Hogan Lovells Hiked Revenues Again in Immelt's Last Full Year as CEO

CEO Steve Immelt said balanced growth across the global firm's practices drove a seventh straight year of revenue gains.

February 20, 2020 at 07:01 PM

5 minute read

Stephen Immelt. (Photo: Diego M. Radzinschi/ALM)

Stephen Immelt. (Photo: Diego M. Radzinschi/ALM)

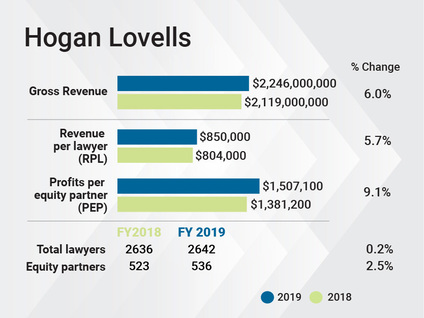

Hogan Lovells posted its seventh consecutive year of growth in 2019, as total global revenue climbed 6% to $2.25 billion.

Profits per equity partner grew 9.1% to $1.51 million, while revenue per lawyer increased by $5.7% to $850,000.

"The good thing about 2019 is that we saw pretty balanced growth," said Washington, D.C.-based CEO Stephen Immelt. "It was not driven by any one sector or one huge matter."

The Americas represented approximately half of the firm's total billings in the previous year. The U.K. and Continental Europe together accounted for another 43%, while Asia Pacific and the Middle East provided the remaining 7%. Revenue from London and the U.K. grew over 10% to £332.6 million.

Deal flow recovered in the second half of 2019 after a slow start to the year, according to Immelt, while the firm's litigation, regulatory and IP practices—less tied to market fluctuations—performed impressively over the full year.

Immelt, who is stepping down from his position in July after six years at the helm, has stressed repeatedly that the firm has been prioritizing sector-based expertise. Viewed along those lines, the automotive industry and financial institutions were standouts.

For the former, the rise of connected cars, electric vehicles and other advancements is fueling dealmaking to license or buy new technologies, while manufacturers are facing increased regulatory scrutiny along with a continued need for financing. Financial institutions, meanwhile, have been facing uncertainty not just from Brexit but the phasing out of the Libor benchmark for inter-bank lending.

For the former, the rise of connected cars, electric vehicles and other advancements is fueling dealmaking to license or buy new technologies, while manufacturers are facing increased regulatory scrutiny along with a continued need for financing. Financial institutions, meanwhile, have been facing uncertainty not just from Brexit but the phasing out of the Libor benchmark for inter-bank lending.

Hogan Lovells' head count remained largely steady in 2019, with over 2,600 attorneys worldwide. Its number of equity partners ticked slightly upward to 536, expanding by 2.5%, with part of the growth coming from changes in South Africa. There, the firm unwound a six-year-old affiliation with a local firm and launched a new fully integrated office with five partners.

The firm also launched a legal services center in Berlin in June, supporting white-collar, investigations and fraud work, and a document review center in Phoenix in December, in conjunction with law company Elevate.

"It's price competitive," said London-based deputy CEO David Hudd, who is also stepping down at the end of June. "That is going to continue to be an important part of our evolution, in terms of how work is going to be delivered."

The firm did raise rates more than 3% in 2019, at a level that Immelt said was consistent with the rest of the market, and further increases are in the works for this year.

"The good news from our perspective is that we were able to capture a good percentage of the rates we introduced in 2019," he said. "It's not automatic. Clients need to feel that [these are] consistent with peer firms and that they're getting value at the end of the day."

While the firm's finance clients in London have been using alternative financial arrangements for two decades, the appetite for these is growing in practices like litigation and in regions like the U.S. But even with a movement towards fixed fees, caps and hard budgets, Immelt recognizes some limits in what will change

"I personally think that sometimes the clients are the ones who are more reluctant to move away from hourly rate billing," he said.

Looking ahead to the rest of 2020, both Immelt and Hudd said they are comfortable with the firm's global footprint and do not expect to expand into any new markets. But they are eyeing growth in New York, California and London.

And as the two prepare to move on from leadership, they had several thoughts on how they would advise their successors: incoming CEO Miguel Zaldivar, a project finance specialist who's currently based in Hong Kong, and deputy CEO Michael Davison, a London-based international arbitration attorney.

"This is a dynamic and unpredictable business. Be ready for things you can't envisage," said Hudd, pointing to Brexit, the election of Donald Trump and other signs of a global turn towards populism that would have been hard to detect when they started in their roles in the middle of 2014.

"But the advantage of a firm like this is that we're broadly based, and not overly dependent on one region," Hudd added. "We're widely hedged, and should keep that hedging in place.

For Immelt, it's valuable to constantly look for new opportunities in the world. He pointed to a decision 15 years ago, while at predecessor firm Hogan & Hartson, to explore hiring an expert in privacy work.

"We now have 200 lawyers who are dealing with privacy," he said. "It's hard sometimes when you've got a lot of work on your desk. But you need to look around and see what the next opportunity is going to be."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Hogan Lovells Confirms New CEO and Deputy CEO

Revenue, Profits on the Rise for Transatlantic Hogan Lovells

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid to Practice Law in U.S. on Indefinite Hold, as Arizona Justices Exercise Caution

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute readTrending Stories

- 1Delaware Supreme Court Names Civil Litigator to Serve as New Chief Disciplinary Counsel

- 2Inside Track: Why Relentless Self-Promoters Need Not Apply for GC Posts

- 3Fresh lawsuit hits Oregon city at the heart of Supreme Court ruling on homeless encampments

- 4Ex-Kline & Specter Associate Drops Lawsuit Against the Firm

- 5Am Law 100 Lateral Partner Hiring Rose in 2024: Report

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250