Ex-Partner's Suit Targets Pierce Bainbridge's Ties With Litigation Funder

The lawsuit raised serious allegations about Pierce Bainbridge's relationship with a litigation funder and questioned the background of name partner Jim Bainbridge.

May 17, 2019 at 04:34 PM

6 minute read

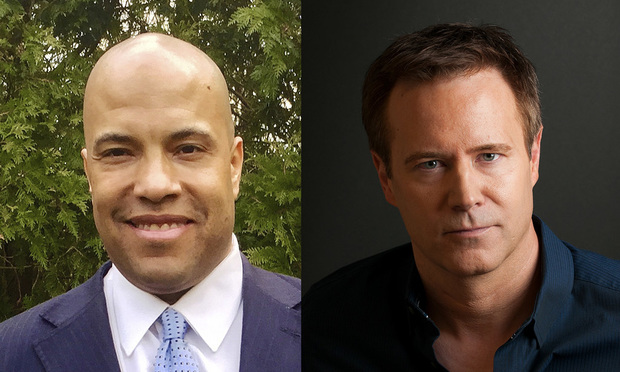

Donald Lewis, left, and John Pierce of Pierce Bainbridge (courtesy photos)

Donald Lewis, left, and John Pierce of Pierce Bainbridge (courtesy photos)

Pierce Bainbridge Beck Price & Hecht and former partner Donald Lewis traded eye-popping accusations of racism, misogyny, drug abuse, sexual assault, defamation and extortion this week, attacking each other with such force that claims of financial mismanagement and misconduct appear as just more fragments of their crumbled relationship.

But Lewis' financial allegations are serious. He claims founder and managing partner John Pierce built the 2-year-old firm on “smoke and mirrors,” duping incoming partners about its prospects and misusing money from litigation funder Pravati Capital to prop up the firm and to cover Pierce's own improper expenses. As evidence of mismanagement, Lewis notes that name partner Jim Bainbridge was one of several defendants who settled with the Federal Trade Commission in 1996 for a telemarketing scheme.

Pravati said Friday that it had profited from its partnership with Pierce Bainbridge and no longer had a funding relationship with the firm, and Pierce called Lewis' allegations nonsense. But Pierce acknowledged that Bainbridge had faced FTC claims, and court records show Bainbridge filed for personal bankruptcy ahead of his settlement with the agency.

Funding Deal

Lewis was fired from Pierce Bainbridge in November. The firm said he was credibly accused of sexual assault by a staffer, and he responded by disparaging his accuser and colleagues. But Lewis has claimed his dismissal was actually a result of his threatening to blow the whistle on “self-dealing and other financial misconduct” by Pierce.

Pierce Bainbridge has grabbed more than its fair share of headlines in its two years of existence for Pierce's bravado and its rapid growth. For example, he has said his firm will overtake Quinn Emanuel Urquhart & Sullivan as a top plaintiffs firm within “five to seven years.”

From the start, the firm has openly worked with litigation funders such as Pravati to fund its growth, but Lewis' lawsuit claims that relationship was built on deceit. “Pierce's apparent logic is that Pravati is in too deep and will throw good money after bad in perpetuity,” the complaint said.

In his suit, which Pierce Bainbridge has characterized as part of an extortion scheme, Lewis said Pierce Bainbridge had a payroll of around $1 million a month when he left, and the firm allowed money to be wasted. He said Pierce's assistant would fly first-class on the firm's dime, and he said he believed that Pierce had taken up to or more than $1 million from the firm in its short existence, although the figures cited in the complaint don't add up to that.

The suit claimed that Pierce Bainbridge was funded “almost exclusively” by litigation financing in Lewis' time there, and it accused Pierce of using those loans for personal outlays, including alimony and tax arrears. Pierce Bainbridge has called allegations about Pierce's finances “irrelevant,” “untrue” and “outrageous.”

Pravati also made requests of Pierce Bainbridge that were ignored, Lewis alleged, saying that in 2018, the funder made clear that the firm should only hire partners with “a verifiable $2 million book of business,” only for Pierce to promote an associate with “zero business” to the partnership.

Lewis also said his former firm overvalued cases and used those numbers to obtain loans. One suit in the firm's portfolio, by the Massachusetts ice-cream maker 600 lb. Gorilla, was said by Lewis to have been valued at $4.75 million, but the final verdict was about one-ninth of that. Another unspecified trademark claim also settled for “several million dollars” lower than the firm projected, he said.

A third case involving video-game dance moves was said by Lewis to have been valued at up to $1 billion in a memo Pierce wrote to Pravati, even though prior counsel had advised the client to take a $400,000 settlement, Lewis alleged. The underlying lawsuit against Microsoft and software developer Epic Games is still pending. (The litigation also led to a failed suit against Pierce Bainbridge from an attorney who claimed the firm took his client and stiffed him on fees.)

Lewis withdrew his complaint against the firm on Wednesday, but refiled it Thursday after Pierce Bainbridge sued him in Los Angeles for defamation and extortion. In a statement, Pierce strongly denied allegations of financial impropriety.

“Mr. Lewis's allegations about Pravati Capital are not true,” he said in a statement. “Pravati is a sophisticated litigation funder that has been in business for years. They perform their own robust diligence on each case they fund, and they know what they're doing. The notion that they could have been hoodwinked into making a bad investment is nonsense.

“And, since Mr. Lewis's departure, the firm has fully repaid the funding that Pravati provided—with a handsome return—and maintains a good business relationship with the Pravati team,” the statement continued.

In a statement, a Pravati spokesman said the firm had scrupulously vetted Pierce Bainbridge and turned a profit, and said it had no loans outstanding.

“We funded Pierce Bainbridge Beck Price & Hecht's significant growth following our disciplined methodology for selecting, underwriting, and structuring investments,” the statement said. “We have been recently fully paid out and are not currently partnering with the firm.”

The lawsuit also alleges other kinds of financial mismanagement, including that Pierce has owed significant sums in accrued tax liens.

FTC v. Bainbridge

Besides the financial accusations, Lewis' suit raises the background of Bainbridge, who is both a name partner and co-managing partner of the firm. Lewis' suit said Bainbridge owned several camera companies that were accused by the FTC in the 1990s of running a telemarketing scam.

According to FTC records, Bainbridge and other defendants in the case allegedly induced consumers to pay up to $700 each for a “3-D” camera and other items by engaging telemarketers to tell consumers that they had won a valuable award. In fact, the FTC claimed, most consumers received only travel certificates of little value.

Bankruptcy court records show Bainbridge filed for personal bankruptcy in 1994, the same year the FTC filed its claims against him and others. Two years later, Bainbridge settled with the FTC.

In his statement to ALM, Pierce acknowledged that his partner, Bainbridge, was the same person named in the FTC's enforcement action, but said the allegations in Lewis' complaint were “wrong and deceptive.” Pierce said Bainbridge sold cameras to telemarketers who allegedly used them in a deceptive scheme, but he was not “involved in the deception,” and settled without admitting wrongdoing.

“Jim is a careful lawyer and a great partner; we do not think the FTC's investigation into unrelated companies more than 20 years ago bears on his standing in the firm or the legal community,” Pierce said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Profits Surge Across Big Law Tiers, but Am Law 50 Segmentation Accelerates

4 minute read

Law Firms Are 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250