The Am Law Second Hundred Are Green—With Envy

The Second Hundred delivered a good year in many respects, but they couldn't keep pace with the competition in the Am Law 100.

May 22, 2019 at 09:00 AM

10 minute read

Credit: Phil Foster

Credit: Phil Foster

The Am Law Second Hundred in 2018 enjoyed one of their best all-around financial performances in the past decade. But beyond the headline numbers, this year's report might dredge up a complicated mix of emotions for a broad group of Big Law firms, from jealousy and anxiety to relief.

Gross revenue rose 3.1 percent to $19.6 billion while revenue per lawyer increased 1.6 percent to just above $667,500. Profits per equity partner were on the rise as well, up 2.8 percent to nearly $760,000.

Get the Am Law 200 data and dive deeper with firm comparison and key performance data on Legal Compass. Access Premium Content

Get the Am Law 200 data and dive deeper with firm comparison and key performance data on Legal Compass. Access Premium Content In 2018, 11 firms grew revenue more than 10 percent and 38 firms saw revenue increase more than 5 percent. That compares favorably to the prior year, when eight firms had double-digit percentage growth in revenue and 22 bulked up by at least 5 percent.

More extreme downsides were limited, too. In 2018, 25 firms in the Second Hundred saw revenue declines, which is better than the year prior when 32 firms' top lines went in reverse. Only two firms in 2018 saw revenue decline by more than 10 percent.

There are six newcomers on this year's Second Hundred, including two firms that slipped from the Am Law 100: Husch Blackwell (No. 101) and Shook, Hardy & Bacon (103). ALM Intelligence gathered financial figures for two new firms this year: Butler Snow (155) and Spencer Fane (188). And two firms grew their way into the group: Hodgson Russ (195) and Nexsen Pruet (197).

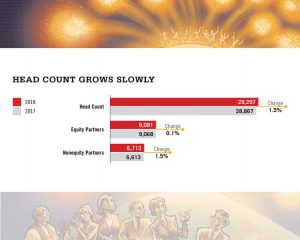

Click for larger image.

Click for larger image.The six firms that left the Second Hundred between 2017 and 2018 include Womble Carlyle Sandridge & Rice, Andrews Kurth and Gardere Wynne Sewell, which left as the result of mergers with other firms. Dorsey & Whitney grew into the Am Law 100. Lane Powell and Herrick Feinstein slid out of the Second Hundred.

When the main metrics are going up, it's hard to complain. But there are reasons for pause upon closer analysis. Some of the unpleasant reactions the Second Hundred might experience would be justified; others can be soothed.

Start with jealousy, which may result from the impulse at Second Hundred firms to compare their financial results to their bigger brethren. The Am Law 100 continued to pull away last year. In fact, the nation's 100 largest firms by revenue grew their lead over the Second Hundred by a wider margin than in all but two years in the past decade.

The Am Law 100 grew revenue by 8 percent last year. Subtracting the Second Hundred's 3.1 percent growth rate creates a delta of 4.9 percent. Wider gaps existed only from 2016 to 2017 (when the delta was 5.6 percent) and from 2014 to 2015 (5.9 percent).

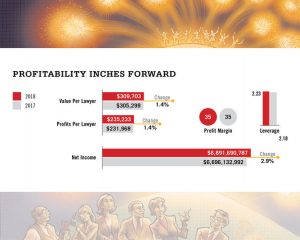

Click for larger image.

Click for larger image.That gap is in part a result of the fantastic returns at the very top of the Am Law 100, which couldn't be matched by even the best performers in the Second Hundred. Consider that Kirkland & Ellis, the nation's largest firm by revenue, added more revenue from 2017 to 2018, $592 million, than all of the Second Hundred combined, $588 million. But growth in the Top 100 was also more widespread. Three times more firms in the Second Hundred experienced revenue declines (25) than in the Top 100 (eight). Twenty-eight Second Hundred firms saw profits per equity partner drop from the previous year; only 11 of the Top 100 had declining profits.

Much has been made in recent years about stratification in the legal market, as the top end pulls away from the rest of the pack. And while the Am Law 100 has indeed outperformed the Second Hundred, that dynamic also existed last year within the Second Hundred itself. One way to see that is to split the group into halves that account for the same amount of revenue. Firms 101 through 135 and firms 136 through 200 both accounted for roughly 50 percent of the nearly $20 billion in Second Hundred revenue last year. The firms in the first group saw average revenue growth of 4.8 percent; average revenue per lawyer growth of 3.8 percent; and average PEP growth of 5.9 percent. The bottom half: 3 percent average revenue growth; 2.7 percent average RPL growth; and 2.1 percent average PEP growth.

If the firms in the Am Law 100 are bigger and doing better, does that mean that bigger is better within the Second Hundred itself? There is some evidence that the larger firms by head count within the Second Hundred performed better last year.

Click for larger image.

Click for larger image.The 25 largest firms by head count in the Second Hundred grew revenue by 4.5 percent and PEP by 3.5 percent. The next 25 largest saw revenue rise 2.8 percent and PEP jump 6.4 percent. Firms No. 151 to 175 boosted revenue by 3.5 percent and PEP by 3.8 percent. The smallest 25 firms increased revenue by 3.8 percent, while PEP was virtually flat, growing by 0.1 percent. And what about the anxiety? That may set in when managing partners consider that their modest growth rates occurred within the broader context of a relatively robust U.S. economy. What happens if there is a recession? Here is one reassuring thought: The Am Law Second Hundred has outperformed the Top 100 during a recession before. During the last recession, in 2008, the Second Hundred saw revenue slip by 1 percent; the Top 100's top line fell by 3.4 percent.

In that sense, the Am Law 100's better performance in 2018 is emblematic of another feature of that larger group: greater historical volatility. Second Hundred managing partners need not look upon that with envy. Relief!

On a more serious note, Nicholas Bruch, director of ALM Intelligence, views 2018 as a warning sign for Second Hundred firms. He prefers to look at the Second Hundred as a constant group of firms—those that made the cut in 2017, compared year-over-year. By that analysis, 43 firms saw revenue shrink or grow slower than inflation (2.4 percent). PEP shrank or grew slower than inflation at 41 firms; 42 firms saw RPL grow slower than inflation.

Making things more concerning is that the Second Hundred has not been as successful as the bottom quartile of the Am Law 100 when it comes to containing costs. Firms 76 to 100 saw costs rise 0.6 percent. Firms 101 to 125 saw costs rise 1.5 percent. Costs rose 3.7 percent at firms ranked Nos. 126 to 150, and 3 percent for firms 151 to 175 and 176 to 200.

"Sometimes companies think about this strong period in the economy as storing up fat for the winter, and there's no fat to store for most of the Second Hundred," Bruch says. "Half of the Am Law Second Hundred is barely eking out revenue growth, barely eking out profit growth. If a downturn comes, I think they will get walloped."

So what should Second Hundred firms do? A growing number are taking seriously the idea of transforming the services they deliver to clients. As top-tier work continues to congregate at the biggest firms and technology and alternative service providers eat away at more routine legal services, Second Hundred firms are left fighting to deliver the vast middle of corporate legal services in a more efficient manner.

Honigman is one firm that has developed a new approach to client service, unveiling this past year a seven-point client service standards program. The program, developed through research interviews with clients, includes budgeting, pricing and post-matter follow-up to learn from clients. It also asks the firm's lawyers to collaborate with firm staff to provide small details to clients, such as knowing how many times a phone will ring before it's answered. The firm has a six-member project management and pricing team that it plans to grow to 10.

Firm chair David Foltyn says the legal services market is more volatile than ever before and there is a race among law firms to figure out how to provide more efficient services. Hiring staff and purchasing new technologies that will be required to provide these types of services costs money, he says. But it will lead to a first-mover advantage.

"Among the Am Law 50, there are more, rather than less, who will be in trouble, because the five or 10 firms that are above all this will keep getting [the work] they're getting, and the next group who has big costs are getting less [work] and are competing with the firms right behind them," Foltyn says. "Among the next 150 firms there are going to be ones who figure this out. And, initially, they are going to win clients' business and value proposition from others."

Honigman, which grew revenue by 6.4 percent last year, was in January selected as one of 19 firms in General Motors Corp.'s panel of preferred law firms.

Thompson Hine has also traveled down the path toward efficiency and believes it is seeing positive financial growth as a result. The firm, which saw revenue growth of 6.9 percent last year and PEP growth of nearly 16 percent, has been spreading throughout its practice groups a policy that mandates that lawyers budget legal matters.

Firm chair Deborah Read says that initiative has begun to pay off in the firm's financials, as clients are more frequently selecting her firm for work based on its dedication to efficiency and predictable costs. Nearly $130 million worth of the firm's work—more than half its annual revenue—is budgeted in a proprietary system Thompson Hine launched in 2014.

Read says she attended a pitch meeting for work with a company that had a $50 million annual budget. She explained the firm's SmartPaTH system for scoping and budgeting legal work. A client expressed skepticism that the firm's lawyers would actually use it, Read says.

"I said we require it," Read says, "and I explained our progress. And honestly, the look on their faces was unbelievable."

Read says the firm won a spot on that panel despite not having an office in the city where the client was located or a practice that was top-rated by Chambers & Associates in the area the client was looking for. She attributes the success to clients seeing value in the firm's dedication to efficiency and predictable pricing.

"This has very much benefited the firm," Read says. "We are outperforming our peer firms."

If the rest of the Second Hundred can take one lesson from those firms, it may be that, as firms fight to prove their value, there is no substitute for hard work.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1How ‘Bilateral Tapping’ Can Help with Stress and Anxiety

- 2How Law Firms Can Make Business Services a Performance Champion

- 3'Digital Mindset': Hogan Lovells' New Global Managing Partner for Digitalization

- 4Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 5Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250