For Those Looking to Crack the Am Law 200, Focus Is Key

A number of firms are knocking on the door of the Second Hundred thanks to commitment to a strategic plan that is delivering major growth.

May 22, 2019 at 09:24 AM

5 minute read

When Graciela Gomez Cowger joined Schwabe, Williamson & Wyatt as an intellectual property lawyer in 2015, the firm had 62 specialties, two leaders and an uncertain place in the market. The firm's annual revenue was around $66 million, and the Am Law 200 was a distant vision. Within three years, though, an overhaul of Portland, Oregon-based Schwabe's leadership structure and practice offerings has boosted revenue more than 30 percent to more than $88 million, according to the firm. With one more year of double-digit growth, Schwabe could be on next year's list. It's among a group of firms nipping at the heels of the Am Law 200, driven by a focused strategy necessary to distinguish it from its midmarket peers.

"It was a moment of self-realization, where you put a mirror up against yourself and see where you're at," Cowger says of the overhaul. "We had 62 areas that we specialized in. It was not sustainable, and we didn't have the kind of differentiators in the market that we wanted." So Schwabe went out on a listening tour of its clients, asking what they wanted from the firm and taking it to heart.

Get the Am Law 200 data and dive deeper with firm comparison and key performance data on Legal Compass. Access Premium Content

Get the Am Law 200 data and dive deeper with firm comparison and key performance data on Legal Compass. Access Premium Content "They wanted us to know more about them and their industries," Cowger says. "They wanted us to provide legal solutions that were informed by that knowledge, so that's what we're setting out to do."

Graciela Cowger of Schwabe Williamson & Wyatt

Graciela Cowger of Schwabe Williamson & WyattSchwabe appointed Cowger as CEO, replacing a pair of leaders who had been in place for nearly 15 years, and focused on six industries (health care and life sciences; manufacturing, distribution and retail; natural resources; real estate and construction; technology; and transportation, ports and maritime). The changes have been welcomed by clients and laterals alike—the firm has added 53 attorneys in the past three years, spurred by commitment to its newfound strategy, and reached its revenue goal two years early, Cowger says. Revenue rose 8.4 percent last year, the firm says.

Riverside, California-based Best Best & Krieger, whose revenue jumped 8.9 percent to $91.5 million in 2018, didn't need to find a focus to get to the Am Law 200's doorstep—public agency work accounts for nearly three-quarters of the firm's portfolio, managing partner Eric Garner says. "It's an unusual niche," he adds, suggesting no other similarly sized firm maintains a public agency focus.

Garner says Best Best has leaned hard into its unique focus to deliver strong results in recent years. It has 10 offices, nine of which are in California, so that it can be close to its clients—the firm is general counsel to nearly 50 cities in the Golden State. Earlier this decade, it acquired a Washington, D.C., firm that handled telecommunications matters, a move that's helped it become a one-stop shop for public agencies in an increasingly connected world.

"If you had said to me three years ago, 'I'm going to be talking to you in three years because you're knocking on the door of the Am Law 200,' I'd say, 'Yeah, right,'" Garner says. "But most of the growth has been organic."

So what does he think is the key to rising up the ranks from a position in the middle of the market?

"It's finding your focus, and then, if you're really fortunate, not a lot of other firms have the same focus," he says.

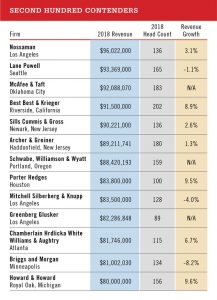

Best Best is one of four firms in the Los Angeles area that could crack into the Am Law 200 in the near future, including Nossaman, whose $96 million in revenue placed it just outside of this year's list, Mitchell Silberberg & Knupp ($83.5 million) and Greenberg Glusker Fields Claman & Machtinger ($82.3 million).

Click for larger image.

Click for larger image.Porter Hedges, a Houston firm whose revenue spiked 9.5 percent to $83.8 million in 2018, is also on an impressive growth trajectory. A run of lateral partner hiring in 2017 paid off last year, says managing partner Robert Reedy, and most of the firm's lateral hires in 2018 were associates. Despite the heavy traffic entering the Texas market in recent years, Porter Hedges has surged thanks to close ties with the energy industry and its relatively limited focus on corporate, energy, bankruptcy, litigation, finance, real estate and construction, Reedy says.

"We've made some significant investments in people over the last few years, both laterals and organic growth," he says. "It's time for all of that to pay off, and it paid off big time in 2018."

Cowger says she occasionally hears from other firms that want to talk about how Schwabe developed and executed its strategic plan. And she hears from prospective laterals who feel their firms lack a strategic focus, or that it's changed so often they might as well not have one. In both cases, she says, the lesson is the same.

"You can't do it halfway. You have to commit," Cowger says. "You have to commit to meeting your clients where they're at, and that takes time and effort. It's not just window dressing."

Email: [email protected]

Brenda Sapino Jeffreys contributed to this report.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid to Practice Law in U.S. on Indefinite Hold, as Arizona Justices Exercise Caution

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute readTrending Stories

- 1Fresh lawsuit hits Oregon city at the heart of Supreme Court ruling on homeless encampments

- 2Ex-Kline & Specter Associate Drops Lawsuit Against the Firm

- 3Am Law 100 Lateral Partner Hiring Rose in 2024: Report

- 4The Importance of Federal Rule of Evidence 502 and Its Impact on Privilege

- 5What’s at Stake in Supreme Court Case Over Religious Charter School?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250