Reed Smith Boosts Revenue, Partner Profits in 'Excellent' 2019

Global managing partner Alexander "Sandy" Thomas said the firm posted record highs in its three most important metrics: revenue per lawyer, profits per partner and gross revenue.

February 27, 2020 at 05:00 AM

5 minute read

Reed Smith global managing partner Sandy Thomas. (Courtesy photo)

Reed Smith global managing partner Sandy Thomas. (Courtesy photo)

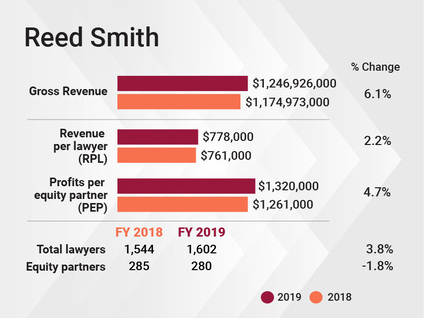

Reed Smith in 2019 hit new highs in what global managing partner Alexander "Sandy" Thomas called the firm's three most important metrics: revenue per lawyer, profits per partner and gross revenue.

The firm brought in a record $1.247 billion, up 6.1% from the previous year. RPL climbed by 2.2% to $778,000. And profits per equity partner rose 4.7% to $1.32 million.

"We had an excellent 2019," Thomas said. "It felt good to be on a march to our goals for revenue and profitability."

Reed Smith also grew net income by 2.6% to $368.94 million.

Thomas found that the firm saw balanced performance across the litigation, regulatory and corporate sectors.

In the U.S., litigators have stayed busy on products liability work in the life sciences, particularly through the sprawling opioid fight and mass tort litigation over pelvic mesh.

On the transactional side, the firm has been growing its capabilities on cross-border deal work, and Thomas said demand was high in 2019. He focused on the sale of shipping loan portfolios, particularly those connected to mainland Europe, deals that draw on the firm's capabilities in Germany, London and New York.

"Finance transactions in that assets class have just been a huge growth area for us," he said.

"Finance transactions in that assets class have just been a huge growth area for us," he said.

Shipping and transportation is one of the firm's five core sectors, along with financial services industry, life sciences and health, energy and natural resources, and media and entertainment.

Thomas acknowledged that ongoing trade wars between the United States and China and the U.S. and the European Union likely tamped down on some of the firm's opportunities, while prompting more work elsewhere.

Reed Smith raised rates more than 3% in 2019, but Thomas said the hikes were in line with the rest of the industry. He added that improved productivity also accounts for a share of the firm's strong performance.

While the firm's head count was largely static across 2018, it grew slightly over the last year, with head count up 56 lawyers, or 3.8%, to 1,602. In London, the firm grew to 314 lawyers, up 4.6%. Revenue for that office in 2019 was $215.06 million.

In November, Reed Smith drew headlines for becoming the first international law firm to secure an Alternative Business Structure license in the U.K., which allows for fee sharing with non-lawyers and outside investment. Thomas said the firm was still considering how to make best use of the status, with an eye toward building a multidisciplinary practice, but it was not considering taking on outside investors.

"We are deconstructing what we're doing for clients and asking what services that aren't traditional legal services are most logical for us to offer," he said.

Reed Smith has also been investing in its technology subsidiary Gravity Stack, and for 2020 is prioritizing getting partners further engaged in understanding how technology solutions can benefit clients.

Another area of investment has been in pricing, as the firm's client value team is now home to nearly 40 staffers. Thomas said the share of work governed by alternative financial arrangements is steadily growing.

"I wouldn't tell you it's growing terribly fast, but we're trying to grow it. We want to be a firm that raises the issue with our clients," he said. "Right now, it's more driven by us running towards it than by demand on its own. "

Substantial resources also went into the firm's May 2019 entry into Dallas, where an initial 16 lawyers have now grown to 32.

" We have exceeded our most optimistic projections in that market," Thomas said. "We go through careful due diligence in looking at these new market options for where there are clients who need our services and are willing to entertain using us. Existing clients were willing to give us a shot and we're off to a great start."

Even more recently, the firm moved into Brussels in January. Thomas added that while the firm is continually evaluating new markets, its focus is currently on integrating both additions.

While the firm is satisfied with the current balance of its footprint, Thomas said that he is interested in growing in markets where the firm is relatively young but having success—two examples being Dallas and Houston. New York is also a priority.

Thomas pointed to Reed Smith's culture as the foundation for its success over the last year.

"We're collaborative, we respect each other and want to help each other," he said. "In the absence of that, we would not have enjoyed the success that we had."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Reed Smith Grows Revenue, Profits as Head Count Stays Flat

Reed Smith's Tech Subsidiary GravityStack Hits Maturity Milestone

Leading Questions: The American Lawyer Interview With Reed Smith's Sandy Thomas

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

5 minute read

Law Firms Mentioned

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250