After Two Years of Revenue Drops, Crowell Sees Financial Rebound

Returning to growth, Crowell reported a strong year in both base business and contingency-fee matters.

March 05, 2020 at 04:35 PM

6 minute read

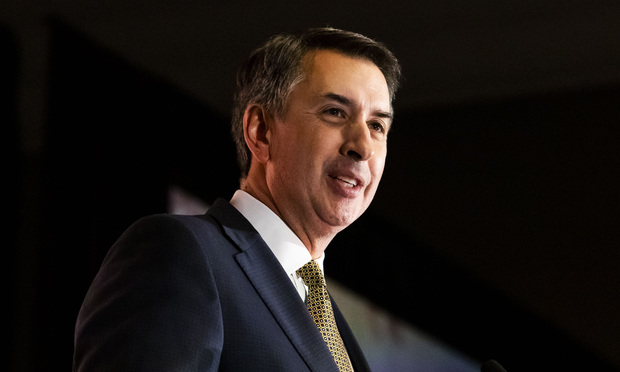

Phil Inglima, of Crowell & Moring. Photo: Diego M. Radzinschi/ALM

Phil Inglima, of Crowell & Moring. Photo: Diego M. Radzinschi/ALM

Crowell & Moring returned to revenue growth in 2019, with its top line rising 8.1% to $433 million and its profit per equity partner rising 9% to $1.11 million.

Philip Inglima, chair of the Washington, D.C.-based firm, called 2019 a strong year for both the firm's base business and contingency-fee matters, many of which relate to competition, health care and representing terrorism victims in litigation.

The firm's net income rose 11.1%, from $95.9 million to $106.6 million, and head count growth in the partner ranks and firmwide was up between 2% and 3%. Inglima said he was "especially pleased" with the firm's 5.2% jump in revenue per lawyer, to $911,000, saying it made clear that the firm's lawyers weren't filling their time with low-rate work.

Inglima said the firm's products liability lawyers and its trial practice saw "outstanding growth" and its health care recovery team, which often works on partial or full contingency, saw "outstanding results" last year. Crowell stands out among Am Law 100 firms for its revenue share—about a quarter—that comes from alternative fee arrangements, although that's a broader category than contingency fees.

"We are looking to continue growing both the base and the recovery practices steadily," he said. "There will be some fluctuations there … but over a five-year arc, we're happy with what it shows."

Compared with five years ago, in 2014, Crowell's revenue last year was about 18% higher, its net income was up about 10%, its revenue per lawyer around 11%, and its profits per equity partner about 8%, although there was significant variation in the years in between.

Crowell's return to growth in 2019 came after a 2018 and 2017 that didn't measure up to its record-setting 2016, which the firm has said was buoyed by a contingency-fee win. But even as top-line revenue went down in those years, Inglima stressed the firm's results over the past five years and noted that its base business—mostly its non-contingency fee work—was growing.

In a recent interview, Inglima said base business grew about 9% in 2018 and 8.1% last year. Over the past five years, the firm said, the category has grown more than 20%.

Last year's growth came in spite of headwinds. The government shutdown that stretched through the first four weeks of 2019 delayed court appearances and government agency work that keep capital markets and mergers-and-acquisitions processes moving. And given the Trump administration's regulatory agenda, Inglima added, it's "not the best time for green energy."

But the firm had several major successes in 2019. In the litigation space, it represented Amazon Web Services in a major dispute over a $10 billion Pentagon contract and helped defeat a challenge by Oracle. It also helped AT&T fend off a challenge to its "5G Evolution" advertising by Sprint and helped MillerCoors crush Bud Light's claims that its beer contained corn syrup. The firm's lawyers helped the University of California win a $50 million settlement and an apology from the University of Southern California over the poaching of an Alzheimer's disease research center.

Other litigation clients included Mozilla Corp., which settled a big suit with Yahoo, and Siemens Mobility, which won a $14 million patent-infringement judgment against a rival in the computer-based train control technology space.

The firm's litigators are representing health insurers with about $3 billion at stake in a dispute over risk-sharing payments that the federal government committed itself to with the Affordable Care Act but subsequently didn't fund. The U.S. Supreme Court is weighing whether to revive that lawsuit.

In mergers and acquisitions, the firm's antitrust lawyers have represented United Technologies Corp., a longtime client of the firm, in its $135 billion merger with Raytheon. The firm is known for representing government contractors, and its practitioners in that space had an "outstanding" year, Inglima said.

The firm's London presence grew last year, with a chain of hires from Squire Patton Boggs continuing into 2019. Inglima said the additions upped the firm's disputes capacity, with a focus on asset-based lending, and said its work for creditors including PNC Financial in the British Steel restructuring was a prime example of their work.

Crowell launched an office in Shanghai last year, although it is still waiting on a license to operate as a law firm and is only offering trade consulting services under the aegis of its C&M International subsidiary, Inglima said.

San Francisco, a growth priority for Crowell, saw a head count drop. While litigation partner Marisa Chun made an "instant impact" on the office's success and privacy lawyer Kristin Madigan and health care regulatory lawyer Gary Baldwin were made partners, the office also saw retirements and departures by junior lawyers to government and nonprofits, said Inglima.

On the whole, the firm said, its new partners and lateral additions last year were rather diverse. Half of the 18 partners or senior counsel who joined last year were women or racially or ethnically diverse, said Inglima, who explained that the firm keeps a "fairly large" bonus pool, which is over 10% of its net income, that it uses to reward lawyers and fund the addition of new talent.

In New York City, where Crowell has considered mergers with Herrick Feinstein and Satterlee Stephens in recent years, Inglima said the firm was open, but not wedded, to the idea of a merger. He said the firm is continuing to search for corporate lawyers and is "more purposefully" growing its ranks of litigators, particularly tech and white-collar litigators, noting that its white-collar practice has been extremely successful over the past several years.

"We've achieved substantial growth in some places and some practices by bringing in an entire group or an entire practice from another firm," he said. "We'd love to do more of that in New York. But we don't have only one gear for growth."

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250