The Am Law 100 Reached New Heights, Driven by Nearly Universal Growth

Revenue grew at an 8 percent clip, and growth was more evenly balanced throughout the Am Law 100 than in recent years.

April 23, 2019 at 09:30 AM

9 minute read

Credit: Egle Plytnikaite.

Credit: Egle Plytnikaite.

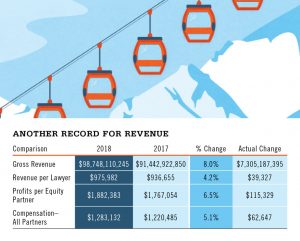

If 2017 was a good year for law firms, 2018 was better. On the heels of a year considered to be the strongest for the Am Law 100 since the Great Recession, the nation's top law firms took their performance a step further. On aggregate, revenue grew at a muscular 8 percent clip over the last year, hitting a record $98.7 billion. That's well past the 5.5 percent growth rate from 2017, the previous high-water mark in the post-recession new normal.

Beyond gross revenue, the Am Law 100 also saw a jump in revenue per lawyer. When growth in RPL, often considered the best barometer of law firm financial health, slowed to 1.5 percent in 2016, it sowed concern that a slump was brewing. But the overall figure accelerated first by 3.2 percent in 2017 and now by 4.2 percent in 2018, the highest growth since 2010. The average for the Am Law 100 is now at $975,982.

Leverage the Am Law 100 data with firm comparison and key performance data, exclusively on Legal Compass. Access Premium Content

Leverage the Am Law 100 data with firm comparison and key performance data, exclusively on Legal Compass. Access Premium Content Profits per equity partner haven't been left out of the fun. The average equity partner in an Am Law 100 firm brought in $1.88 million in profits in 2018, a figure that grew 6.5 percent from the previous year.

These results have served to lighten the mood in the country's biggest law firms, where leaders weren't all ready to celebrate, even after a robust industrywide performance in 2017.

"There's going to be a lot of confidence anytime you string some positive years together," says Eric Seeger, a principal at law firm consultancy Altman Weil. "There is always a degree of skepticism, because the bottom can always fall out. But the people leading large law firms have been through that a time or two."

Balanced Growth … to a Degree

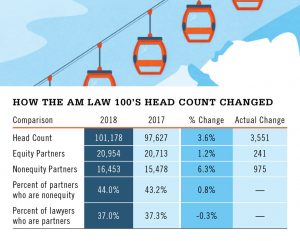

For an industry increasingly marked by stratification, a pattern of more balanced growth returned in the last year. While in 2017, the trend of the biggest, richest firms outperforming their smaller peers accelerated, 2018 brought good news across the board.

Robust deal work kept the largest firms busy in 2018, while countercyclical practices, like litigation, helped bolster firms farther down the list. That more universal demand growth coupled with a strong average rate increase of 4.3 percent spurred 2018's success.

One useful way to demonstrate the recent divergence between the giants at the top of the Am Law 100 and their counterparts that haven't scaled up quite as vigorously is to group the firms roughly by quartiles of revenue. For 2018, the top 10 firms accounted for 26 percent of the Am Law 100's revenue. The next 17 firms accounted for the next 25 percent of revenue. Firms No. 28 thru 53 accounted for another quarter of the revenue. And the final 47 firms generated the final 24 percent of the Am Law 100 pie.

One useful way to demonstrate the recent divergence between the giants at the top of the Am Law 100 and their counterparts that haven't scaled up quite as vigorously is to group the firms roughly by quartiles of revenue. For 2018, the top 10 firms accounted for 26 percent of the Am Law 100's revenue. The next 17 firms accounted for the next 25 percent of revenue. Firms No. 28 thru 53 accounted for another quarter of the revenue. And the final 47 firms generated the final 24 percent of the Am Law 100 pie.

In 2017, the top 10 firms fueled the overall growth of the Am Law 100, with their collective success amounting to 38 percent of that year's aggregate revenue increase. While the next quartile contributed exactly one-quarter of the year's growth, the firms ranked 28th and below lagged, particularly the final 47, which only added 17 percent of the total increase.

Last year, by contrast, growth was much more equitable. Sure, the top 10 grew more than any other segment. But their contribution only accounted for slightly over 27 percent of the growth this time around. Firms No. 11 through 27 accounted for 24 percent of the growth, while firms No. 28 through 53 nearly matched the top quartile, at just under 27 percent. For the third straight year, the bottom quartile provided the smallest share of growth, this time at 23 percent.

Gretta Rusanow, head of advisory services for the law firm group at Citi Private Bank, says Citi's numbers from a survey of Am Law 100 firms reflected a similar trend. In 2017, 58 percent of these firms reported demand growth; in 2018, 74 percent did so.

But the quartile numbers also show that the firms higher up on the list continued to do more with the lawyers that they have on board. Take RPL, for example. The four quartiles delivered RPL growth of 5.5 percent, 5.7 percent, -0.7 percent and -1.9 percent, respectively. In 2017, those numbers were 4.2 percent, 2.8 percent, 2.3 percent and 2.7 percent.

But the quartile numbers also show that the firms higher up on the list continued to do more with the lawyers that they have on board. Take RPL, for example. The four quartiles delivered RPL growth of 5.5 percent, 5.7 percent, -0.7 percent and -1.9 percent, respectively. In 2017, those numbers were 4.2 percent, 2.8 percent, 2.3 percent and 2.7 percent.

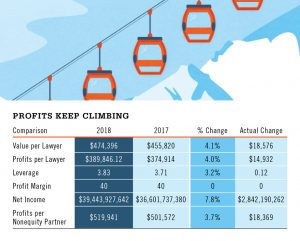

Or look at profitability. While average PEP rose 6.5 percent among the 100 firms, the top 10 firms grew PEP at over 9 percent, and firms No. 11 through 27 grew the figure at 8.5 percent. Gains were significantly smaller in the bottom half: close to 4.5 percent in the third quartile and less than 2 percent in the final quartile.

Few Losers

Another indicator of the overall health of the industry is the shrinking number of firms posting declines in 2018. While 12 Am Law 100 firms saw their revenues dip in 2017 and two saw double-digit drops, only seven firms on the 2018 list had top-line setbacks, the steepest of which was Baker Botts' 7.3 percent decline.

Baker Botts and Morrison & Foerster were the only two firms in the top 60 to show sagging revenues. The other five faltering firms—Drinker Biddle & Reath; Jenner & Block; Crowell & Moring; Baker, Donelson, Bearman, Caldwell & Berkowitz; and Cahill Gordon & Reindel—were ranked below No. 75.

Meanwhile, two firms—both coincidentally based in Missouri—bounced out of the Am Law 100, although it won't be clear until the release of the Am Law 200 figures whether St. Louis' Husch Blackwell and Kansas City's Shook, Hardy & Bacon exited because their revenue declined or simply did not rise enough to keep pace.

To follow a conversation on this subject between The American Lawyer editor-in-chief Gina Passarella and executive editor Ben Seal beginning Tuesday, April 30, register here:

Two new firms nudged their way into the Am Law 100 in 2018. Womble Bond Dickinson arrived via the trans-Atlantic merger between Womble Carlyle Sandridge Rice (ranked 111th in 2017) and the U.K.'s Bond Dickinson, which closed in November 2017. Dorsey & Whitney returned to the list in the 99th spot after a one-year hiatus, fueled by a 9.2 percent rise in revenue.

The Big Two

For the second year in a row, the two firms at the top of the list—Kirkland & Ellis and Latham & Watkins—deserve special notice.

For the second straight year, Kirkland grew its revenue by more than 15 percent, hitting a torrid 18.7 percent in 2018. That produced a top-line figure of $3.757 billion, a new record. The $592 million in revenue added last year equals that of the 64th firm on our list. Kirkland's revenue growth was greater than the total revenue posted by 37 of the Am Law 100. Still, the vigorous growth across the board ensured that Kirkland's success accounted for a smaller share of the list's total growth: 8.1 percent compared with 11.6 percent in 2017.

For the second straight year, Kirkland grew its revenue by more than 15 percent, hitting a torrid 18.7 percent in 2018. That produced a top-line figure of $3.757 billion, a new record. The $592 million in revenue added last year equals that of the 64th firm on our list. Kirkland's revenue growth was greater than the total revenue posted by 37 of the Am Law 100. Still, the vigorous growth across the board ensured that Kirkland's success accounted for a smaller share of the list's total growth: 8.1 percent compared with 11.6 percent in 2017.

Latham posted a double-digit top-line increase of its own in 2018, with a 10.5 percent rise bringing total revenue to $3.386 billion. That accounted for 4.4 percent of the total growth among firms in the survey. In 2017, that figure was 5.5 percent.

Dealmaking prowess explains much of this success. According to data from Mergermarket, the two firms ranked first and second for global deals by volume, with Kirkland at 568 and Latham at 360. And in the private equity arena, the two firms were first and second for global deals by value. (Goodwin Procter and DLA Piper handled slightly more of these transactions than Latham, but Kirkland still did more than twice as many as second-place Goodwin.)

Looking Forward

The pace of mergers slowed as 2018 drew to a close, a development some analysts say portends a wider slowdown in the global economy. Uncertainties associated with Brexit, the United States' ongoing trade fight with China, and increased activity by regulators are prompting a growing number of experts to predict a recession is likely to begin in 2020.

"Firms are not thinking so much that there won't be another downturn, but that it won't be as severe as the last one, and they have the feeling that they've managed their way through it before," Seeger says.

Rusanow, meanwhile, just finished a set of 83 early peer reviews with Citi's law firm clients.

"The mood is pretty positive. I wouldn't say it's bullish," she says. "The overall feel is that there's not going to be a recession this year."

But with the prospect looming in the not-so-distant future, ALM Intelligence analyst Nicholas Bruch sees a distinction between the present moment and the years prior to the Great Recession. While the recent strong run has put firms on more solid footing to address whatever does happen next, it hasn't been as impressive as the sustained period of double-digit growth firms experienced in the middle of the last decade. At the same time, leaders have done a better job of making difficult decisions to help them weather the storm.

"'We'd love it if we could have another year before the next one wallops us,'" Bruch says, describing what he hears from law firm leaders. One or two more good years means they could handle what's ahead.

Email: [email protected]

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

5 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250