Latham Revenues Surge to $3.76 Billion on Strong Demand

Partner profits were also up significantly in what chairman Richard Trobman called an "absolutely amazing year."

February 26, 2020 at 10:00 AM

6 minute read

Richard Trobman of Latham & Watkins. (Courtesy photo)

Richard Trobman of Latham & Watkins. (Courtesy photo)

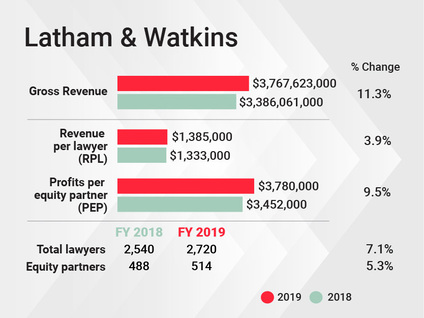

Latham & Watkins posted double-digit revenue gains for the second year in a row in 2019, boosting its top line by 11.3% to just over $3.76 billion.

The firm's growing equity partner tier saw profits rise at nearly the same clip. Profits per equity partner reached $3.78 million, up 9.5% from 2018, and revenue per lawyer rose 3.9% to almost $1.4 million.

Echoing other firms, Latham credited strong demand for what chair and managing partner Richard Trobman called an "absolutely amazing year." Last year, the firm's 2,720 lawyers increased their client-chargeable hours by 8%—far outpacing an industrywide demand uptick of 1.1% reported recently by Citi Private Bank's Law Firm Group.

"It's another metric that drives and shows how significant is the success we're enjoying. It's reflective of what we view as our investment in our platform and our investment in our clients," said New York-based Trobman. "We see that movement toward firms like ours."

To emphasize that increase in demand, Latham touted how its top clients used more of the firm's offices than in 2018. For instance, the firm's top 25 clients worked with Latham lawyers from 25 of its offices on average last year, which is up from 22 offices in 2018.

Despite the increases in revenue and demand, it appears unlikely that Latham will overtake Kirkland & Ellis in the race to become the highest-grossing U.S. law firm, according to preliminary reporting for The American Lawyer's annual Am Law 100 rankings.

Kirkland dethroned Latham as No. 1 with its 2017 financial performance, and in 2018, the firm raked in $3.75 billion in revenue. Latham could only regain its title this year if Kirkland's overall revenue grows less than 0.2%. The third-ranked firm based on 2018 performance was Baker McKenzie, with revenue of $2.9 billion.

Kirkland dethroned Latham as No. 1 with its 2017 financial performance, and in 2018, the firm raked in $3.75 billion in revenue. Latham could only regain its title this year if Kirkland's overall revenue grows less than 0.2%. The third-ranked firm based on 2018 performance was Baker McKenzie, with revenue of $2.9 billion.

Latham's London office saw faster revenue growth than the firm at-large in 2019; while the firm's revenue grew 11.3% across all offices, the London office's revenue grew by at least 15%, the firm said. Latham declined to detail London revenue in pound or dollar terms.

With 390 lawyers, London is the firm's second-largest office behind New York. (Trobman, who was previously based in London, relocated to the New York office last year.)

Both transactional and litigation practices performed strongly in 2019, Trobman said. Litigation accounted for 30% of Latham's gross revenue last year.

"It's a significant and growing part of our global law firm," Trobman said.

Six of the seven high-stakes commercial disputes Latham took to trial by November were led by different female lawyers, according to the Litigation Daily. That includes a $666 million arbitration win Latham scored for its client DXC Technology in an accounting dispute with Hewlett Packard Enterprise Co.

Latham's lawyers also prevailed in two $1 billion cases last year. First, its lawyers fought off a $1.2 billion claim made by jilted investors of Puma Biotechnology who had accused the company of making false or misleading statements about a clinical trial for a breast cancer drug. As a result of the jury verdict, Latham's client is expected to pay out, at most, $18 million in damages.

Latham also came to Facebook's rescue, successfully persuading a federal judge in November to knock out two out of three proposed nationwide classes. The $6 billion class action lawsuit was filed after hackers stole the personal data of 29 million Facebook users in 2018. A settlement in the case was in the works in late January.

But the firm's transactional practice has its own set of victories to show off. Its lawyers represented the Canada Pension Plan Investment Board, which was one of the parties that chipped into the $7.6 billion take-private acquisition of Merlin Entertainments, which owns Legoland Resorts, Alton Towers and Madame Tussauds.

Latham also played a key role in the largest initial public offering in history, advising the underwriters of Saudi Arabian Oil Company's IPO.

Latham's overall head count rose by 7.1% last year, adding a net 180 lawyers to its ranks, including 26 more equity partners (up 5.3%) and 33 nonequity partners. Among the 23 lateral partner hires Latham made 2019 was Edward Nelson, a New York partner specializing in private investment funds who left Gibson, Dunn & Crutcher after more than 10 years there.

Latham was an early investor in Reynen Court, a self-described "app store" for legal tech that formally launched in January of this year. Similar to the Google Play Store or the Apple App Store, Reynen Court allows law firms to purchase certain software and use them within their own networks by providing the neutral infrastructure needed for installation, use and management.

"The investment in Reynen Court is emblematic of a lot of things that we do here as a firm, which is to remain on the cutting edge of the practice, to be constantly thinking about the business of law," said Trobman, who characterized the firm's investment in the legal tech platform as a "knowledge" investment, not an economic one.

Trobman didn't highlight any specific plans to grow certain practice areas or to expand the firm's current geographic footprint of 29 offices in 14 countries. Latham did close its Rome office last year, but LeeAnn Black, the firm's chief operating officer, said it was a "post office location" with no lawyers based there.

Trobman added that the firm is very committed to its Milan office, which is home to 38 Latham lawyers.

Read More

Daily Dicta: Latham's Billion Dollar Litigator

Daily Dicta: Latham Leads With First-Chair Women Litigators

Kirkland Poised to Keep Top Am Law 100 Rank After Another Stellar Year

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

How Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

4 minute read

Fried Frank Partner Leaves for Paul Hastings to Start Tech Transactions Practice

3 minute read

Weil Adds Acting Director of SEC Enforcement, Continuing Government Hiring Streak

3 minute read

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250