Confirmation Bias, Market Stratification and the Am Law 100

Are we so inclined to believe the market is stratifying that we tune out the countervailing data?

April 25, 2019 at 02:56 PM

2 minute read

As humans, we are immutably susceptible to confirmation bias. We interpret facts to confirm our beliefs. This has probably been happening with respect to our belief that Big Law is stratifying into tiers of haves and have-nots. As we peruse the Am Law 100 performance data, we're probably availing of some numbers to confirm this belief, and overlooking the results that don't.

As humans, we are immutably susceptible to confirmation bias. We interpret facts to confirm our beliefs. This has probably been happening with respect to our belief that Big Law is stratifying into tiers of haves and have-nots. As we peruse the Am Law 100 performance data, we're probably availing of some numbers to confirm this belief, and overlooking the results that don't.

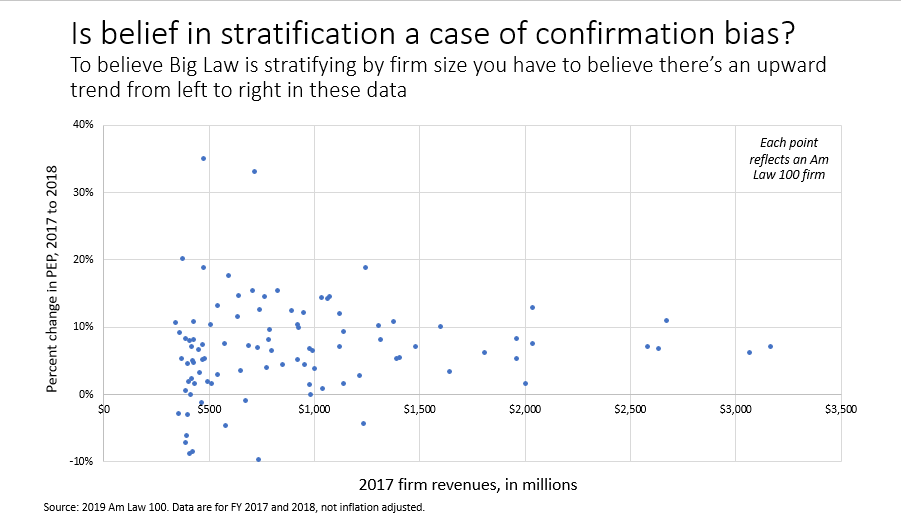

To assess what is truly happening with stratification, it's best to strip away firm names and look at all the data at once. The figure below does this. Each point is an Am Law 100 firm. On the horizontal axis is 2017 firm revenue and on the vertical axis is growth in profits per equity partner from 2017 to 2018. If larger firms were performing more strongly, we would see an upward trend in the data points from the left to right; there is no such trend.

But what if we look at stratification by firm profitability rather than by revenue? Or over longer time frames? I've looked at them all; there's no trend to be seen. It's hard to avoid the conclusion that we're being misled by our prior convictions into believing in market stratification that simply isn't happening.

For smaller and less profitable firms this has an important implication: position is not destiny. You can grow profits irrespective of your starting position. The insight is important too for larger and more profitable firms: Don't kid yourself into believing your strength today guarantees growing prosperity.

Hugh A. Simons, PhD, is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He writes about law firms as part of the ALM Intelligence Fellows Program. Contact him at [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250