Leaner Baker & Hostetler Sees Revenue Growth Across Practices

The firm started the previous year with five practice areas. All of them boosted revenue, leading to a near double-digit increase firmwide.

February 19, 2020 at 04:44 PM

5 minute read

Baker & Hostetler offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM

Baker & Hostetler offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM

Baker & Hostetler chairman Paul Schmidt said every one of the firm's practice areas had boosted its revenue in 2019, fueling near double-digit growth over the past year.

"That makes for a very nice year-end discussion, when all practice groups are up," said Washington, D.C.-based Schmidt, who just completed his first year at the helm of the Cleveland-founded firm.

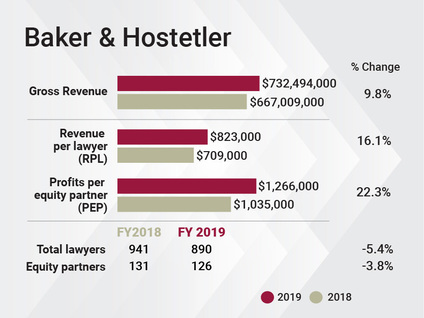

The firm, which brands itself as BakerHostetler, brought in over $732 million, up 9.8% from 2018. Net income increased by an even greater clip, rising 17.1% to just over $159 million, as the firm trimmed its head count across all categories of attorneys.

"We make sure we're operating in an efficient and effective manner," Schmidt said. "It's good to pay attention to that when things are good. We make sure we have the right people in the right place with the right workload."

The firm showed five fewer equity partners, five fewer non-equity partners, and 51 fewer total attorneys than the previous year, a 5.4% drop in total head count. Profits per equity partner reflected the decrease, climbing by 23.1% to $1.27 million. Schmidt said the contracting equity partner ranks largely stemmed from attorneys transitioning into senior partner status.

Schmidt attributed the firm's robust revenue growth to rising demand and strong hours billed across the firm. This included major large-scale litigation matters, strong transactional work and significant efforts on privacy and data protection. The firm created a new "digital assets and data management" practice group in January, bringing the total number of practices to six.

Schmidt attributed the firm's robust revenue growth to rising demand and strong hours billed across the firm. This included major large-scale litigation matters, strong transactional work and significant efforts on privacy and data protection. The firm created a new "digital assets and data management" practice group in January, bringing the total number of practices to six.

Illustrating the burgeoning demand for those services, Schmidt noted that the firm had helped clients respond to over 1,000 data breach incidents, including the massive Marriott breach, in the last year.

"The work we're doing there gives rise to counseling, incident response and class action," he said.

Meanwhile, the firm's litigators were busy across the country, representing the official committee of tort claimants in the Chapter 11 reorganization of PG&E Corp. in California, and players in the opioid multidistrict litigation out of Cleveland. The firm also notched a $74 million judgment in Texas on behalf of energy client Castex.

"We're getting recognized in the market for having the expertise, scale and depth to handle the largest and most complicated matters, particularly in litigation," Schmidt said. He added that the firm had been rewarded for its investments in e-discovery and other litigation capabilities, much of which came as a result of its longstanding work on recovering billions from Bernard Madoff's Ponzi scheme. A team of over 100 lawyers have thus far recovered over $14 billion and returned over $13 billion to customers.

Deal work was highlighted by E.W. Scripps Co.'s acquisition of eight television stations in seven markets from the Nexstar Media Group Inc., as well as transactions in the health care arena.

The firm was also able to capitalize on rate increases that surpassed 3%.

"Lawyers are anxious about rates, but our realization stayed constant," Schmidt said. "Even with a rate increase, I think that clients see the value they get from us on these major matters."

These clients are also increasingly asking about alternative fee arrangements, keeping the firm's client value team busy. The firm's geographical reach, with high-quality lawyers in both pricey and lower-cost markets across the U.S., has it well-positioned to compete in this area. But Schmidt said that these had yet to become a material part of its business.

"We have to be prepared to offer them, but at the end of the day, it seems that the clients are interested in evaluating that option, and then they revert to what they are used to," he said.

Looking forward, the firm has been aiming to put cash aside to prepare for office relocations and renovations, aided by a "small" 2% capital call in a strong year. And Schmidt is hoping to be able to announce an expansion within the U.S. later in 2020.

He's also looking to continue growing the litigation practice, adding privacy, white collar and antitrust attorneys to take advantage of its existing capabilities in large-scale litigation. The firm also is aiming to broaden its presence in middle market private equity transactional work, and other areas that make sense are specialized real estate and health care.

After a full year at the helm, Schmidt pronounced that energy is high and morale is good.

"People continue to be working hard and productive, and when they're working hard they're happy," he said. "The firm is really well poised for growth, and we've been very innovative. We're a firm on the move."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Baker & Hostetler Elects New Chairman for First Time in 14 Years

Baker & Hostetler Reshuffles Practice Groups, Signaling Data's Dominance

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250