Sidley Sees Gains in Revenue, Partner Profits as Equity Tier Dips

The firm has seen its revenue grow by close to $1 billion since 2011.

March 04, 2020 at 02:12 PM

5 minute read

Larry Barden and Michael Schmidtberger, Sidley Austin (Courtesy photo)

Larry Barden and Michael Schmidtberger, Sidley Austin (Courtesy photo)

Sidley Austin continued its streak of revenue growth into a ninth year, finishing 2019 with solid gains in gross revenue and profits per equity partner.

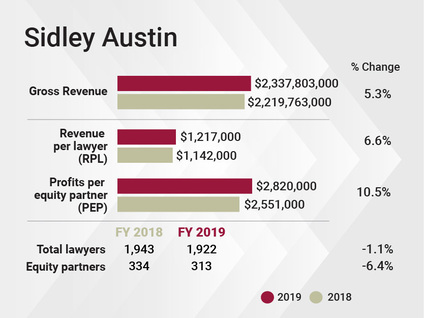

The Chicago-based law firm grossed $2.337 billion last year, a 5.3% increase from 2018. The rise the firm saw in profits per equity partner was nearly double that—a 10.5% increase to $2.82 million—though that was spread across a smaller equity partnership. Since 2011, Sidley has seen its overall revenue increase by nearly $1 billion, a point the firm's leadership touted.

"We have a phrase around here—'built to win'—that we've been using over the last year or so," said Larry Barden, the chair of the firm's management committee. "When you look at the decade, we built pretty exceptional breadth and depth across our global platform."

Sidley's London office—the firm's fourth-largest location with 142 lawyers—played a significant role in its 2019 financial performance. The revenue generated by the London office has more doubled over the past decade, reaching £98.1 million ($125.7 million) last year, according to the firm.

"We continue to see an expansion of the client base there, and client penetration is occurring at the highest ends of the private equity firms, the highest tier, as well as the upper middle markets and others," Barden said. "We saw significant growth in restructuring in London."

Firmwide, Barden cited standout performance by several practice groups, including regulatory and enforcement, banking and financial services, energy and infrastructure, mergers and acquisitions and private equity. However, unlike some of its Am Law 50 cohorts, the firm's lawyers did not see a growth in the hours they charged clients in 2019 over 2018.

For the first time since 2011, Sidley's overall head count dropped slightly, declining 1.1% from 1,943 to 1,922 lawyers spread across 20 offices in nine countries. The firm also saw its equity tier contract by 6.4% to 313 as it lost a net 21 equity partners.

For the first time since 2011, Sidley's overall head count dropped slightly, declining 1.1% from 1,943 to 1,922 lawyers spread across 20 offices in nine countries. The firm also saw its equity tier contract by 6.4% to 313 as it lost a net 21 equity partners.

Barden attributed those drops to the "normal course ebb and flow of retirements, and an occasional departure for in-house roles or a smaller firm."

Sidley added 25 partners from other firms in 2019, including Tai-Heng Cheng and Simon Navarro from Quinn Emanuel Urquhart & Sullivan in New York, a team of private equity partners from Cooley led by Mehdi Khodadad, and former Paul Hastings restructuring partner Leslie Plaskon.

The firm also picked up Peter Roskam, a former U.S. representative from Illinois' sixth congressional district, for its government strategies practice in Chicago and Washington. A Republican, Roskam served six terms in the House before losing in November 2018 to current Democratic incumbent Sean Casten.

Sidley also racked up big court victories in 2019, representing clients such as Airbus and AT&T. Airbus has been fighting Boeing before the World Trade Organization for years over the subsidies in the European Union and the United States. In 2019, the WTO sided with Airbus—flanked by Sidley lawyers—and allowed the EU to issue retaliatory trade measures against the U.S.

AT&T, meanwhile, was fighting with the U.S. Department of Justice, which opposed the company's merger with Time Warner. Hanging over the fight was President Donald Trump's clear disdain for CNN, a Time Warner subsidiary. AT&T took the fight all the way to the U.S. Court of Appeals for the D.C. Circuit with Sidley appellate lawyers, where the company won.

On the deal front, Sidley's highlights included advising GIC Private Ltd., the sovereign wealth fund of Singapore, in its $8.4 billion acquisition of Genessee & Wyoming, a U.S. railroad company, with Brookfield Infrastructure, a Toronto-based infrastructure investment fund.

Barden and his colleague, Michael Schmidtberger, the chair of Sidley's executive committee, believe "the best is yet to come" for the firm. For inspiration, Schmidtberger cited a saying from the All Blacks, the national rugby team of New Zealand: "Leave the jersey in a better place."

"As a partnership, we are entirely committed to that continuous intergenerational investment," Schmidtberger said.

But at this point, Sidley isn't looking to expand its geographic footprint, either in the U.S. or abroad. Schmidtberger said the firm has aimed to be in the "major financial, regulatory, commercial centers," and while it has looked at markets like Paris and Moscow, "we don't have any plans right now to open new offices."

"We're always watching and looking," he said.

Read More

Sidley Austin Cancels Partners Meeting in Florida Amid Coronavirus Spread

Built to Win: Sidley Austin, Litigation Department of the Year Finalist

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250