Foley & Lardner Reaps Big Gains From Gardere Merger

The firm tracked at least $10 million in new work that resulted from the April 2018 merger.

April 09, 2019 at 05:13 PM

5 minute read

The original version of this story was published on Texas Lawyer

Foley & Lardner's Miami office. Photo: J. Albert Diaz/ALM

Foley & Lardner's Miami office. Photo: J. Albert Diaz/ALM

Foley & Lardner saw gross revenue and net income swell in 2018, as its merger with Dallas-based Gardere Wynne Sewell bore fruit.

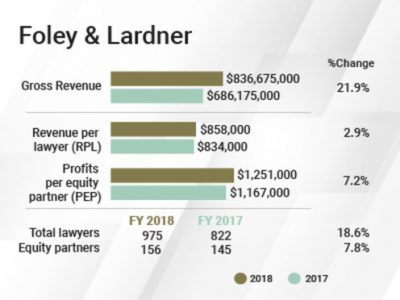

Gross revenue hit $836.7 million for the Milwaukee-based Foley & Lardner, an increase of 21.9 percent, compared with $686.2 million in 2017. Net income was up 15.5 percent, at $195.3 million, compared with $169.1 million the year before.

And even with a much higher head count, revenue per lawyer (RPL) came in at $858,000 in 2018, up 2.9 percent from $834,000 in 2017.

Profits per equity partner (PEP) were $1.251 million, up 7.2 percent from $1.167 million the year before.

That's a big change in metrics for the lawyers who came from Gardere Wynne—the combined firm's 2018 RPL was 35.3 percent higher than Gardere Wynne's 2017 RPL of $634,000, and 2018 PEP was 52 percent greater than Gardere Wynne's $823,000 in 2017.

The two firms officially merged April 1, 2018.

The two firms officially merged April 1, 2018.

“We were delighted in the growth this year, particularly with all of the expenses associated with the consolidation and, frankly, the effort,” said Jay Rothman, a partner in Milwaukee who is chairman and chief executive officer of the firm.

The merger created a 1,100-lawyer firm with offices in 24 cities in the United States, Mexico, Asia and Europe. The combined firm is known as Foley Gardere in Austin, Dallas, Denver and Houston, and Foley Gardere Arena in Mexico City.

Speedy Integration

Dallas partner Holland “Holly” O'Neil, a member of the firm's management committee and chair of pre-merger Gardere Wynne, said the firms were well-prepared for the integration thanks to a lot of planning and meeting even before the deal closed.

A number of practice areas have already meshed well, Rothman said, pointing to corporate, litigation and intellectual property.

Rothman said the firm tracked what he calls “but for” revenue, which is work that resulted from cross-selling and cooperation between lawyers from both legacy firms. That work totaled at least $10 million, he said.

In the months between the merger and the end of the fiscal year on Jan. 31, the firm opened about 125 new matters which accounted for about 15,00 billable hours, Rothman said.

“In our corporate practice alone, we did 200 joint pitches,” he added.

Rothman said Gardere Wynne's strength in Texas and Mexico was valuable, particularly because legacy Foley & Lardner clients were driving the firm to those markets. The firm now has broader capabilities, a deeper bench and more geographic dispersion, he said.

“It's been very, very positive for the Gardere legacy lawyers as well,” O'Neil said.

There were nevertheless out-of-pocket expenses incurred with linking the firms, Rothman said, including the opportunity cost of having lawyers and professionals spend time together on meetings that were unrelated to client work.

“There were expenses, when you think about technology and getting people in front of each other,” Rothman said, estimating that those costs totaled between $8 million and $10 million.

But O'Neil said the number of planning conversations between the two firms pre-merger mitigated the integration costs post-combination.

“The sort of pre-closing process of integration planning and getting people together really turned out to be incredibly valuable for us, and was really an accelerator of the benefits,” she said.

Rothman said he is encouraged by the fact the firm boosted its revenue by 21.9 percent—outpacing the 18.6 percent increase in lawyer head count—despite the one-time integration costs.

In 2019, Rothman said, the firm has shifted its focus from integration to lateral hiring in areas including energy—Foley added an alternative energy practice to Texas firm Gardere Wynne's oil and gas practice—corporate, high-stakes litigation, bankruptcy, False Claims Act litigation, tax, supply chain, health care, and technology including cybersecurity, technology transfers, patent prosecution and intellectual property defense.

“We view this as evolutionary. It is iterative. We will never be done,” he said.

Aside from the merger, the firm also made individual lateral hires in Texas last year. They included Craig Chick, who joined the Austin office in April 2018 as a director of public affairs in the government solutions practice, and counsel Neal Bakare in Houston, a former in-house lawyer for Macquarie Bank who joined Foley & Lardner to do energy and finance work.

But Foley & Lardner also lost some legacy Gardere Wynne lawyers in Texas immediately before and shortly after the merger, and the firm ended up with a head count of 975 on a full-time equivalent basis for 2018.

The departures include a 14-lawyer team that joined Husch Blackwell in Houston; three energy litigators who moved to Bradley Arant Boult Cummings in Houston; two IP litigators who left, due to a client conflict, to join Crowe & Dunlevy in Dallas; and six real estate lawyers who moved to Jackson Walker's Dallas office.

Rothman said the firm is off to a good start in 2019, but he declines to make predictions.

“We have been exceeding our budget on productivity … We continue to remain busy, but it's barely two months into the fiscal year,” he said.

Read More

Foley & Lardner to Merge With Dallas-Based Gardere

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Departing Attorneys Sue Their Former Law Firm

- 2Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 3'Something Else Is Coming': DOGE Established, but With Limited Scope

- 4Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 5Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250