Covington, Playing the Long Game, Closes In on $1.2B in Revenue

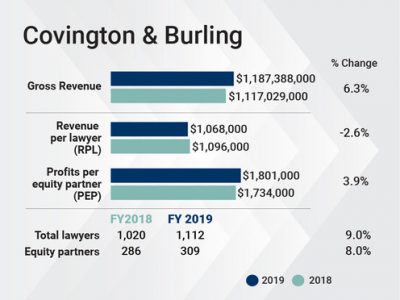

Gross revenue climbed 6.3% in 2019, and profits per equity partner went up 3.9% despite a growing equity partner tier.

February 13, 2020 at 06:59 PM

5 minute read

Douglas Gibson, chairman of Covington & Burling.

Douglas Gibson, chairman of Covington & Burling.

Washington, D.C.-founded Covington & Burling reported revenue growth of 6.3% in 2019, pushing the firm's gross revenue to $1.187 billion and completing a 10-year window under former chairman Timothy Hester in which the firm roughly doubled in size from its $586 million mark in 2010.

Profits per equity partner were up from 2018, increasing by about 4% to $1.8 million per partner despite growth in the equity partner tier. But as Covington added lawyers firmwide, revenue per lawyer went down 2.6% to $1.068 million.

The firm's total lawyer head count went up by 9%, while its equity partner count moved up by 8% to a total of 309 out of 1,112 attorneys. The firm does not have a nonequity tier.

"We don't measure our success by year-over-year financial performance," said Douglas Gibson, Covington's newly elected chair, and Hester's successor. "We had a strong year and are on the right path, but we look longer-term as part of our strategy."

Gibson said the majority of practice areas outperformed internal expectations, and that no one or two practice areas floated the firm in 2019. It was a solid collective performance that allowed the firm to continue its growth, he said.

"No single client or matter did that," Gibson said. "We really did enjoy success across all of our practice areas. And we had some longer-term investments come to fruition."

While several practice areas contributed to the firm's 12.1% increase in net income, Gibson highlighted activity in a couple of areas. He said the firm's corporate practice worked on over 270 transactions over the course of the year worth about $260 billion. He said around 100 of those were M&A deals.

While several practice areas contributed to the firm's 12.1% increase in net income, Gibson highlighted activity in a couple of areas. He said the firm's corporate practice worked on over 270 transactions over the course of the year worth about $260 billion. He said around 100 of those were M&A deals.

"Because of our broad and deep regulatory and policy practices, we are able to provide corporate and M&A services better," Gibson said.

The firm represented Tokyo-based Astellas Pharma in its purchase of U.S.-based Audentes Therapeutics for $3 billion; worked with Merck in its acquisition of cancer-therapy company ArQule for $2.7 billion; and provided services to the Sherman family as it purchased MLB's Kansas City Royals for about $1 billion.

Gibson also highlighted Covington's "critical mass" in its white-collar and litigation practices, saying the firm is set to continue the type of work that earned it recognition as The American Lawyer's Products Liability Litigation Department of the Year in 2019.

That team has defended McKesson in its ongoing legal battles around opioids, which have led to a $260 million settlement in Ohio. The team also is representing Eli Lilly in its Cialis litigation and Monsanto in over 12,000 lawsuits related to its Roundup weed killer, cases that figure to contribute to the firm's bottom line in 2020, he said.

Gibson added that the Committee on Foreign Investment in the United States and regulatory practices were going strong, highlighting work the firm has done for clients looking to navigate the U.S./China trade war and understand data privacy concerns.

Gibson, who took his new post in January, said there was little change in the firm's C-suite and other high-ranking, non-attorney positions. Though he did highlight that the firm brought in Kimberly Breier as a special adviser. Breier was formerly the assistant secretary in the Bureau of Western Hemisphere Affairs at the U.S. Department of State.

On the lateral front, Gibson said Covington brought in 15 partner hires through the course of the year, including Amanda Kramer in New York. Kramer was an assistant U.S. attorney in the Southern District of New York for 11 years before joining Covington.

Gibson said the firm is not overly interested in merger discussions. "We had a period of incredible growth over the last decade. We can succeed independently and don't have to merge," Gibson said.

He said there is always the possibility of Covington onboarding a smaller firm, but even that is unlikely as most of the firm's practice areas are at a critical mass, and geographic expansion is not on its agenda in 2020.

Gibson, like many other firm leaders, said a potential economic downturn, which has been on everyone's mind over the last year, is still a cause for concern. But, he noted, the firm plays a long game and it is built to weather such storms.

"We make decisions for the long term," he said, using the past as evidence. "If you look at 2009 during the downturn, we didn't lay off any attorneys or tell summer associates not to come in."

Read More

Covington Surpasses $1 Billion in Revenue, Capping a Decade of Rapid Growth

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250