After Strong Year, Katten Sets Sights on Greater Growth, Brand Recognition

Katten's partnership last week approved a new three-year strategic plan, which focuses on building out groups that dovetail with the firm's finance practice.

April 11, 2019 at 03:43 PM

4 minute read

Roger Furey, an IP partner at Katten Muchin Rosenman in Washington, D.C.

Roger Furey, an IP partner at Katten Muchin Rosenman in Washington, D.C.

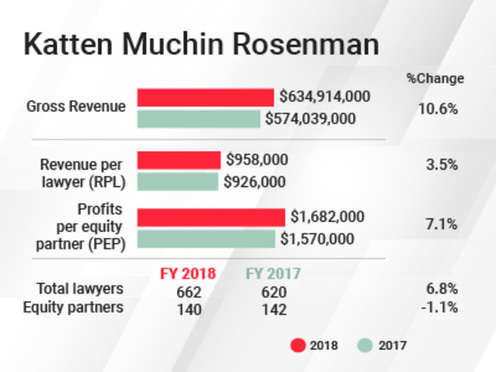

Katten Muchin Rosenman grew revenue by more than 10 percent last year to a record of nearly $635 million and also saw strong rises in profits per equity partner, revenue per lawyer and head count, according to preliminary data from ALM.

Profits per equity partner increased about 7 percent to about $1.7 million while revenue per lawyer rose 3.5 percent to $958,000. The firm's lawyer head count rose nearly 7 percent to 662 as the number of equity partners at the firm fell from 142 to 140.

Katten's chair Roger Furey said he viewed the year as “foundation-setting,” with more growth to come. The Chicago-founded firm made a number of investments in 2018, including adding more than 35 lateral partners. One particular focus was the opening of a Dallas office in February that now has about 35 lawyers after launching with seven partners from a predecessor firm of Hunton Andrews Kurth.

Katten Muchin Rosenman YOY

Katten Muchin Rosenman YOY Building on 2018's success, Furey said the firm's partnership last week approved a new three-year strategic plan. The plan focuses on building out practice groups that dovetail with the firm's relatively well-known finance practice, Furey said. Ultimately, Furey said the firm would hope to move up by about 10 spots in the Am Law 100 rankings. In the past two years, the firm has ranked No. 62.

“We are a bit of a well-kept secret for people outside the finance area,” Furey said. “The clients who operate in the finance space, they know Katten is a go-to firm. They see us across the table all the time. We want to get the word out beyond those people.”

Washington, D.C.,-based Furey took the reins as firm chairman in 2016, replacing Chicago-based Vincent Sergi, who had been the firm's leader for more than two decades. Katten also has a CEO, financial services partner Noah Heller, who is among the youngest firm leaders in the Am Law 200. The firm's leadership ranks also include chief operating officer Craig Courter, who was hired in 2017 after a long stint at Baker McKenzie.

In one example of how Furey said the firm hopes to capitalize on its finance practice to build other strong groups, the firm has been hiring health care lawyers. The health care industry has seen an influx of financial service needs as private equity firms buy up health providers, Furey said.

The firm's Dallas office in October added a three-partner team of health care lawyers who had all been leaders at their former firms. The three-woman group included Lisa Atlas Genecov (formerly of Norton Rose Fulbright), Cheryl Camin Murray (ex-Winstead) and Kenya Woodruff, (formerly of Haynes and Boone).

“There is a lot of synergy between our finance and healthcare groups,” Furey said. “Some of the people in our healthcare group have been among the busiest on [private equity]-related deals in the past year.”

Katten also added a four-lawyer bankruptcy and restructuring group in New York that included Steven Reisman, a lawyer known as “Two-Dollar Steve” in the hip-hop community for his penchant for handing out $2 bills at rap shows.

As for how the firm will measure its success on its strategic plan, Furey said it would look at brand recognition polls such as those offered by Acritas. On the financial side, he said the firm's growth would hopefully be a byproduct of strengthening relationships with both clients and the firm's lawyers.

“We want to grow and strengthen our firm fabric by focusing on the development of some of the younger lawyers in the pipeline and making sure they are well-equipped to be the future owners of the firm,” Furey said. “That will necessarily lead to growth in profitability and revenue.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250