Equity and Nonequity Partners Are on Divergent Paths

Nonequity partner pay is staying flat while equity partners are seeing profit growth.

April 17, 2019 at 01:15 PM

5 minute read

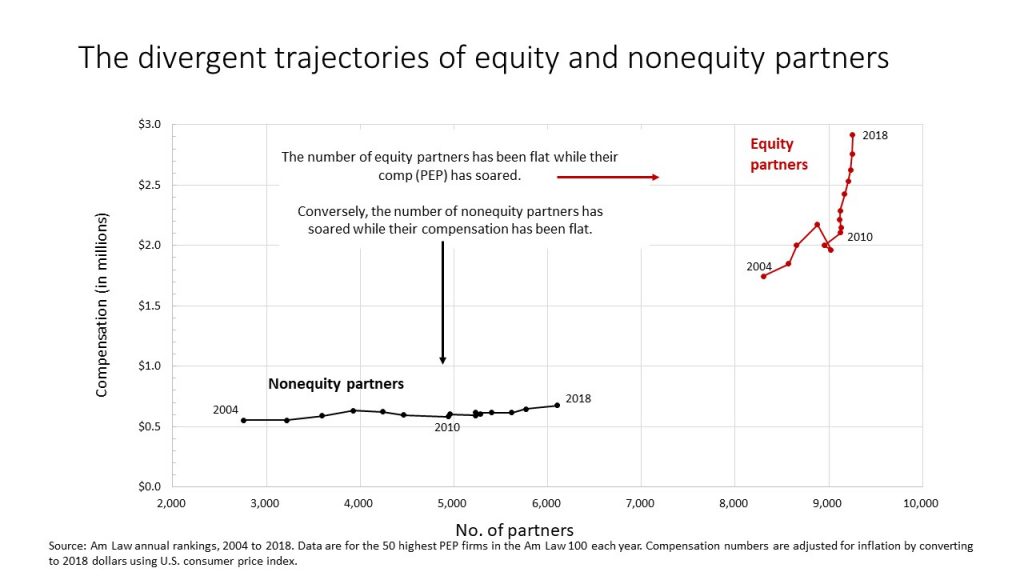

While the Am Law 100 reports are still being racked and stacked, one dynamic is already clear: 2018 witnessed little movement in the number of equity partners while their compensation (profits per equity partner) grew strongly; conversely, nonequity partner numbers grew strongly while their compensation was flat. This continues a trend going back over a decade that has been especially pronounced since 2010. To be clear, this is not an artifact of middle and lower tier firms—the data shown are for the 50 most-profitable firms in this year's Am Law 100.

Law firm traditionalists will decry this dynamic as an erosion of the implicit social contract between firms and their senior lawyers and would-be equity partners. I see it differently: It's evidence of law firm leaders coming to grips with market reality and managing through the constraints of outmoded traditions.

Following the onset of the global financial crisis in 2008, law firms diddled for a couple of years. This was entirely rational; after the market busts of 1991 and 2000, business returned to rude health in just 12 to 18 months. Alas, not this time. By 2010, it was clear there'd been a permanent shift. Clients were exercising their smarts and their muscle—they moved away from one-stop-shop sourcing from “house” firms to best-of-breed sourcing across many firms; they bulked up their legal departments to take more work in-house; they pushed more work to low-cost and nontraditional providers. They also availed of the shift in market power created by firms rushing headlong into each other's markets—both practice-wise and geographically (especially New York and London). These moves intensified firm-vs.-firm competition, thereby dampening billing rate increases and enabling clients to achieve ever steeper discounts.

The old law firm business model had run its course. No longer could firms rely on growing demand and 8 to 10 percent rate increases to keep profits growing. This created a problem. Failure to keep the compensation of commercially powerful partners on an upward trajectory would risk their being poached by rivals. Fortunately, firms had a ready solution. Simply put, they had to break from the imbalances caused by decades-old partner promotion and compensation systems and instead pursue tighter linkages between the economics of partners' practices and their compensation.

The awkward reality is that practice economics diverge wildly—by geography, practice area, and individual partner. In 2018, the 50 most profitable Am Law 100 firms had (in aggregate) 520 lawyers in Germany, 500 in Paris, 190 in Italy, 180 in Brussels, and 160 in Central and Eastern Europe (Budapest, Moscow, Prague and Warsaw). One can argue about whether U.S. firms should have lawyers in these cities; it is inarguable that having partners in these locations on a single worldwide compensation scale entails a subsidy being paid by U.S. partners to their overseas brethren.

An analogous issue arises with practice areas. Health care, real estate, environment, venture capital, appellate and projects just aren't as profitable as M&A, capital markets, private equity, white-collar crime, complex litigation, etc. And even within a practice area there can be sharp disparities. Partners billing high hours at low leverage are not contributing as strongly to firm profits as their brethren with perhaps lower hours but high leverage.

Given the damage caused by losing commercially strong partners, it's not surprising to see firm leaders move systematically to tighten economics-to-compensation linkages. Growth of nonequity partners is just one element of this; others include gates (holding points) on compensation ramps; comp ladders that vary sharply by country; different comp trajectories for partners in inherently low-leverage practices; introduction of a new lower-tier comp level; moves down the scales for those no longer performing commensurately with their comp level; greater distance from top to bottom of bands; and glide paths for partners in the later stages of their careers.

At their core, these moves evolve partner compensation from tenure-driven to performance-driven. This is not itself a problem. However, it becomes a problem if firms don't invest in having honest, productive discussions with partners about performance. Without such dialog, comp systems (especially those that are open) can seem capricious. This is profoundly demotivating and alienating.

The requisite investment in partner development is not a one-off, partly because development is never achieved in a single episode, and partly because the nature of the behavioral changes sought will themselves change. How could it end up? One benchmark is the partner development practices employed by elite consulting firms. They have well-prescribed partner development paths with much client and peer input and explicit milestones along the way: up-or-out at one year and three years after promotion (for the many talented lawyers who don't have the requisite commercial and relationship-building acumen to be effective partners); up-or-out again between seven and 10 years (for those excellent partners who don't have the ability to lead both client relationships and teams of other partners); every-three-year perform-or-out evaluation of senior partners; and, lastly, a glide path for partners as they approach retirement.

All that said, what should you do if you're a capable, ambitious, nonequity partner? Well, here's a possible three-step process: (1) get feedback and guidance on how you can be a more productive partner; (2) push the work down, lever up and invest the freed-up time in business development; (3) repeat.

Hugh A. Simons, PhD, is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He writes about law firms as part of the ALM Intelligence Fellows Program. Contact him at [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

5 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250