Growing Brownstein Boosts Revenue as Lobbying Stays Strong

Brownstein Hyatt managing partner Richard Benenson said the firm's D.C. office and its gaming, natural resources, litigation and middle-market M&A practices all helped drive double-digit revenue growth.

February 07, 2020 at 01:46 PM

3 minute read

Richard Benenson, with Brownstein Hyatt Farber Schreck.

Richard Benenson, with Brownstein Hyatt Farber Schreck.

As it continues to build momentum in lobbying and other practices, both in Washington, D.C., and nationally, Brownstein Hyatt Farber Schreck saw strong revenue growth for 2019 and an increase in profits, despite ongoing investments in the firm.

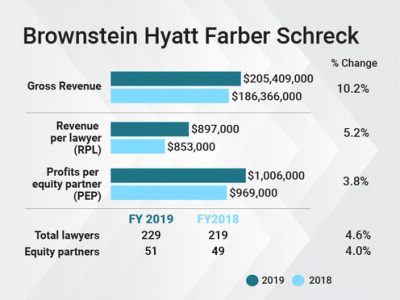

Brownstein saw gross revenue grow 10.2%, to $205.4 million in 2019 from $186.4 million in 2018. Revenue per lawyer was up 5.2% to $897,000 in 2019.

That included lobbying revenue of $40.7 million for the year, managing partner Richard Benenson said. According to the Center for Responsive Politics, those revenues included $39.54 million from federal lobbying, which was second only to Akin Gump Strauss Hauer & Feld, which raked in $42.7 million. Brownstein Hyatt narrowly led Akin Gump in the second quarter of the year, when it brought in $10.07 million in lobbying revenue.

Benenson noted that the government relations practice was particularly strong in the last three quarters of 2019.

Profits per equity partner were up 3.8% to just over $1 million, compared with $969,000 in 2018. Net income increased 8.1%, to $51.7 million.

Benenson said practices performed well across the firm. Particular highlights he noted were in the D.C. office, the gaming practice, natural resources, litigation and middle-market mergers and acquisitions.

The firm saw head count increase by 4.6%, to 229 lawyers in 2019, while the partnership grew by four lawyers, to 133. The additions were split evenly among the equity tier and the nonequity tier. Equity partners totaled 51, and nonequity partners numbered 82.

The firm saw head count increase by 4.6%, to 229 lawyers in 2019, while the partnership grew by four lawyers, to 133. The additions were split evenly among the equity tier and the nonequity tier. Equity partners totaled 51, and nonequity partners numbered 82.

In total, Benenson said, Brownstein Hyatt hired almost 50 people in 2019. He said the firm invested much of its additional revenue in 2019, so he sees RPL as a better barometer of success than PEP.

Those investments included raising associate salaries—they now start at $150,000 in the firm's Denver headquarters—as well as cybersecurity and privacy measures and C-suite positions. The firm brought on chief operating officer Barbara Mica from Munger, Tolles & Olson in March, and it is pursuing a ISO27000 certification in the security space.

The firm also expanded in Nevada and added a Wyoming office early this year, when it absorbed a three-person group early this year, led by shareholder Neal Tomlinson.

While the firm raised rates by an average of 5.2%, its pricing strategy overall did not change, Benenson said. A significant number of client relationships involve monthly retainers, he said, and between 3% and 5% of all revenue comes from other "nontraditional" fee arrangements like success fees and hybrid fees.

In 2020, Benenson said, the firm will continue to grow and invest in talent, as well as support multidisciplinary groups.

Read More

Chasing New Frontiers, Brownstein Expands in Nevada and Adds Wyoming Outpost

New Federal Lobbying Leader? Brownstein Bests Akin Gump in Q2 Revenues

Culture is Key in Law Firm Competition, Brownstein Hyatt's Leaders Say

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Lack of Independence' or 'Tethered to the Law'? Witnesses Speak on Bondi

4 minute read

Fenwick and Baker & Hostetler Add DC Partners, as Venable and Brownstein Hire Policy Advisers

2 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250