Mintz Hits New Revenue, Profit Highs After a Decade Under NY Leader

A deep focus on client service brought another consecutive year of growth to the Boston-based firm, said managing partner Robert Bodian.

April 10, 2019 at 04:24 PM

4 minute read

Robert Bodian of Mintz (Courtesy photo)

Robert Bodian of Mintz (Courtesy photo)

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo enjoyed another year of revenue and profit growth in 2018, amid changes to the firm's compensation and branding.

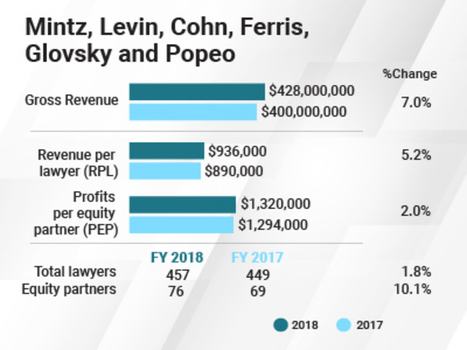

Gross revenue increased 7 percent in 2018, to $428 million, according to projections for the fiscal year ending March 31. Revenue per lawyer grew 5.2 percent to $936,000, and profits per equity partner increased 2 percent to $1.32 million.

This marks the fourth year of consecutive growth for the Boston-based firm, which rebranded last year to simply “Mintz” last year. Four years ago, the firm implemented a new system for sharing origination credit that maxes attorneys out at 75 percent of the initial production credit and shares the rest with colleagues or the firm.

“I don't know if by coincidence or otherwise, but that change has been coincident with the very strong run we've been having,” said managing partner Robert Bodian.

“I think it sort of puts into practice our thinking along the lines of collaboration. It's not a seismic change in terms of how we approach things, but it aligns the talk with the walk,” he added.

As for the firm's 2018 results, Bodian also credited collaboration, pointing to clients in particular.

As for the firm's 2018 results, Bodian also credited collaboration, pointing to clients in particular.

“I think, as a firm, we're definitely providing more services, deeper services to the clients and partnering with clients I'd say on a better level,” said New York-based Bodian, who became the firm's first managing partner outside of Boston when he took the helm in May 2009.

The firm's litigation, M&A, capital markets and health care and life sciences practices all performed well in 2018, Bodian said. The firm handled transactions related to energy and sustainability totaling at least $500 million, he said.

Mintz represented TPG Capital and Welsh, Carson, Anderson & Stowe as a part of a consortium's $1.4 billion acquisition of hospice provider Curo Health Services. The firm also advised an investor group led by TPG Capital and Welsh, Carson, Anderson & Stowe in a $4.1 billion acquisition of Kindred Healthcare Inc. that closed last summer.

After advising Spero Therapeutics Inc. in its initial public offering in 2017, the firm worked with the biopharmaceutical company on its pricing of an underwritten public offering last year.

On the litigation front, the firm represented Fragrance Net's minority stockholders in a derivatives case filed seven years ago that resulted in a $40 million settlement.

Mintz grew its head count by 1.8 percent to 457 lawyers in 2018. It also increased the number of equity partners by 10.1 percent to 76 in 2018, thanks in part to significant lateral additions in its Boston, New York and San Diego offices.

The firm also added Pete Michaels, co-lead of Greenberg Traurig's financial regulatory and compliance practice, along with his longtime colleague David Ward. Also in Boston, longtime Suffolk County District Attorney Daniel Conley joined the firm as special counsel and as a senior adviser for its lobbying arm, ML Strategies.

David Siegal, co-chair of Haynes and Boone's government enforcement and litigation practice, joined Mintz in New York, as did former Manhattan federal prosecutor and Gibson, Dunn & Crutcher of counsel Jason Halperin, who joined as partner in the firm's corporate investigations, enforcement and white-collar practices.

In California, Mintz added the former chair of Morrison & Foerster's global corporate practice, Scott Stanton, to its San Diego office, which now boasts a head count of some 65 lawyers.

As for its year ahead, Mintz plans to refine its strategic plan, hone its industry focus and bring in strategic laterals in areas. The firm will also continue to work with clients “to improve client service to make it best in class,” Bodian said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid to Practice Law in U.S. on Indefinite Hold, as Arizona Justices Exercise Caution

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250