As the Litigation Funding Industry Grows, So Do Efforts to Control It

With more states enacting or considering laws aimed at predatory consumer lending, some commercial litigation finance companies worry that they are also targets.

July 11, 2019 at 05:30 AM

12 minute read

The original version of this story was published on Law.com

Image: Shutterstock

Image: Shutterstock

As the litigation funding industry continues to flourish, consumer litigation finance is the subject of increasing legislative and regulatory action at the state and federal level, attracting the lobbying attention of some Am Law 100 firms. And some commercial litigation funders worry they could be swept up in the backlash.

Groups such as the U.S. Chamber Institute for Legal Reform, a business lobbying group, the Lawsuit Reform Alliance of New York, and members of the insurance industry including the National Association of Mutual Insurance Companies (NAMIC) have the lawsuit lending industry in the crosshairs. They argue that lawsuit investment could distort the civil justice system, spur more lawsuits and encourage claimants to press for unreasonable settlements. NAMIC declined a request for comment for this story.

Opponents of third-party litigation finance want the industry outlawed or, at a minimum, strictly regulated with consumer disclosures, disclosures of funding arrangements in civil litigation and interest rate caps to guard against predatory rates and terms. Litigation funding trade groups want state regulations that don't define cash advances as loans, and don't set interest-rate caps.

Consumer litigation finance in the United States primarily serves lower-income litigants with cash advances of a few thousand dollars against anticipated settlements or judgments that don't have to be repaid if there is no settlement. Commercial litigation finance, in contrast, primarily funds parties and law firms engaged in high-stakes suits and can involve millions of dollars in third-party investment, including increasingly from hedge funds and private equity.

Some commercial litigation finance companies are saying they believe efforts at tightly regulating consumer litigation finance are also meant to thwart their operations.

For instance, last year the Republican-controlled Wisconsin legislature enacted a groundbreaking law, Wisconsin Act 235, requiring litigation funding arrangements to be disclosed in civil cases, a measure that was supported by the U.S. Chamber ILR. It was the first state to do so, and the law was criticized by the commercial funders. It applies as much to a $2 million commercial contract as to a $2,500 consumer contract, wrote law professor Anthony Sebok in a recent white paper. Similar legislation requiring disclosure of third-party litigation funding agreements was recently proposed in the Texas state legislature.

Allison Chock, chief investment officer and U.S. legal counsel of New York-based Bentham IMF, a unit of the global litigation funder headquartered in Australia, said in an interview, “due to overbroad definitions, many proposed bills that are being pushed as 'consumer protection measures' can inhibit the commercial side of litigation finance as well. What we are doing is trying to educate the public and legislators, as they actively try to push these bills, about the differences between commercial litigation finance and consumer litigation finance.”

Global litigation finance company Burford Capital managing director David Perla, former president of Bloomberg Law, who is based in New York, said in a recent interview that opponents of third-party litigation finance “absolutely conflate the two [consumer and commercial litigation funding] and I believe it is intentional, because consumer creates a more emotional reaction and confusion is helpful to them.”

Meanwhile, Harold Kim, the chief operating officer of the U.S. Chamber Institute for Legal Reform, said in an emailed statement July 3, “from our perspective, whether it's consumer lawsuit lending or direct funding of litigation by hedge funds, they both share the common problem of a third party getting involved in litigation between a plaintiff and defendant. As such, whether it's transparency or rate caps, there needs to be appropriate policy responses on both fronts.”

Legislation in the States

At least 10 states already have enacted legislation to limit consumer litigation financing and others are considering it, according to the National Conference of State Legislatures:

- Arkansas consumer funding restrictions that were enacted in 2015 included rate caps, and effectively eliminated consumer litigation funding in the state. Tennessee also imposed rate caps. A law enacted in West Virginia this year capped interest rates so low that funders have mostly stopped doing business in that state as well, according to the Alliance for Responsible Consumer Legal Funding, a trade group.

- Indiana, Oklahoma, Vermont and Wisconsin imposed some limits on consumer litigation financing. Nevada enacted a law this spring requiring licensing.

- Maine, Nebraska and Ohio passed legislation between 2007 and 2010 that codified litigation funding but did not impose many restrictions, according to a NAMIC policy analysts' report. NAMIC declined a request for an interview.

Alabama, Illinois, Georgia, Kansas, Louisiana, Missouri, New Jersey, North Carolina and Texas also have considered bills regulating the consumer litigation finance industry. Utah proposed a bill that requires a person who sues the state or a political subdivision disclose his source of funding. New York legislators considered a bill this year that would require more detailed explanations of fee structures and impose registration but the measure failed to make it out of committee.

The U.S. Chamber ILR's Kim cited Wisconsin and West Virginia as states that have “implemented important safeguards to protect consumers against outrageous interest rates,” saying “states should follow the lead of these states and pass similar laws.”

Jack Kelly, managing director of the American Legal Finance Association, which represents about 45 member companies and was established in 2004, said ALFA supports regulation as long as the laws are not so restrictive as to choke the industry.

“ALFA believes the best way to regulate consumer legal funding is through comprehensive legislation that ensures victims can continue to access this critical product. That starts with licensure and regulation mandating high standards of conduct for the industry and consumer protections such as 'know-what-you-owe' contracts and open forums for complaints,” he said.

Eric Schuller, president of another consumer litigation finance trade group, the Alliance for Responsible Consumer Legal Funding, which represents about 50 companies, said his organization similarly supports rule making that allows the industry to operate. Schuller also represents Illinois-based Oasis Financial, a pre-settlement funder that has been a defendant or a plaintiff in consumer lawsuits in several states. Schuller said, “We would love to have 50 regulations in 50 states because it sets parameters on what consumers get themselves into.”

Sebok, a law professor at the Benjamin N. Cardozo School of Law at Yeshiva University in New York, who has studied litigation finance and consults for Burford Capital as well as for ALFA, said advocates for strict state regulation of consumer litigation funding often argue that the cash advances are loans, which is a big point of disagreement. Funders say they are more akin to an asset sale. If the advances were regulated as consumer loans, the industry might not be able to continue, he contends.

“The Chamber and its allies have taken the position that the legal finance product is a recourse loan and therefore should be subjected to the same credit protections as other recourse loan products,” he said. “There is a lot of reason to believe that if you would import into the regulation of non-recourse transactions for legal finance the percentage model in the consumer credit protection clause of Colorado and usury laws, [we] would have no legal finance industry “

Stepped-Up Agency Enforcement

Attorneys general and state agencies also have taken action against litigation funders under state consumer protection laws.

- In 2005, former New York Attorney General Eliot Spitzer entered into a series of voluntary agreements with nine third-party litigation advance firms, requiring clear and conspicuous disclosure of terms and conditions on cash advances but didn't regulate interest rates, because funding agreements weren't considered loans under state law. Critics of litigation funding such as NAMIC contend the action didn't fundamentally change how the companies conduct business, said Bernard Nash, co-chair of the state attorneys general practice at Cozen O'Connor in Washington, D.C.

- In 2014, South Carolina's Department of Consumer Affairs made an administrative ruling that consumer litigation financing met the definition of a loan under state law, and must comply with state consumer protection code.

- In 2016, Oasis Legal Finance LLC and Plaintiff Funding Holding Inc. reached a $2.3 million consent judgment with the Colorado attorney general over the excessive interest rates that the state alleged that they charged consumers, with neither company admitting any wrongdoing. The companies countersued the attorney general, claiming that their transactions were not loans as defined by state law, but a Denver district court ruled in favor of the state.

And most recently in New York in June, RD Legal Funding LLC, which funds plaintiffs and law firms in pre- and post-settlement funding arrangements, and is represented by Boies Schiller Flexner, according to court records, presented its opening brief before the U.S. Court of Appeals for the Second Circuit in the company's cross-appeal against the New York Attorney General's Office and the federal Consumer Financial Protection Bureau, which accused the firm in 2017 of deceptive and misleading practices in making loans to 9/11 and NFL claimants with effective interest rates of up to 250%.

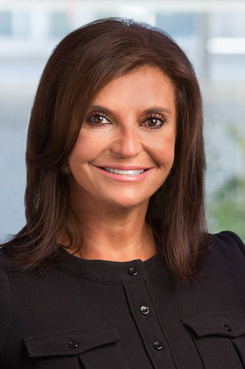

Lori Kalani, Cozen O'Connor

Lori Kalani, Cozen O'ConnorALFA filed an amicus curiae brief in the case, siding with the attorney general and the CFPB. The initial lawsuit by the CFPB was dismissed in federal court in September 2018 on constitutional grounds but is on appeal. The Attorney General's Office is appealing in state court. (RD Legal's affiliated hedge fund, RD Legal Capital LLC, also was sued by the U.S. Securities and Exchange Commission in 2016 for allegedly violating federal securities laws and ordered last year to cease and desist violative practices and pay a civil penalty. The SEC also suspended the company's founder, who is an attorney, from working in investments for six months and ordered him to pay substantial civil penalties.)

“There is going to be more activity in these states because AGs are very close to consumers, and consumers can complain to the AG,” said Lori Kalani, co-chair of the state attorneys general practice at Cozen O'Connor. “In states where there isn't legislation, the AG still has the ability to investigate and bring a lawsuit based on broad consumer protection authority. I expect AGs who work together will continue to take action as the industry grows.” Kalani also said more states are beefing up their consumer protection divisions under the Trump administration.

Meanwhile, at the federal level, SB471, the Litigation Funding Transparency Act of 2019 sponsored by U.S. Sen. Chuck Grassley, R-Iowa, would require mandatory disclosure of third-party funding at the outset of lawsuits. A similar bill has been introduced before, but failed to make it out of committee. Commercial litigation investors and trial lawyers' American Association for Justice are lobbying against the bill; insurance companies and the U.S. Chamber of Commerce are supporting it.

Akin Gump Strauss Hauer & Feld represents the U.S. Chamber ILR in lobbying for the Senate bill, along with Skadden, Arps, Slate, Meagher & Flom and Brownstein Hyatt Farber Schreck, among others, according to filings posted on OpenSecrets.org. The American Tort Reform Association, NAMIC and Allstate Insurance and Sentry Insurance also are registered as lobbying for the bill. Burford Capital is listed as lobbying against the bill. The American Association for Justice (formerly the Association of Trial Lawyers of America) is also listed as lobbying on it.

Read More

CFOS Fueling Rise of Litigation Finance, Survey Says

As Industry Grows, Litigation Funders Become the Litigants

Law Firm Financing: Ethical Concerns Beyond Fee-Splitting

Australian Class Actions Rise Sharply, Litigation Funding Drives Increase

Is Financed Litigation the Next Frontier for Corporate Legal Departments?

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Covington, Steptoe Form New Groups Amid Demand in Regulatory, Enforcement Space

4 minute read

Consumer Finance Law Enforcer Takes Private Practice Job at Morgan Lewis

With 'Fractional' C-Suite Advisers, Midsize Firms Balance Expertise With Expense

4 minute readTrending Stories

- 1Thursday Newspaper

- 2Public Notices/Calendars

- 3Judicial Ethics Opinion 24-117

- 4Rejuvenation of a Sharp Employer Non-Compete Tool: Delaware Supreme Court Reinvigorates the Employee Choice Doctrine

- 5Mastering Litigation in New York’s Commercial Division Part V, Leave It to the Experts: Expert Discovery in the New York Commercial Division

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250