Schulte Roth Sees Profits Rise in 2018 as Transition Approaches

The firm grew revenue and partner profits as it paves the way for generational change and new leadership.

March 19, 2019 at 02:42 PM

4 minute read

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

Schulte Roth & Zabel turned in “a solid year” in 2018, executive committee chairman Alan Waldenberg said, as it pivots toward a younger generation of lawyers and leaders.

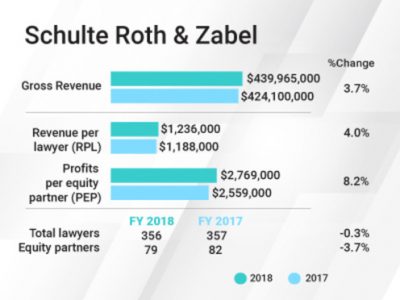

The New York-based firm saw gross revenue increase by 3.7 percent in 2018, to $439.97 million, as revenue per lawyer (RPL) increased by 4 percent, reaching $1.24 million.

Profits per equity partner (PEP) jumped 8.2 percent to $2.77 million in 2018, split across a slightly smaller partner tier of 79 lawyers. The firm has no nonequity tier.

Still, net income was up by 4.3 percent, at $218.75 million for the firm, which boasted a 50 percent profit margin in 2018, up one percentage point from 2017.

Still, net income was up by 4.3 percent, at $218.75 million for the firm, which boasted a 50 percent profit margin in 2018, up one percentage point from 2017.

The firm did not take any unusual cost-cutting measures in 2018, Waldenberg said. And rates increased consistent with the rest of the market. With regard to the profit margin growth, he said, “some other people are really good at running the business.”

Waldenberg credited strength in practices “across the board” for the firm's 2018 performance. The M&A, litigation and shareholder activism practices were especially active, he said, highlighting several matters.

A major deal the firm worked on was Veritas Capital's $1.05 billion acquisition of a large health care unit from GE. Schulte Roth also represented Albertsons in its attempt to merge with Rite Aid, though the deal ultimately failed.

In its activist practice, which Waldenberg called “the premiere practice in the city,” the firm continued to work with activist campaigns related to Procter & Gamble and pizza company Papa John's.

In litigation, the firm represented Paragon Coin, a cryptocurrency startup aimed at the cannabis industry, in Securities and Exchange Commission matters, which settled in November. It is also representing former Equifax executive Jun Ying in an insider trading case. He was indicted last year, and pleaded guilty to securities fraud earlier this month.

Schulte Roth also saw a pickup in funds work related to cryptocurrentcy and blockchain, Waldenberg noted.

Investments in the Future

One area where Schulte Roth saw costs grow was associate pay. The firm matched market leaders, “to the dollar,” which took starting salaries for first-years to $190,000. But he noted that the bonus structure is not identical to other firms, as “someone who works really hard here will make more.”

“We're lemmings,” Waldenberg joked, with regard to associate salaries. He said that expense came out of partners' pockets.

“As salaries go up for associates, we have to be sure we can pay them,” he said. “If they're efficient, it's not that expensive to pay for it.”

Waldenberg also highlighted the firm's performance on The American Lawyer's Midlevel Associate Satisfaction Survey in 2018—Schulte Roth was the top-ranked firm based on associate responses, a vast improvement from its 78th-place finish two years before.

“That bodes well for associate retention and recruiting,” he said.

As a whole, Schulte Roth is moving toward getting younger, Waldenberg said. The smaller equity partner tier was the result of a few older partners transitioning to of counsel status, he noted.

As that kind of change continues, the firm will likely have news around this time next year about a leadership transition at the top, Waldenberg said. And already this year, he said, the eight-person executive committee added two new members, in “an attempt to make it a little younger and change the membership a bit.”

“We've been having discussion about this for a long time. It will be a perfectly natural kind of transition,” Waldenberg said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 2'Something Else Is Coming': DOGE Established, but With Limited Scope

- 3Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 4Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 5Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250