Venable Posts Financial Gains After Fitzpatrick Deal

The firm continued its run of growth in revenue and partner profits amid a merger with 100-lawyer New York firm Fitzpatrick Cella.

April 18, 2019 at 07:45 PM

4 minute read

The original version of this story was published on National Law Journal

Venable's offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Venable's offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Fresh off its merger with a 100-lawyer New York firm, Venable extended its decade-long run of increases in profits and revenue per lawyer.

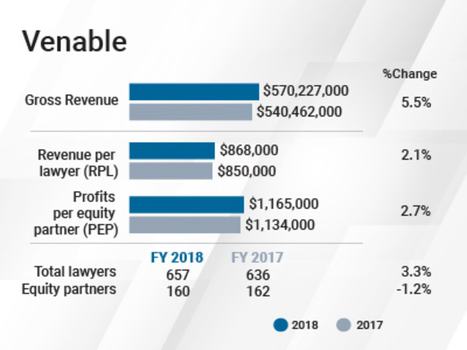

Venable, which completed its merger with Fitzpatrick, Cella, Harper & Scinto in November 2018, grew its gross revenue 5.5 percent last year to $570.2 million. The firm increased its total lawyer head count by 3.3 percent and revenue per lawyer ticked up 2.1 percent to $868,000. The equity partnership contracted by 1.2 percent, helping boost profits per equity partner 2.7 percent to $1.165 million.

The firm, with its roots in Baltimore and Washington, D.C., has said the Fitzpatrick deal would add nearly $80 million in revenue, with the combined firm's future projected revenue topping $620 million.

Larry Gesner, co-managing partner of Venable, evaluated the early progress of the combination as “fantastic.” Gesner said the firm is intensely focused on integration, and held a retreat for the combined firm's new lawyers in recent weeks in Baltimore.

Larry Gesner, co-managing partner of Venable, evaluated the early progress of the combination as “fantastic.” Gesner said the firm is intensely focused on integration, and held a retreat for the combined firm's new lawyers in recent weeks in Baltimore.

Prioritizing the largest combination in firm history has not stopped Venable from pursuing additional growth in other geographical markets. Venable added nine media and entertainment lawyers in Los Angeles last month, including four partners and five associates, all from Kelley Drye & Warren.

Gesner said he expects the firm to continue growing outside its mid-Atlantic roots in the coming year.

“The markets where we are not as big are a little bit easier to grow in, and those are San Francisco and LA and New York, although now we're quite big in New York,” Gesner said, noting the Fitzpatrick combination. “I think we'll continue to grow in those areas.”

Venable's growth in New York was not limited to its Fitzpatrick combination. Gesner noted the addition of Ani Hovanessian, now chair of the firm's New York tax and wealth planning practice, as a particularly significant hire. Hovanessian joined as a partner from Holland & Knight along with Lawrence Mandelker, who joined the group as counsel from Seyfarth Shaw. Together, Gesner said, the duo will build out the firm's New York tax and wealth planning capabilities.

The firm also recruited Guenther Schumacher in New York as chief revenue officer from Ogilvy, an ad agency. Gesner said Schumacher was giving Venable an entirely new perspective on its branding and approach to various markets.

He said the firm's growth in markets outside the mid-Atlantic would not come at the expense of Baltimore and D.C. Venable elected 19 lawyers to its partnership effective April 1, including 12 in Baltimore, Washington and the D.C. suburb of Tysons, Virginia. The firm simultaneously promoted 34 associates to counsel, including seven lawyers in D.C. and Virginia, and seven lawyers in Baltimore.

Venable looked to carefully navigate its expenses last year ahead of the merger, although its nonequity compensation rose nearly 14 percent amid adding a net 13 nonequity partners last year. Gesner said Venable's top expenses are its lawyer cost, then staff, and then rent—in that order. Venable moved into new offices in Washington, D.C., in February 2017, putting it across the street from Arnold & Porter Kaye Scholer near Chinatown.

To help offset such expenses, Venable did raise rates. But, Gesner said the firm's rates are “below the median for the Am Law 100.”

Gesner said the firm will continue to focus on the D.C. market, and that its initial concerns have subsided regarding how the market could change after President Donald Trump took office. While various areas of the firm, such as antitrust work, are not “quite as active,” Gesner said, other practices have been very active, including the firm's election law practice, its data security and privacy practices, and its payment processing practice.

“I think the D.C. market continues to be just a great market for lawyers, that's the reason there are so many lawyers here,” Gesner said. “It's competitive obviously, but [it's] just a great market and a continued growth market. As long as the federal government is in business, which we hope will be a long time, I think it'll be a good market for lawyers in D.C.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250