Goodwin Procter's Focus on PE, Tech and Life Sciences Fuels More Revenue Gains

Technology and life sciences deals continue to drive big gains for Goodwin, which boosted revenue by 11% last year.

February 19, 2020 at 02:36 PM

5 minute read

Robert Insolia, Goodwin Procter.

Robert Insolia, Goodwin Procter.

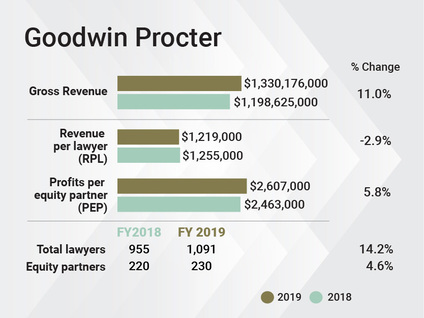

Boston-founded Goodwin Procter, already on the cusp of the Am Law top 25, saw its revenue rise to $1.33 billion in 2019, an 11% increase from 2018. The firm grew profits per equity partner by 5.8% to $2.6 million.

Overall lawyer head count increased 14% to 1,091 as net income rose 10.9%, leading to a 2.9% decrease in revenue per lawyer, according to preliminary figures.

Robert Insolia, Goodwin's former managing partner who was elected as the firm's chair last April, attributed the continued growth—as well as a particularly strong last three years—to the successful execution of a strategic plan over a the course of the past decade.

"We have been on this path for the past 10 years as part of a dual strategy," Insolia said. "Dive deeper into a select number of verticals, and take advantage of what we refer to as the 'convergence of tech on everything'."

As the firm enjoys the fruits of those efforts, Insolia said success has created a momentum of its own—including on the lateral hiring front.

"We are seeing the benefits of our strategy in a number of ways, and one is that people self-select to be part of that culture and part of that strategy," he said.

Insolia said the firm added 34 laterals in 2019, all in key practice areas and geographies. He said the firm isn't in the business of placing bets on potentially overpriced rainmakers, but rather finding practice groups or individuals in key areas that are a good fit.

He said the firm has also benefited from being "deep" in several practices and industries that are in demand right now—in particular private equity, life sciences and technology.

He said the firm has also benefited from being "deep" in several practices and industries that are in demand right now—in particular private equity, life sciences and technology.

Insolia said the same strategy has propelled the firm's U.K. and European growth.

Goodwin opened an office in Cambridge, England, in November of 2019 to try and bolster its life sciences footprint in the Oxford/Cambridge/London tech triangle. Its London office has managed rapid revenue increases in recent years, growing 11% last year to $74 million after a nearly 60% rise in 2018.

Goodwin was also just the second U.S. firm to open an office in Luxembourg when it arrived in that country in October.

Insolia said the firm would most likely have not opened the Luxembourg office if it wasn't worried about potential ripple effects from Brexit, but that for now expectations in the U.K. are high and business is good.

The one metric where the firm saw a year-over-year decline, revenue per lawyer, is not a cause for concern, Insolia said.

"I understand looking at the numbers annually," Insolia said. "But we want to see over time what the trend line is and we think the RPL will be positive this year."

Insolia said the firm didn't make any significant changes to its partner compensation, expense management or fees in 2019.

He also said the firm is not actively looking at potential merger opportunities at this point, in part because the firm has had so much success on-boarding practice groups in new markets. And Goodwin might even pump the brakes on that strategy.

"There's a big difference between a merger and bringing on a new practice group," Insolia said. "Bringing on a practice group is a great way to establish yourself in a new geography, but we are not currently looking at any new geographies."

Goodwin's transactional lawyers have been key revenue drivers in recent years, and Insolia mentioned the firm's handling of Slack's IPO as well as the firm's work on Roche's acquisition of Spark Therapeutic as highlights from 2019.

But he said the real mark of success for the firm's private equity and tech practices isn't their involvement in a few specific prominent deals, but rather their combined growth.

"Ten or so years ago, about 15% of our PE deals were tech," Insolia said. "Now that number is around 60%. We have about 250 PE lawyers and about 250 technology lawyers, so that presents an opportunity for us when they communicate with each other."

Insolia said the firm is still committed to its diversity and inclusion initiatives. Within five years, the firm wants to have its partner classes mirror the makeup of the associate classes.

"Our incoming associate class was 51% female and 33% diverse," he said. "It's a high bar, but this isn't just a firm issue or a legal industry issue. It's a societal issue and we want to be part of the solution."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More:

Goodwin Grabs 4 Life Sciences Partners From Fenwick & West, Sidley Austin

Goodwin Names New Chair, Managing Partner

Goodwin Procter Sees Revenues Soar on Tech, Life Sciences Deals

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250