DLA Piper Shows Near Double-Digit Growth in 2019

Clients are increasingly willing to pay premium rates for high-value work, said global and Americas co-chair Roger Meltzer.

February 14, 2020 at 06:18 PM

5 minute read

DLA Piper. (Photo: Jason Doiy/ALM)

DLA Piper. (Photo: Jason Doiy/ALM)

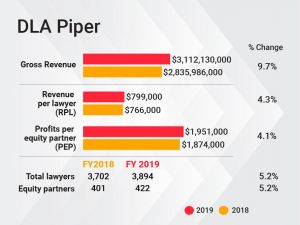

DLA Piper grew its revenue by nearly 10% last year, crossing the $3 billion threshold for the first time.

The top-line figure of $3.11 billion translated to a third consecutive year of growth for the global firm, which also expanded average profits per equity partner by 4.1%, hitting $1.95 million. Revenue per lawyer moved upward by 4.3% to just under $800,000.

Global and Americas co-chair Roger Meltzer attributed much of the firm's financial performance to its continued movement up-market and commensurate rate increases.

"One of the things you're now seeing in the evolution of DLA Piper is a much greater level of organic growth," he said, noting the firm is pulling in more and more high-value matters from key clients.

"That has allowed us to increase rates and have those rates be acceptable, given the quality, regional and sector expertise we offer along a wide range of things that are important not only to multinationals but also the midmarket," he continued.

The firm's leadership said the results validated the decision to focus on building a truly global firm since DLA Piper's creation in 2005 via a three-way merger.

"When we created DLA Piper 15 years ago, we told clients if they came with us, we'd provide them high-quality seamless service delivery all around the world," global co-CEO and Americas co-chair Jay Rains added. "It's gone from people testing you to going all in and buying you."

Looking at the firm's 2019 U.S. performance in particular, Rains flagged corporate work as a standout, highlighting the strong niche it has carved out in upper middle-market M&A activities. Results out of the firm's offices in California and Texas were particularly noteworthy, he said, noting that he would like to see greater growth from New York and Washington, D.C.

Looking at the firm's 2019 U.S. performance in particular, Rains flagged corporate work as a standout, highlighting the strong niche it has carved out in upper middle-market M&A activities. Results out of the firm's offices in California and Texas were particularly noteworthy, he said, noting that he would like to see greater growth from New York and Washington, D.C.

Internationally, global co-CEO Simon Levine highlighted the firm's efforts in tax and intellectual property work, along with corporate work. For one example of the firm's growing capabilities worldwide, lawyers in 12 different countries, without outside help, succeeded in closing a $3.1 billion deal between Qualcomm and TDK involving the buyout of an early 5G joint venture.

"We couldn't have even dreamed of that transaction 10 years ago," Rains said, noting that deals of that magnitude also generate premium tax and employment work after the acquisition is completed.

The firm has also increased its capabilities in litigation, pointing to a confidential arbitration involving attorneys on three continents.

"It's so much more important and existential to the clients than the kind of litigation that we were doing eight years ago," Meltzer said.

Levine named the U.K., the Netherlands and Germany as standouts in 2019. But a year after the firm said it had rounded out its expansion efforts in Latin America, he called the region a "challenging one" for the firm.

"The way that we've approached Latin America is not to over-lawyer it, in the sense of having head counts materially larger than their economies would justify," added Meltzer, who oversaw the firm's expansion in the region.

Overall, the firm grew its head count in 2019 by 5.2%, and the size of the firm's equity partnership grew by the same share. That comes after the number of equity partners ticked slightly downward in 2018, in part because of a string of departures to McDermott Will & Emery.

The firm responded in 2019 with a "very robust" lateral program, as well as a number of younger partners progressing from income partners to equity partners, based on ALM's methodology. (DLA Piper itself professes to have only one category of partnership.)

But Meltzer cautioned that the opportunities for hiring that emerged in the last year would not necessarily continue in 2020: "I wouldn't say DLA Piper is going to expand by 5% plus in head count year in and year out."

Looking forward, the firm does aim to grow its presence in continental Europe and Asia, along with its Dublin office, which opened in 2018. In the U.S., leaders are eyeing New York, California, D.C., Texas and Chicago.

Firm leaders say they're are also investing heavily in technology. One side of this is looking to take better advantage of the firm's own data to drive initiatives in workplace improvement and diversity and inclusion. Another side is design thinking and blockchain. Levine pointed to investments in technology addressing real estate transactions, algorithms advising clients on anti-cartel and anti-competitive behavior and distributed ledger platform Hedera Hashgraph.

"They all cost money, but as far as we're concerned, they're all important investments in the future," Levine said. The goal, he added, is to advance how the firm and its attorneys present themselves to clients: "To be a consigliere, rather than just a reactive lawyer."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

DLA Piper's California Expansion Has Not Slowed Down

DLA Piper Leads Big Law in Social Media as More Firms Shun Facebook: Report

Hedging Against Recession, DLA Piper Bets on Data and Tech Programs

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Saul Ewing Loses Two Partners to Fox Rothschild, Marking Four Fla. Partner Exits in Last 13 Months

3 minute read

Dentons Taps D.C. Capital Markets Attorney for New US Managing Partner

Exceptional Growth Becoming the Rule? Demand Drove Strong Year for Big Law

Eagles or Chiefs? At These Law Firms, Super Bowl Sunday Gets Complicated

3 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250