Why Your Firm Needs a Sector-Based Strategy—and How to Build One

There may be challenges along the way, but for law firm leaders that successfully organize by sector, opportunity awaits.

November 22, 2019 at 01:53 PM

11 minute read

The general counsel of a major U.S. health care provider summed up the fundamental client-counsel disconnect: "Nine of our 10 executive team members are physicians. My outside counsel is giving me legal advice in lawyer-ish and I need to translate it into doctor-ish. Not just the terminology, but my lawyers need to demonstrate that they know how health care executives think, what worries them, why issues matter for our industry. That's not happening nearly enough."

The ability to maintain and grow client relationships hinges on law firms' ability to match their technical, legal knowledge with sector-specific insights. And our research with clients shows that far fewer law firms are delivering that standard.

There may be challenges along the way, but for law firm leaders that successfully organize by sector, opportunity awaits.

Demand for Sector-Specific Insights

General counsel recognize that they risk getting trapped in their own industry silos, so they count on outside counsel to deliver insights based on their broader market exposure. One financial services GC stated, "Clients expect as part of the 'advice and counsel' the ability of their legal adviser to provide best practices based on what they are seeing across the industry, and to be a business adviser in addition to providing legal advice. I want a partner who helps me see around corners."

This ability to predict broader trends' implications for a specific GC requires partners to combine their experience across the sector with their knowledge of their client's particular business context. Joe Calve, chief marketing and business development officer at McGuireWoods, echoes this point: "Clients tell us again and again that they value service providers who know their business and markets—not superficially, but as deeply and profoundly as they do."

Most law firms' websites suggest that they are well prepared to deliver sector insights, but the reality is much different. Let's face it: Just because you have a couple partners who serve an airline, it doesn't mean you have a "transportation sector group." Turning experience into insights requires a collective effort: integrating different perspectives into a nuanced, customized point of view that tackles more complex issues than any of those individual lawyers could have developed on their own. It's what we call "smart collaboration." So if all the partners serving an industry are from the same practice group, it's almost certain that you're not delivering the holistic insights that your clients need.

How can your firm get the edge that comes from delivering true sector-focused insights? Our research and experience suggest that firms need to focus on strategic sector selection, leadership, organization and measurement.

How can you get started on a sector-based approach to serving clients?

Identifying Key Sectors

Our work with Am Law 50 law firms demonstrates that even large, sophisticated firms are still grappling with how to organize and operate effectively by sector. Taking a deep dive to understand your existing client base is an obvious place to start, but firms often fail to give it the necessary time and resources needed to move from data to "a-ha" ideas, then action steps with clear accountability. Here is what we recommend:

- Begin with a market segmentation study of the firm's existing clients—group them by sector and industry, then map to other sources (such as Pitchbook) to identify market share or market penetration.

- Consider growth rates and market size in your focus sectors. For example, software may be the largest segment within the technology sector in terms of market size, but is it fast-growing? For marketing purposes, especially, consider those verticals that are emerging and have the fastest projected growth rates over the next five years. Your firm may be working with only a handful of autonomous vehicle startups or solar panel companies, but that work provides a toehold in a fast-growing technology area.

- Measure competitive advantage vis-a-vis peer firms. In a mature industry, it is relatively easy to identify where your firm has the advantage of relationships with major players. Less so with an emerging area, but these "greenfield" opportunities should be examined carefully. Geography matters. Firms with offices in industry clusters can leverage their proximity to these centers, tapping into industry knowledge and company formation.

- Prioritize and focus. Savvy firms limit the number of sectors, typically between three to seven, and then invest heavily and strategically in them. For example, Orrick, Herrington & Sutcliffe lists its three primary sectors on its homepage, and reinforces the firm's sector focus at the beginning of chair Mitch Zuklie's website bio. Combined with regular internal communications and organization by sector, this marketing reinforces the firm's three-sector strategy.

Organization and Leadership

Once the key sectors have been identified, the firm needs to organize around those sectors (and within the vertical areas beneath the sector when appropriate). Best practices in organization and leadership include:

- Demonstrate leadership support for the sector strategy. Firm executives need to continually endorse the sector strategy internally and externally, emphasize its importance to the firm, and organize around it in a meaningful way. Choose widely respected sector leaders, who also have the willingness and capability to lead—not those who simply want a title. In the beginning, it is helpful to appoint someone who is part of or close to the management committee so that they can keep their sector strategy closely aligned with the firm's and secure necessary resources and approvals. Appointing a thought leader within their industry is essential so that they are immediately visible and credible in marketing efforts.

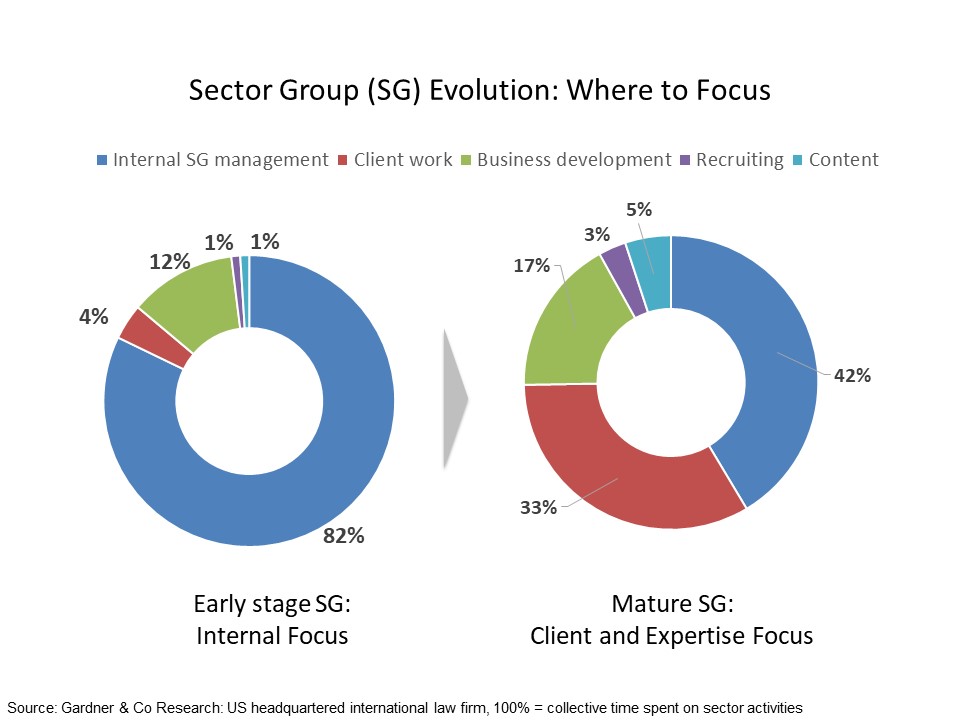

- Help leaders pivot to the right activities. We studied one law firm 18 months after it had implemented a sector strategy and found marked differences in the activities of highly successful versus less successful sectors leaders. In the first six months or so, the startup stage for all sector groups focused heavily on creating a vision for the group, setting strategy, identifying target clients, and bringing people on board. Soon after that, some leaders began pivoting to externally oriented activities: working with clients, pursuing new prospects, and deepening and codifying domain expertise to enhance credibility and advance their reputation. By the time we analyzed the data, those groups that had made the pivot had won more matters from new and existing clients, and significantly improved their client satisfaction scores.

- Identify strong subsector leaders. At the industry subsector level—for example, clean-tech or fin-tech within the technology sector—appoint leaders who are known both for their passion of the domain and for their ability to execute. As one law firm CMO described it: "Our industry initiatives succeed or fail at the working group level—selecting the right attorney leader is critical." Leaders from these groups can then report into, or liaise with, the larger sector board structure.

- Elevate and promote the structure. Provided that you have a solid governance, clear accountability, and strong leadership, it is not necessary to entirely replace your practice group structure. Consider creating a sector board, including each sector leader and a representative from each of the practices that have the most overlap with a sector. There should be a prestige factor to being a board member—they should be viewed as governing the sector effort. Board composition should reflect diversity by practice, geography, race and gender.

- Master the matrix by ensuring that the sector structure is supported through the various administrative mechanisms the firm has in place. Marketing support is critical in this effort, and often is the difference between success and failure. Since adding administrative head count is difficult in most firms, consider restructuring in a way that supports sector efforts. For example, marketing professionals already supporting the IP department may be asked to pick up the technology sector as well. Connecting the sector leadership with experienced marketing professionals is important, as it will lend gravitas, organization and energy to the effort.

- Align and reward. As the firm introduces new expectations for sector leaders and begins to measure their success along new dimensions, it must also reflect this focus in the reward and recognition system. If the firm continues to reward the same behavior as before, sector leaders are very unlikely to invest the necessary time and energy in building the sector. One important way firms can achieve this is by bringing sector leadership into the compensation process as a "second pen" by soliciting their feedback during the review process. Their input should carry at least equal weight as feedback from practice leaders.

- Allocate budgets strategically. Few firms have accurate ways to measure the return on investment of any given marketing event, which means that inertia and politics tend to determine budgets. For example, if a firm has sponsored the same seminar for 10 years, it will continue to—results or no results. Agile firms adapt budget spend to their sector priorities. They invest in the fast-growing industries where they have placed their bets, and spend far less on lower-priority areas. The sector leadership sets overall budget direction because they know which initiatives are most important to the firm effort. This may include making major investments in sector/industry conferences and in-person meetings.

- Build internal connectivity. Ina Brock, a life science partner who heads the sector effort at Hogan Lovells, emphasizes the importance of bringing people together across the firm platform. In her experience, an in-person offsite allowed everyone to understand the breadth of the firm offering in the sector. As she stated, "there was a 'wow' moment when everyone realized the breadth of expertise that we had across the industry." Sharing industry trends, important new matters, and practice expertise among the industry team will help build esprit de corps and provide momentum for team efforts.

Measuring Success

Forward-thinking firms use third-party software like Foundation to help automate tracking clients and use research and proxies to measure sector strategy. How do you know that a sector strategy is successful? We recommend the following:

- Put comprehensive classification system in place. This step is basic but vital—and many firms get it wrong, at least initially. Consistently tag new and existing clients by sector in the financial and marketing systems to ease reporting. Convergence in many industries might make this a difficult task. For example, does a fin-tech company fall under finance or technology? Brock's practical advice: "It's important to know [which sector] the clients see themselves." Client listening programs and ongoing dialogue about a client's core business and strategic direction will inform such decisions.

- Track sector activity and performance. Diligently record the deployed sector resources across client, business development and external relations activities, and monitor them in the context of fees collected from clients in this sector. Over time, you will be able to develop a meaningful picture on ROI, and the trendlines will validate the strategy and execution (or pinpoint the need for course correction).

- Understand brand perception. Marketing research companies, like Acritas, regularly poll in-house counsel and ask who they consider an expert in various industries. If a sector strategy is working, the brand awareness should be strengthening in those few sectors the firm has identified over time (two- to three-year time frame) and should outpace those sectors not selected. Firms can employ their own research into client service interviews and client care calls. Other proxies include such third-party recognition as U.S. News & World Report industry rankings and industry awards.

A sector-based approach requires collaboration across practices and offices, which is never easy. Especially in the beginning, firms face both hard and soft costs associated with transitioning to sector-based strategies. Even worse, it takes time for the benefits to accrue, so initially it seems that collaboration fails to pay out.

Over time, however, the actual costs and perceived risks drop as lawyers learn how to work together efficiently, and develop the tools and processes to develop and deliver sector-specific expertise. During this time, the ROI begins to turn positive as firms deliver higher-value work based on their enhanced reputation, which in turn feeds higher profits, increased client satisfaction and stickiness, and more innovation.

Given this, law firm leaders need to consider: Has collaboration become the way of developing and delivering integrated, nuanced and customized business insights? If the answer is no, be careful not to throw the towel in too soon. We are reminded of Edison's famous words: "Many of life's failures are people who did not realize how close they were to success when they gave up."

Heidi Gardner is a distinguished scholar at the Harvard Law School Center on the Legal Profession. David Harvey is a senior consultant at LawVision.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readLaw Firms Mentioned

Trending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250