Partner Compensation Changes at Morrison & Foerster Lead to Equity Partner Drop, PEP Surge

Morrison & Foerster said it modified its partnership compensation structure at the start of 2018, following a year of consultation with its partners.

March 25, 2019 at 02:33 PM

5 minute read

Larren Nashelsky, chairman of Morrison & Foerster.

Larren Nashelsky, chairman of Morrison & Foerster.

A change in Morrison & Foerster's partner compensation system helped prompt a 14 percent surge in the firm's profits per equity partner in 2018 amid an otherwise flat financial year.

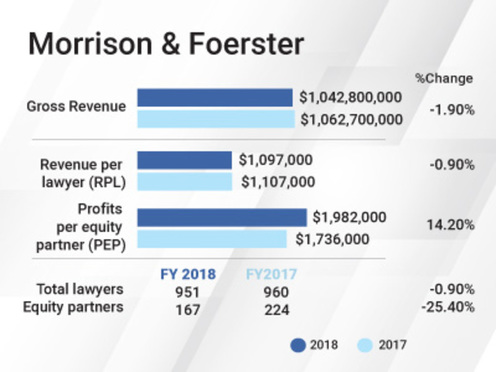

Morrison & Foerster in 2018 faced a tough hurdle trying to replicate a breakout 2017 in which the firm grew by double-digit percentages in revenue, revenue per lawyer and profits per equity partner. Against that tough comparison, revenue at the 951-lawyer firm was down 1.9 percent last year to $1.04 billion and revenue per lawyer was down 0.9 percent at roughly $1.1 million, according to ALM data.

But the firm's PEP surged to just shy of $2 million last year, up from $1.74 million a year prior. The firm's compensation for all partners figure was nearly unchanged, at just over $1.4 million.

The PEP surge in 2018 was the result of a change last year in how the firm compensates its partners, according to a firm statement. That change resulted in far fewer partners receiving more than 50 percent of their compensation from profit draws, The American Lawyer's definition of an equity partner.

“Morrison & Foerster modified its partnership compensation structure at the start of 2018,” said the firm's statement. “The modifications followed a year of consultation with our partners and was made to ensure that the compensation model further advances the strategic needs of the firm.”

As a result of the compensation modifications, the firm's equity partner count fell to 167 from 224—a 25 percent decline. Meanwhile, the firm's nonequity partner ranks swelled 50 percent to 129 from 86. The firm's total partner count, including equity and nonequity partners, fell 4.5 percent.

The firm's adjustment brings its ratio of equity-to-nonequity partners more in-line with Am Law 100 averages. For instance, in 2017, 56.8 percent of all partners in the Am Law 100 were listed as “equity” partners. Morrison & Foerster's equity partners now comprise 56.4 percent of its partnership.

The firm's adjustment brings its ratio of equity-to-nonequity partners more in-line with Am Law 100 averages. For instance, in 2017, 56.8 percent of all partners in the Am Law 100 were listed as “equity” partners. Morrison & Foerster's equity partners now comprise 56.4 percent of its partnership.

Morrison & Foerster has shrunk its equity partner head count six years in a row, according to ALM data.

Despite the drop in equity partnership, Larren Nashelsky, Morrison & Foerster's New York-based chairman, said in an interview the firm had not “de-equitized” partners as part of the compensation review. “There has been no radical change in our partnership,” Nashelsky said. “It is really, over the last few years, strengthening and improving the performance of the partnership and our leverage and profitability.”

Nashelsky said the firm was happy with its 2018 financial performance, the high-stakes matters it handled last year and the 15 lateral partners the firm recruited.

Some key matters included representing Sprint Corp. and its controlling shareholder, SoftBank Group Corp., in the $146 billion merger of Sprint and T-Mobile US Inc.; representing ride-share firm Uber in its highly watched, and ultimately settled, trade secrets case against competitor Waymo; and representing Alibaba Group Holding in its purchase of Ant Financial and the Asian financial giant's $14 billion Series C fundraising.

On the lateral hiring front, Morrison & Foerster last year brought on former Willkie Farr & Gallagher tax partner Anthony Carbone; former director of the U.S. Treasury Department's Office of Foreign Assets Control, John Smith; and Lisa Phelan, a former leader in the antitrust division at the U.S. Department of Justice.

This year, the firm has already hired 19 partners, Nashelsky said, including nine with the launch of a Boston office and three partners in London, where the firm last year saw 26 percent revenue growth.

“We are on a tear in the first few months of 2019,” Nashelsky said.

Morrison & Foerster is still facing a proposed $100 million gender discrimination class-action suit filed in 2018 that alleges “the 'mommy track' is a dead end” at the firm. Three additional plaintiffs joined in an amended complaint in January. The firm has previously denied the allegations in the complaint.

Nashelsky, in the interview, said the firm last year promoted 12 new partners, six of whom were women. Over the past five years, the firm says 48 percent of its partner promotions have been for women. The partnership today is 23 percent women, the firm said.

Nashelsky said the firm was proud of its promotions of women as well as its pro bono work last year. While the firm's nearly $2 million PEP represents a high-water mark for Morrison & Foerster, Nashelsky said the firm wasn't driven by a desire to compete with the nation's most profitable firms.

“We are not in an economic arms race with other firms,” Nashelsky said. “We have a special place at Morrison & Foerster. We take stock of a lot of things when we think about the kind of firm we want to be. Financial performance is one of them. So is giving back. So is excellence in lawyering. So is diversity and inclusion, and so is representing the world's leading companies.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG Wants to Provide Legal Services in the US. Now All Eyes Are on Their Big Four Peers

K&L Gates Sheds Space, but Will Stay in Flagship Pittsburgh Office After Lease Renewal

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250