EY, Big Four Top Brand Rankings for Alternative Legal Services

Boosted by several recent acquisitions, EY bumped PwC from the No. 1 spot on Acritas' list.

October 09, 2019 at 03:00 AM

4 minute read

EY offices in Tysons, Virginia. (Photo: Diego M. Radzinschi/ALM)

EY offices in Tysons, Virginia. (Photo: Diego M. Radzinschi/ALM)

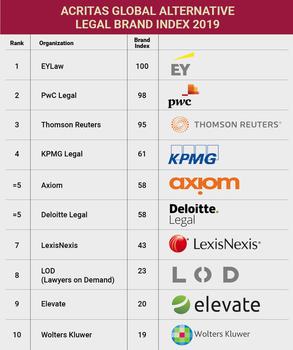

For the second year in a row, the Big Four accounting firms took four of the five top spots in Acritas' ranking of the brand strength of alternative legal service providers, with EY displacing PwC at the top of the list.

EY jumped up 24 points in the index, vaulting from the fourth spot in 2018, on the heels of several significant acquisitions in recent years. In January the company closed on the purchase of the Pangea3 legal managed services business from Thomson Reuters—itself ranked third on the list—after adding Riverview Law last August.

"There's a correlation between increased market awareness and the acquisitions they made," said Acritas director Jo Summers.

EY's global co-leader for law Cornelius Grossmann said the organization was thrilled the marketplace was responding to its multidisciplinary approach.

"The combination of global domain knowledge and scale with process rigor and technology-enabled service delivery helps EY clients achieve better business outcomes," he said in a statement.

Last year's leader PwC placed second on the list, two points behind PwC. Thompson Reuters, while gaining 12 points in the index, dropped one place to third. KPMG moved up one rank to fourth but held steady on points. Deloitte, meanwhile dropped two ranks and 22 points, into a tie for fifth place with legal staffing and services provider Axiom.

Last year's leader PwC placed second on the list, two points behind PwC. Thompson Reuters, while gaining 12 points in the index, dropped one place to third. KPMG moved up one rank to fourth but held steady on points. Deloitte, meanwhile dropped two ranks and 22 points, into a tie for fifth place with legal staffing and services provider Axiom.

Axiom has also been in the public eye over the last year, proposing an IPO in February and scrapping it last month in favor of an investment from European private equity firm Permira.

The top 10 featured one new name this year, Elevate. Like EY, the business made a series of acquisitions over the last year, with three corporate purchases in February alone. As a consequence, the firm rose 17 points in the index, jumping up 13 places.

"Our acquisitions in the past 12 months have added management talent, extended our consulting and global services capabilities, and added AI to our software offerings," Elevate chairman and CEO Liam Brown said in a statement. "As the legal market embraces new ways of working, we see growing demand for our multi-disciplinary solutions for legal and business teams, reflecting improving awareness of our brand as the law company."

The report was based on a survey of over 1,100 general counsel or their equivalents in $1 billion-plus revenue organizations across the world. Acritas probes respondents on three points: which organizations are top-of-mind for legal services, which organizations they feel most favorably toward, and who is at the forefront of innovation.

Acritas also collected data on these companies' legal spending over the last five years, which indicates that alternative providers are increasing their market penetration.

"The share of spending is remaining the same, but the proportion who are using alternative providers is increasing," Summers said.

Nearly half of legal departments are using alternative providers in 2019, up from less than one-third in 2014. The average user of alternative providers puts $1.7 million of their budget toward them, up from $1.5 million, a figure that's in line with the general increase in legal budgets. The overall market share of the alternative providers, meanwhile, increased from 5 percent to 9 percent.

While Acritas does not provide full details on the organizations ranked out of the Top 10, it did flag several fast risers: Consilio Managed Services, UnitedLex and Lumen Legal.

And, although respondents were specifically told not to name law firms, several global firms did land on the list, likely because of their efforts to build their own bespoke legal tech offerings. Baker McKenzie, Clifford Chance and Allen & Overy all tied for 23rd place in the rankings.

"There's still a lot for organizations to do as they develop their alternative brand strategy," Summers said. "Some of them, as we know, have their own branded service, but as yet we're seeing very low levels of awareness."

Read More:

For Law Firms and ALSPs, the Future Is About Collaboration

Baker McKenzie Tops Asia-Pacific Law Firm Brand Ranking for Third Straight Year

Jones Day Holds an Edge as Firms Double Down on Brand Strategy

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

About to Become a Partner? Here's What to Know About Your Newfound Wealth

10 minute read

Holland & Knight Hires Chief Business Development and Marketing Officer From EY

2 minute read

Gibson Dunn Lands EY GC for New Practice Advising Accounting Firms

Bonuses and Beyond: Law Firms Wrap Up Lucrative Year With Record-High Rewards

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250