Gibson Dunn Revenues Hit $2B in Another Double-Digit Growth Year

"It was a fabulous year," said chairman Kenneth Doran, as the firm closes in on a quarter-century of nonstop growth.

February 24, 2020 at 05:00 AM

5 minute read

(Photo: Diego M. Radzinschi/ALM)

(Photo: Diego M. Radzinschi/ALM)

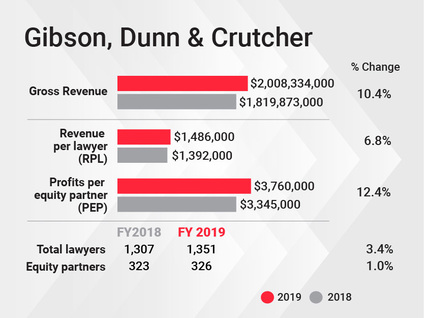

Gibson, Dunn & Crutcher posted a second consecutive year of double-digit growth in 2019, as the firm's revenues crossed the $2 billion threshold for the first time.

The 10.4% rise marked the 24th straight year in which the firm's top line increased. Net income also increased by 13.6%, the 23rd consecutive year of profit growth.

Profits per equity partner climbed upward 12.4% to $3.76 million, while revenue per lawyer hit $1.49 million, up 6.8%.

"Across practice groups, across offices, it was a fabulous year," said Gibson Dunn chairman and managing partner Kenneth Doran. "We've invested strategically for a number of years, and we're seeing a return on our investments."

The firm earned litigation department of the year honors from The American Lawyer, as labor and employment, white-collar crime, energy and environmental work, and class actions drove business in that arena.

One highlight was successfully defending T-Mobile owner Deutsche Telekom in the federal antitrust lawsuit filed by 13 states and the District of Columbia challenging its $26 billion merger with Sprint. The firm also represented Facebook in civil litigation arising out of reports of the alleged misuse of Facebook user data by Cambridge Analytica, the company's $5 billion settlement with the FTC, and cases seeking to prevent criminal defendants from subpoenaing service providers for the social media records of victims or witnesses.

One highlight was successfully defending T-Mobile owner Deutsche Telekom in the federal antitrust lawsuit filed by 13 states and the District of Columbia challenging its $26 billion merger with Sprint. The firm also represented Facebook in civil litigation arising out of reports of the alleged misuse of Facebook user data by Cambridge Analytica, the company's $5 billion settlement with the FTC, and cases seeking to prevent criminal defendants from subpoenaing service providers for the social media records of victims or witnesses.

Another high-profile matter involves representing Chevron against state and local governments that are trying to hold Big Oil responsible for climate change-related liabilities over the production, sale and promotion of fossil fuels.

Performance was equally healthy in Gibson Dunn's transactional practices, buoyed by M&A, private equity and real estate. Here, standouts included advising RedBird Capital Partners in its recent $3.47 billion acquisition, with partners, of YES Network from Disney; helping Los Angeles-based private equity firm Leonard Green & Partners raise capital for two private equity funds totaling $14.75 billion; and leading the representation of MGM Resorts International in its $825 million sale of Circus Circus Las Vegas.

Macroeconomic factors caused some stress for the firm's capital markets practice for much of 2019, but that work appears to be rebounding, according to Doran. That pressure was particularly apparent in London, where the long-running uncertainty surrounding Brexit had a chilling effect both on securities work and real estate. The firm did not make specific data about its London office available.

"Now that there's a path forward, that should pick up," Doran said.

Gibson Dunn grew its head count by 3.4% over the past year, bringing the total number of attorneys to 1,351. The equity partnership was largely static. And Doran said that a reported 34% rise in the size of the nonequity partnership, from 56 to 75, was largely illusory, as it does not accurately reflect a "fairly large" group of partners who were promoted to equity status Jan. 1, 2020.

Some of the firm's biggest lateral hires were in New York, where it brought on a trio of Jones Day bankruptcy and restructuring partners in October, along with several white-collar experts, including Mueller investigation veteran Zainab Ahmad. And it found room for more M&A lawyers in New York and elsewhere around the country, including Denver, Palo Alto, California, and Houston.

"We invested in our strengths," said Doran, "not in new practices."

Looking forward, priorities for growth include private equity and real estate. And Doran recognizes that maintaining the firm's vaunted reputation in litigation means continued investment, both in landing laterals and developing promising young attorneys already with the firm.

With regard to regions, growing in the Bay Area is a strategic focus for the firm, as is New York, where the firm has its largest office.

"The opportunities there are enormous," Doran said.

London, Germany and Paris also remain priorities, and even with the coronavirus and a trade war, the firm is bullish on long-term prospects in China.

Gibson Dunn has not opened a new office since moving into Houston in 2017, and while it is currently exploring several potential markets, the process is moving slowly.

"It would shock me if there were to be a new office in 2020," Doran said.

Nearly two decades into his leadership of Gibson Dunn, Doran acknowledged that he and his colleagues will have to continue working hard to maintain the firm's impressive trend line.

"We're very aware that financial success isn't how we define our success," he added. "It's the value we add to our clients, our pro bono work and giving back to our communities, and ways to improve ourselves that aren't part of the bottom line—like diversity and inclusion, for example."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Gibson Dunn Posts Double-Digit Revenue Gain in 23rd Straight Year of Growth

Kirkland M&A Whiz Sorabella Jumps to Gibson Dunn

Debevoise White-Collar, Banking Partner Moves to Gibson Dunn

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250