Debevoise Cracks $1B in Revenue in Third Straight Year of Major Growth

Debevoise managed to increase its profit margin and its leverage in 2019.

February 24, 2020 at 12:00 PM

5 minute read

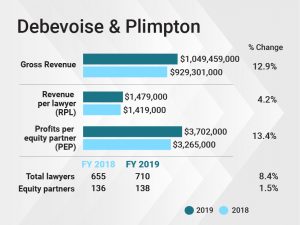

Debevoise & Plimpton's revenue rose nearly 13% last year and its profits per partner grew by an even greater amount to $3.7 million, as the firm boosted its head count in New York and overseas while raising revenue per lawyer.

The firm's revenue rose from $929 million to about $1.05 billion in 2019, driven by a combination of growth in its transactional and disputes practices, presiding partner Michael Blair said. Profits per equity partner rose 13.4%, from $3.27 million to $3.7 million, and revenue per lawyer rose 4.2%, hitting $1.48 million.

"It's our third consecutive double-digit percentage growth in revenue and our third consecutive double-digit percentage growth in [PEP]," Blair said. "The main driver is a really substantial growth in demand from our clients."

The firm's London office, its second-largest after New York, grew its revenue from $139 million to almost $152 million. The firm's average lawyer head count in the U.K. rose by almost 12%. Blair said the office is a key part of the firm's success with private equity clients, and added that commercial litigation and international disputes work has also helped the office grow.

The firm's London office, its second-largest after New York, grew its revenue from $139 million to almost $152 million. The firm's average lawyer head count in the U.K. rose by almost 12%. Blair said the office is a key part of the firm's success with private equity clients, and added that commercial litigation and international disputes work has also helped the office grow.

Clients in the technology sector—and those whose needs are increasingly technology-inflected, like the insurance business—helped drive demand, Blair said. Other areas where the firm has done well are cybersecurity and data privacy and in its offering to healthcare industry clients, he said.

Debevoise's record over the past three years has been enviable, Blair said, with revenue rising 43% in that period, revenue per lawyer rising 23% and profits per equity partner rising 54%.

Debevoise managed to increase its profit margin and its leverage in 2019. Its partnership—all of whom are equity partners—grew by two lawyers, while the ranks of associates and other lawyers grew over 10%. The greatest head count growth was in London and Hong Kong, both of which had a double-digit rise in full-time equivalent lawyers from 2018 to 2019, compared with an 8.4% firmwide rise.

Blair said the firm's M&A team, its largest practice, had a 27% increase in deal volume in 2019. The investment management group also broke its previous record, and banking and insurance practitioners also had very strong years, he said.

On the transactions side of the ledger, the firm represented Interxion, a networking and data center company, in an $8.4 billion merger with Digital Realty; worked for New York Life on a $6.3 billion acquisition from Cigna; and represented blue-chip companies like Johnson & Johnson, Prudential Financial and Toyota. It also worked with the financial advisers on International Flavors & Fragrances' $26 billion acquisition of a unit of DuPont's business.

The firm's private equity fund formation lawyers also helped form some of the largest-ever funds focusing on infrastructure (Global Infrastructure Partners IV, which closed at $22 billion), venture capital (Sequoia's $8 billion Capital Global Growth Fund III) and European health care (GHO Capital Fund II, which closed at €975 million).

In the disputes column, Debevoise worked for members of the Sackler family, the owners of Purdue Pharma, which makes the opioid painkiller OxyContin. While Blair wouldn't say how much the firm made from that work in 2019, an audit filed in bankruptcy court says the firm made $5.2 million in the first quarter of the year.

International disputes practitioners have been especially busy, Blair said, juggling several cases with more than $1 billion on the line in each of them, not all of which were public. They also won a $6 billion award in one dispute last year, Blair said.

Other major wins included MZ Wallace v. Fuller, a trademark case that went to trial, and a multibillion-dollar whistleblower case brought against a group of insurers and financial giants by Total Asset Recovery Services. The firm also helped notch a major victory before the U.S. Supreme Court in a case involving the taxation of trust income to a beneficiary, North Carolina Department of Revenue v. Kimberley Rice Kaestner 1992 Family Trust.

Amid all the legal work last year, the firm's lawyers undertook a deep internal review and decided to stick with its lockstep compensation system. While some legal market observers say the lockstep poses problems in keeping and retaining star partners, Blair said Debevoise's system is a "competitive advantage" because it fosters teamwork, both within the firm and with its clients' legal departments.

"We think the lockstep system we have, and the collaborative culture we have, which the lockstep system undergirds, is the best system for competing in this world of growing complexity," he said. "We don't think we'd be as successful as we've been without that culture."

Debevoise had some high-profile hires — and departures — in 2019. In April, it hired Lisa Zornberg, who had been the chief of the criminal division at the U.S. Attorney's Office for the Southern District of New York. It also brought on funds lawyers Lorna Bowen, Justin Storms and Andrew Ford from Linklaters and bankruptcy leader Sidney Levinson from Jones Day.

Among departures, Matthew Biben, a banking partner, moved to Gibson, Dunn & Crutcher in August. And in early 2019, Matthew Fishbein, a partner, took a new role leading investigations for the Brooklyn District Attorney's Office.

Despite the firm's 8.4% head count growth, Blair said Debevoise plans a measured approach.

"Organic growth is the highest quality kind of growth," he said. "We will continue to grow at a very healthy, above-market level, but we're not going to do anything transformative. We're just going to do it the old-fashioned way."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250