Capital Markets, US Gains Fuel Revenue Boost for White & Case

Revenue rose 6.6% as a slightly smaller equity tier saw partner profits increase 8.25%.

February 21, 2020 at 05:30 AM

4 minute read

White & Case chair Hugh Verrier. (Courtesy photo)

White & Case chair Hugh Verrier. (Courtesy photo)

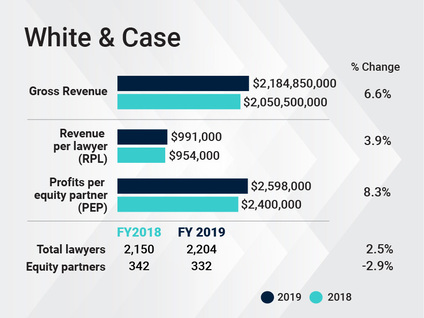

New York-founded global powerhouse White & Case grew its revenue by 6.6% in 2019, pushing the firm's top line to $2.185 billion.

Profits per equity partner grew by 8.25% to about $2.6 million, split across an equity partner tier that contracted by 2.9% last year. Revenue per lawyer climbed 3.9% to $991,000, as overall head count rose 2.5% to 2,204 lawyers.

Hugh Verrier, the four-term chairman of White & Case, said 2020 marks the final year of a five-year plan that has spurred impressive growth.

"We grew heavily in the U.S., as per the plan, and specifically in New York," Verrier said. "We are an international firm, so there is a European and Asian component to this as well. The year wasn't quite as strong in Europe and the U.K., but they still did well overall."

Verrier said that expanding two newer U.S.-based offices, in Houston and Chicago, was a focal point, and that the growth was solid for both in 2019.

The bulk of the firm's offices—24—are spread throughout Europe, the Middle East and Africa, with 10 in the U.S. and another 10 in the Asia Pacific region.

The bulk of the firm's offices—24—are spread throughout Europe, the Middle East and Africa, with 10 in the U.S. and another 10 in the Asia Pacific region.

Since the firm enacted its five-year plan in 2015, those offices combined have boosted firmwide revenue by 43%, RPL by 24%, PEP by 29% and head count by 15%.

The firm highlighted its capital markets, finance and M&A practices as major drivers of 2019 gains.

Saudi Aramco, a longtime client of White & Case, was a big part of that success. The state-owned oil giant went public in 2019 with a $25.6 billion IPO, currently the largest ever.

White & Case also represented the Saudi company in its $69.1 billion acquisition of Saudi Basic Industries Corp.

The firm, with its strong U.K. and European footprint, watched the Brexit process unfold closely, but Verrier said it's not overly worried about potential fallout. He noted that the firm's annual partner meeting was held in London in 2019 for the first time in the office's 50-year existence.

"There has been a calm nervousness about Brexit, but our results continue to be strong," he said.

White & Case didn't make any substantial changes to its overhead management or undertake any significant operations or technological changes in 2019, Verrier said.

The firm did, however, see a 31% increase in overall nonequity partner compensation, from $105.91 million up to $139.69 million in 2019. It also had a 15% increase in nonequity partners, upping the firm count from 188 to 217, as the equity partnership shrank slightly.

The firm's C-suite remained unchanged, and Verrier said that having continuity in high-level roles is integral for business success.

"Part of my job is to bring in the skill sets that create a division of labor at the firm which is beneficial to the clients," Verrier said.

Verrier said the firm did not make any significant updates to its rates and billing. He did say that his firm, perhaps more than most due to its strong international presence, is and has been dealing with more fixed rate work than most firms.

While the U.S. is largely stuck on the billable hour, many other parts of global legal marketplace are not, he said.

"We aren't pushing the envelope on alternative fees," Verrier said. "It's market driven for us."

The firm reported that it brought in 42 lateral partners last year, and promoted another 45 in early 2020 in its largest partner class ever. The firm said 38% of the promoted partners were women, while 19% of its lateral hires were female.

The percentage of U.S. partner promotions skewed more favorably toward women, where 56% of promoted partners were women. The firm also said that 25% of its promoted partner class in the U.S. identified as an ethnic minority.

Verrier said the firm is in the process of developing its next five-year plan. He said it typically takes around 18 months from concept to execution, and the firm wants to have the next iteration ready when the sand runs out on the current one.

"We are in the thick of it," Verrier said of the plan development. "We want to close strong with our goals and not mess up the existing plan."

Read More

White & Case Deployed 400-Lawyer Army for Saudi Aramco IPO

White & Case Grows Chicago Office With Kirkland, Winston Hires

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250