Holland & Hart Reports Drops in Revenue, Profits and Head Count

"We're trying to anticipate what the changing needs of our clients are and partnering with them in ways that they love," said firm chair Liz Sharrer.

March 29, 2019 at 06:14 PM

4 minute read

Elizabeth Sharrer, Holland & Hart.

Elizabeth Sharrer, Holland & Hart.

The mid-size law firm Holland & Hart posted declines in revenue, profits and head count in 2018 as it lost 16 partners in a hot lateral market.

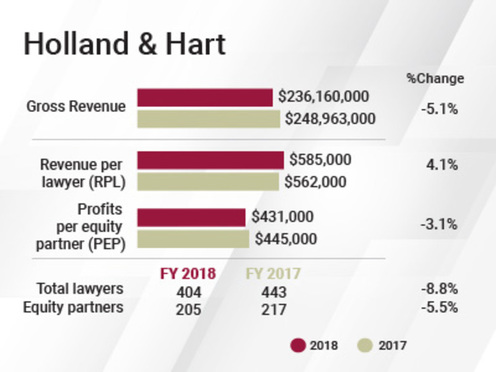

The firm's gross revenue dropped 5.1 percent, from $249 million to $236.2 million as net income saw an 8.5 percent decline, from $96.5 million to $88.3 million. Profits per equity partner decreased by 3.1 percent, from $445,000 to $431,000.

The firm's head count also fell by 8.8 percent—from 443 attorneys to 404.

Despite the numbers, Holland & Hart firm chair Liz Sharrer said the year was a good one for the firm. She noted that revenue per lawyer rose 4.1 percent, from $562,000 to $585,000.

“We're actually happy with 2018,” Sharrer said. “Our lawyers were very busy and did a lot of work.”

The firm's patent practice saw a 20 percent increase in revenue year over year, she said. And for 2019, the practice is on track for another 25 percent increase, she said.

The firm's energy practice, an area where the mid-sized Colorado-based firm first made its name, is also performing well, according to Sharrer. Not only is the firm advising in the oil, gas and mining space, but Holland & Hart's renewables practice is increasingly landing work, she said. Additionally, the firm's corporate and M&A practice saw $3 billion in transactions last year, said Sharrer.

The firm's energy practice, an area where the mid-sized Colorado-based firm first made its name, is also performing well, according to Sharrer. Not only is the firm advising in the oil, gas and mining space, but Holland & Hart's renewables practice is increasingly landing work, she said. Additionally, the firm's corporate and M&A practice saw $3 billion in transactions last year, said Sharrer.

The active lateral market did take a toll on the firm, however. And retirements also had an impact.

Holland & Hart saw two major groups leave for Dorsey & Whitney: A group of ten intellectual property partners left in February, and a seven-lawyer corporate transactions team left in September. Polsinelli picked up three former Holland & Hart partners in Colorado early in the year, and Las Vegas office managing partner Patrick Reilly joined Brownstein Hyatt Farber Schreck.

The firm added only one lateral partner—former Stoel Rives partner Loren Hulse.

Holland & Hart has also transitioned from a one-tiered equity partnership to a multilevel partnership split into three parts: income partner, equity partner and senior partner. Sharrer said the change was aimed at retaining and recruiting talent.

“In this really competitive market, we have a lot of really good senior associates that deserve that title,” she said.

Income partners are most analogous to non-equity partners in that they don't participate in profit sharing but they do engage in the firm's governance. Senior partners serve a quasi-of counsel role, although, like income partners, they are active in the firm's governance.

Sharrer stressed that Holland & Hart will avoid the pitfall of many multitiered partnerships, wherein an associate makes non-equity partner with little opportunity to advance to equity partner. She calls this phenomenon a “parking spot.”

The firm has promoted five attorneys to income partner, nine to senior partner and four to equity partner since the beginning of this calendar year.

Throughout the year, Sherrar said the firm will make “strategic hires” in key areas such as tax, renewables and intellectual property. She also said the firm will continue to leverage its 2017 investment into an innovation office led by Technology & Innovation Officer Duc Chu.

“We're trying to anticipate what the changing needs of our clients are and partnering with them in ways that they love,” said Sharrer. “That's where we see the most success in clients that are coming back and growing our work.”

Similar Stories:

Dorsey Doubles Down on Salt Lake City With Holland & Hart Hires

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1'Something Else Is Coming': DOGE Established, but With Limited Scope

- 2Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 3Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 4Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

- 5'Battle of the Experts': Bridgeport Jury Awards Defense Verdict to Stamford Hospital

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250