Orrick's Partner Profits Break $2 Million, Firm Posts Double-Digit Revenue Growth

Orrick's profits per equity partner grew by 14% last year as its large institutional clients entrusted the firm with more work.

February 10, 2020 at 05:41 PM

4 minute read

Photo: Jason Doiy/ALM

Photo: Jason Doiy/ALM

Orrick, Herrington & Sutcliffe posted double-digit growth in revenue and partner profits last year as the firm surpassed the $2 million mark in profits per equity partner for the first time.

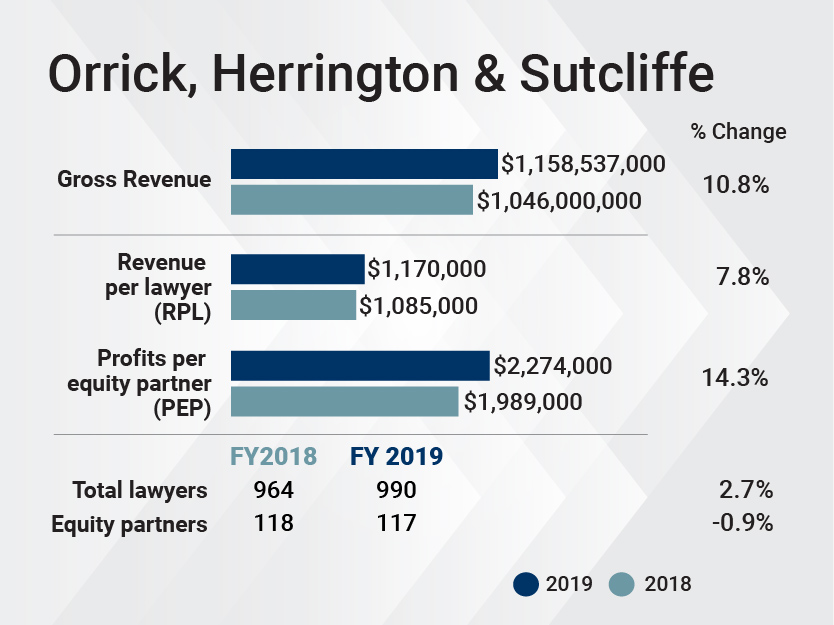

According to preliminary numbers submitted by Orrick, the firm's revenues grew by nearly 11% in the fiscal year 2019, from $1.05 billion to $1.16 billion. Profits per equity partner (PEP) jumped 14%, from $1.99 million to $2.27 million; and revenue per lawyer grew 8%, from $1.09 million to $1.17 million.

Orrick global chairman and CEO Mitch Zuklie attributed the stellar financial year to the firm's large institutional clients, including Microsoft, Oracle, Johnson & Johnson and Ocwen, which entrusted the firm with more matters.

"I'm most excited by the fact that our most important clients are trusting us with more work across more areas than ever before," Zuklie said.

Zuklie said the firm makes a point of being responsive to clients' needs. This may mean aggressively courting a lawyer at a rival firm who the client admires or bringing in attorneys with the expertise they ask for—especially in cybersecurity, which is an area of growing importance but where there aren't yet deep, long-standing relationships.

"It's like that old political saying: 'It's the economy, stupid.' Except for us, the saying goes, 'It's the clients, stupid,'" Zuklie said.

Cybersecurity growth was the impetus behind Orrick's new Boston office, which was founded by former Ropes & Gray's cybersecurity co-heads Doug Meal and Heather Egan Sussman. The lateral hiring has continued into 2020 with the addition of former PwC cybersecurity attorneys Keily Blair and James Lloyd in London.

Cybersecurity growth was the impetus behind Orrick's new Boston office, which was founded by former Ropes & Gray's cybersecurity co-heads Doug Meal and Heather Egan Sussman. The lateral hiring has continued into 2020 with the addition of former PwC cybersecurity attorneys Keily Blair and James Lloyd in London.

Zuklie says Orrick has not strayed from the strategy it launched as it came out of the great recession—one that calls for the firm to excel in three key areas: technology and innovation, energy and infrastructure, and finance.

He said the firm's technology and finance teams helped clients raise a collective $19 billion in venture capital financing in 2019, up 24% year over year, and guided several companies in their initial public offerings, including Beyond Meat's $240.6 million offering last year.

Zuklie added that the firm was very active in litigation, taking 21 cases to trial and working on 30 appeals last year.

Orrick is representing Oracle in its $8 billion copyright case against Google, which is set to be decided by the U.S. Supreme Court. Orrick attorneys, in defense of Microsoft, also successfully fended off a class certification in a high-profile gender pay suit in December.

Despite the additions in Boston and hires in Silicon Valley, New York, Los Angeles and Seattle, partner head count remained flat for the second year running. Its year-end head count totaled 117, down one equity partner from last year. The firm saw several attorneys defect to rival firms, including Winston & Strawn, Sidley Austin and Greenberg Traurig. Orrick added 26 non-partner attorneys last year, increasing its total head count to 990.

In 2020, Orrick said it will continue to develop legal technology products through its in-house technology arm, Orrick Labs. This year, the firm is planning to launch a new product, Joinder, which is currently in beta testing, as the firm continues to look for ways to spin off and monetize legal technology products. Zuklie also alluded to an "on-demand staffing solution" that the firm is developing along with Major, Lindsey & Africa.

"You'll see us partner more with businesses that aren't in the legal space, per se, and spinning products off as individual companies as part of our business strategy," he said.

Client engagement with the firm's data analytics arm, Orrick Analytics, grew in 2019 as well. The team of attorneys and statisticians, who use artificial intelligence and other tools to work on document-heavy matters more efficiently, saw their project caseload grow by 24% and their client roster by 11% to 506 total clients.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250