FisherPhillips Makes Big Gains in Revenue, Profit

A jump in demand fueled the national labor and employment firm's profit rebound.

March 14, 2019 at 06:23 PM

5 minute read

The original version of this story was published on Daily Report

Roger Quillen of Fisher Phillips. (Photo: John Disney)

Roger Quillen of Fisher Phillips. (Photo: John Disney)

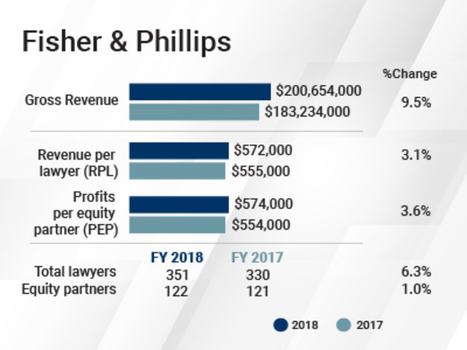

Fisher & Phillips posted significant increases in revenue and profit last year, following a growth slowdown for both metrics in 2017.

The national labor and employment firm's revenue surged 9.5 percent to $200.65 million, and net income grew 4.7 percent to $70.13 million.

A 6.3 percent head count increase meant all the revenue gain did not translate into higher revenue per lawyer (RPL), which increased by 3.1 percent to $572,000.

The firm also incurred expenses from an ongoing technology investment push and higher associate salaries. As a result, profit per equity partner (PEP) increased at a slower rate than net income, rising 3.6 percent to $574,000. That was a big improvement, however, from 2017, when PEP declined slightly, by 1.1 percent ($6,000) to $554,000.

FisherPhillips' chairman, Roger Quillen, who is marking his 20th anniversary in June as chairman and managing partner, attributed the 9.5 percent revenue jump mostly to a notable increase in client demand, which grew by 7.3 percent last year. Productivity per lawyer also increased slightly, by 1.1 percent, he said, and the firm raised its effective billing rate by 2.6 percent, on par with the industry.

By contrast, in 2017 average billable hours per attorney had declined by 1.4 percent and the firm experienced an unusual degree of associate attrition, which Quillen told the Daily Report last year stemmed from pay scales that were no longer competitive in some cities.

By contrast, in 2017 average billable hours per attorney had declined by 1.4 percent and the firm experienced an unusual degree of associate attrition, which Quillen told the Daily Report last year stemmed from pay scales that were no longer competitive in some cities.

Quillen said that last year the firm reviewed associate salaries city by city and made increases, and then it further adjusted salaries in some areas in January to meet the market rate in New York, Chicago, Boston, California and other competitive legal markets. “We are very market-driven,” he said.

The firm also continued to invest heavily in IT upgrades, which encompassed personnel, hardware and software, Quillen said, increasing its usual IT spend by $3 million last year. “FisherPhillips is investing heavily to ensure a long-term competitive position vis a vis our largest competitors,” Quillen said.

Improving internet security and data privacy has been one push. Sophisticated clients, Quillen noted, now audit their outside firms on the level of data privacy and cybersecurity protections. “They do not want their law firm to be the weak link,” he said.

Investing in data analytics and knowledge management, which can make pricing and outcomes more predictable for clients, has been another focus. Finally, FisherPhillips has invested in its client-focused extranet. “In the legal industry there is great concern for legal tech, not just internally but in how we interface with clients. We want it to be friendly and compatible with clients who want to interface in this way,” Quillen said.

FisherPhillips has budgeted a similar increased spend on IT for 2019, Quillen added.

The Talent

While the firm added no new offices last year, its 6.3 percent attorney head count increase amounts to almost double its lawyer growth rate in 2017. Average attorney head count for 2018 grew by a net of 21 lawyers, but the firm actually had increased head count at year-end by a net of 40 lawyers, Quillen said, ending the year with about 370 attorneys.

The firm lost roughly 40 attorneys to attrition, and half of those went in-house, Quillen said, as companies continue to build up their in-house legal departments. He identified the lure of the in-house law department as one of the top challenges facing large law firms. “It costs us talented attorneys,” he said, adding that it also affects the volume of work and pricing.

FisherPhillips made some big lateral hires in Washington, recruiting Theresa Connolly, an employment litigation partner with a focus on trade secret misappropriation, from Constangy, Brooks, Smith & Prophete to become the head of its office there, along with another Constangy partner, Boyd Rogers, who worked closely with her. (Rogers later took an in-house job at HR provider TriNet as managing counsel for HR compliance, labor and employment.)

The firm expanded its D.C. presence in January by acquiring a six-lawyer employment law boutique, The Farrington Law Firm, including partners Dan Farrington, Margaret Jacobsen Scheele and Sarah Biran. Farrington became the co-managing partner with Connolly for the D.C. operation.

FisherPhillips announced in June that it had named Southern California-based partner Regina Petty as its first chief diversity officer.

As far as practice activity, Quillen said FisherPhillips is “extremely busy” in states with aggressive enforcement regimes and active plaintiffs bars as the federal regulatory regime continues to lag. “We are struggling to meet our attorney hiring needs in those states,” he added.

Laws and regulations around gender pay equity are an active area, he said, along with an increase in sexual harassment claims. Medical and recreational marijuana as it affects the workplace is also a hot area, since there are significantly conflicting federal, state and local laws.

“We are assuming in our planning a recession late in the year,” Quillen said, but he added that FisherPhillips is not seeing any indicators so far in its practice activity.

Labor and employment firms generally see an uptick in single-plaintiff workplace complaints for their clients during a recession, he added, because it's harder for employees to get a new job elsewhere.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250