Lowenstein's Earnings Spike Amid Gains in Head Count, Revenue Per Lawyer

Lowenstein Sandler posted year-over-year improvements in all financial metrics for fiscal 2019, including an 11% leap in gross revenue.

February 19, 2020 at 04:40 PM

5 minute read

The original version of this story was published on New Jersey Law Journal

Lowenstein Sandler posted year-over-year improvements in all financial metrics for fiscal 2019, including an 11% leap in gross revenue.

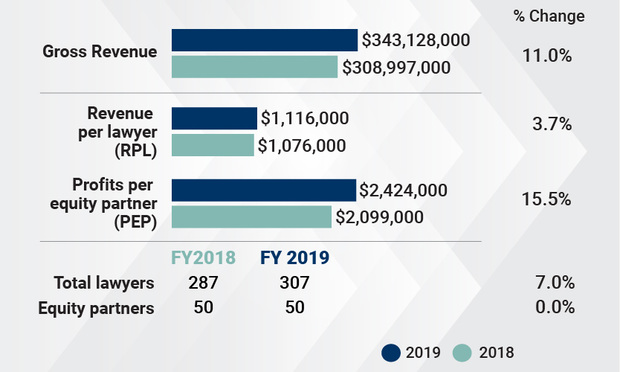

The revenue increase (to $343 million from $309 million) is fueled in part by considerable attorney head count growth, though revenue per lawyer, as well as other per-lawyer metrics, improved too.

Lowenstein, with its largest offices in Roseland and midtown Manhattan, has yet to crack the Am Law 200′s group of "first hundred" firms, though it is gaining ground and compares favorably to many of those firms in its metrics. It was 109th in gross revenue rankings last year.

"In and of itself, that is not a goal," managing partner Gary Wingens said of a possible vault into the first hundred in the coming years. But, he added, "in order to continue to attract really good lawyers at every level, we have to be able to be competitive in the types of metrics" that the Am Law 200 tracks.

Lowenstein Sandler financials/illustration by ALM

Lowenstein Sandler financials/illustration by ALMOver a five-year period, the firm's gross revenue has grown roughly 49%, from $230 million in fiscal 2014.

The firm's head count (measured by average full-time equivalents for the year) was 307 in 2019. That's a 7% increase and net gain of 20 full-time equivalents from 2018.

In terms of raw head count, the firm had 351 total lawyers at year's end, compared with 325 at the end of 2018 and 291 at the end of 2017, Wingens noted.

Last year was a "very active recruiting year," though lateral hires were "virtually all individual additions," he said. "We needed a lot more people to do the work."

That work included what Wingens said was a record-setting 2019 for the number of investment fund launches that Lowenstein advised, as well as banner years in venture capital, private equity and M&A deals.

"We've been launching funds for some of the country's largest hedge funds and private equity funds for quite some time. In recent years we've really been building our market share among what we'd call well-pedigreed fund launches," meaning funds launched by former managers of well-established funds, often with financial backing from those well-established funds, he said.

Also, the firm's bankruptcy practice, which accounts for slightly less than 10% of the firm's attorney head count but more than 10% of gross revenue, according to Wingens, had an active year, he said, noting the Bumblebee, Barneys and Fred's stores bankruptcies as examples.

Gary Wingens

Gary WingensLowenstein's highest-value M&A deals of 2019—representing Indorama Ventures in its $2 billion acquisition of Huntsman's specialty chemicals portfolio, and Estée Lauder's $1.7 billion acquisition of Have & Be Co. Ltd.—were both cross-border deals that relied on help from the Washington, D.C.-based global trade practice the firm added in late 2018, Wingens said.

Head count growth certainly fueled revenue, but lawyers brought in more on an individual basis, too, in 2019. Revenue per lawyer increased by 3.7%, to $1.12 million, from $1.08 million. The $1.12 million RPL figure puts Lowenstein slightly ahead of the fiscal 2018 average for the first hundred ($975,982) and well ahead of the fiscal 2018 average for the second hundred ($667,513), according to ALM data.

And a 15.5% spike in profit per equity partner (PEP) puts that figure at $2.42 million. Again using fiscal 2018 figures from the 2019 Am Law 100 as a reference, Lowenstein's PEP figure is on par with that of first hundred firms Shearman & Sterling ($2.43 million) and Akin Gump ($2.4 million).

Lowenstein has had 50 equity partners in each of the last two years. That, combined with overall head count growth, means leverage (the ratio of all firm attorneys less equity partners to equity partners) increased. Stated simply, for every equity partner, there are more than five lawyers of another rank at Lowenstein.

Wingens noted that the firm actually has 70 equity partners per its partnership agreement, while 50 is the number of partners who receive majority equity compensation. Still, by either measure, it's "a high bar to become an equity partner" at the firm, Wingens said.

"There is no hard-and-fast rule … but your partners have to view you as really important to the future of the firm," he said. "We're not following a pure numbers game, but what we find is, when we make the right people partner, the work follows."

As for firms' varying leverage models, Wingens said there are "lots of different formulas for success."

"One thing we've seen in this industry is there's lots of room for different models," he said. "We are fortunate to have the kind of work that supports" many lawyers, he added.

Some 300 of Lowenstein's lawyers are equally distributed between the Roseland and Midtown Manhattan offices, with many attorneys splitting time. Wingens noted the "increasing mobility between the two offices," which he said is a point of recruiting these days, specifically the compensation parity among lawyers based in those locations.

"You're going to get the exact same work and make the same money" in either New York or New Jersey, is the message to recruits, according to Wingens.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

- 1How ‘Bilateral Tapping’ Can Help with Stress and Anxiety

- 2How Law Firms Can Make Business Services a Performance Champion

- 3'Digital Mindset': Hogan Lovells' New Global Managing Partner for Digitalization

- 4Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 5Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250