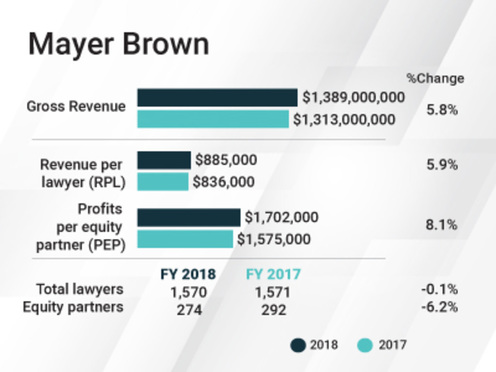

The Chicago-founded international firm's revenue grew nearly 6 percent last year to just shy of $1.4 billion, according to preliminary ALM data. Profits per equity partner rose 8 percent to $1.7 million, and revenue per lawyer was up nearly 6 percent, at $885,000. The firm's head count was virtually flat at 1,570 lawyers, while its ranks of equity partners declined by about 6 percent to 274.

Part of the firm's success was due to growth in its New York corporate practice, where head count rose from about 30 lawyers to more than 60 during the year, firm chairman Paul Theiss said in an interview.

Part of the firm's success was due to growth in its New York corporate practice, where head count rose from about 30 lawyers to more than 60 during the year, firm chairman Paul Theiss said in an interview.

Meanwhile, a record 66 of the firm's top 100 clients by revenue worked with Mayer Brown lawyers in all three of its international regions (The Americas, Asia and Europe), Theiss said.

The firm's financial performance was fairly even across the board, Theiss said. All three regions saw revenue and PEP rise between 5 and 9 percent from the prior year, and its transactional and litigation practices grew in roughly equal amounts, Theiss said. The firm opened a Tokyo office in 2018.

“That is the sign of a healthy and thriving law firm,” Theiss said. “Across geographies and across practice areas we continue to improve together. And our clients value that, and our partners value that.”

Mayer Brown last year hired 50 lateral partners and has made about 10 more hires this year, Theiss said.

Some of those notable hires last year included Nicole Saharsky, the former co-chair of Gibson, Dunn & Crutcher's constitutional law practice; Glen Kopp, a former chair of Bracewell's white-collar practice group in New York; Hallam Chow, a Beijing-based former project finance partner at White & Case; a number of partners in Tokyo; and a pair of London-based partners that included Sam Eastwood, the former head Norton Rose Fulbright's business ethics and anti-corruption group.

Despite the new partner hires, Mayer Brown's equity partnership has fallen the last two years, including the 6 percent drop last year. Theiss characterized the decline in the firm's equity partner ranks as “an aberration” mostly due to a high number of retirements.

Not all the firm's hires worked out. James Tanenbaum, who joined the firm's capital markets group from Morrison & Foerster, resigned from Mayer Brown shortly after he joined after it surfaced that he faced sexual harassment allegations at his prior firm. (In a letter to ALM editors last year, Tanenbaum said he “never harassed anyone or intentionally made anyone feel uncomfortable.”)

Mayer Brown last year also suffered the loss of the highly lauded leader and founder of its Supreme Court practice, Stephen Shapiro, who was killed in August. Shapiro's brother-in-law faces a murder charge in his death.

In the first few months of 2019, Mayer Brown has made a handful of notable hires, including Steven Tran, a Hong Kong-based M&A partner formerly at Hogan Lovells; Paul Chen, a former leader of DLA Piper's U.S. insurance transactions team in Northern California; and, also in Northern California, a three-partner insurance team led by former Dentons global insurance practice co-leader Kara Baysinger.

The firm's top-line growth last year represents its sixth straight year of revenue growth. The firm's PEP in that time has grown by nearly 50 percent.

Theiss said the firm would continue to focus on adding talent to make its international platform more attractive to existing and potential clients. He noted the lateral market is the most competitive he has seen it since his career began in 1985 at Mayer Brown.

“The competition is taking place for talent, and it's also taking place in the hearts and minds of our clients,” Theiss said. “We think the hallmarks of Mayer Brown are a relentless focus on professional excellence and client service, and that's how we continue to be leaders in driving the firm forward.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute read

‘High Demand’: Former Trump Admin Lawyers Leverage Connections for Big Law Work, Jobs

4 minute readTrending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250