'Power Alley' Practices Push McDermott to New Revenue, Profit Highs

The firm posted double-digit revenue gains as its fast-growing equity tier surpassed $2 million in profits per partner.

March 06, 2020 at 03:15 PM

6 minute read

Ira Coleman of McDermott Will & Emery. (Photo: J. Albert Diaz/ALM)

Ira Coleman of McDermott Will & Emery. (Photo: J. Albert Diaz/ALM)

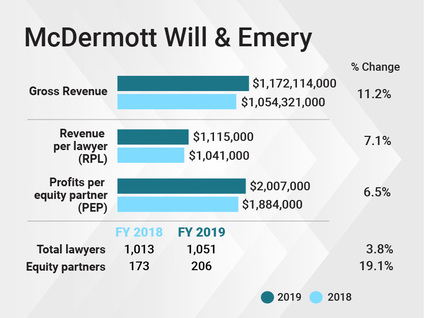

For the second year in a row, Chicago-based McDermott Will & Emery saw double-digit revenue growth in 2019, boasting an 11% increase to $1.17 billion.

Revenue per lawyer was up 7% to $1.12 million, while profits per equity partner increased 6.5% to eclipse $2 million—across an expanding partnership—on a 27% rise in net income to $413 million.

The firm upped its overall attorney count by 3.8% to 1,051, while the equity partnership grew 19% from 173 to 206. The nonequity partner tier contracted by 9.6% to 328, which the firm credited largely to promotions.

After relatively tepid financial growth through much of the last decade, the last two years have been comparatively explosive for McDermott.

"Our power alley practices have been major contributors," Ira Coleman, the firm's Miami-based chair, said in an interview. "Private equity, especially in health care; employment law; transactions; and private client practice were all up."

Coleman said that several of the firm's larger offices saw big gains year-over-year, with the firm's New York, Washington, D.C., and Miami offices all producing around 15% growth, while Los Angeles was up 42% and Boston jumped by 44%.

Coleman said that several of the firm's larger offices saw big gains year-over-year, with the firm's New York, Washington, D.C., and Miami offices all producing around 15% growth, while Los Angeles was up 42% and Boston jumped by 44%.

The firm did not provide London revenue, but Coleman said McDermott expects to continue to grow its U.K. presence. London is home to one of the firm's prized lateral hires last year, Tom Whelan, who was global head of private equity for Hogan Lovells before his October 2019 move.

Coleman said the firm has been planning for a potential British exit from the EU for some time, and while they can't "see around corners," business has not been disrupted in any meaningful way.

He said the firm continues to handle high-level matters for private equity-backed health care system operator Steward Health Care System. The firm helped Steward close multiple merger deals, including a $1.25 billion transaction with Medical Properties Trust and a $2 billion merger with IASIS Healthcare.

McDermott also helped brew up the craft beer merger between Dogfish Head and Boston Beer company, a deal valued at roughly $300 million.

Thanks to the lateral additions of Paul Hughes and Michael Kimberly to the firm from Mayer Brown, the firm also had a key U.S. Supreme Court win in 2019 in Kisor v. Wilkie, concerning the limits of judicial deference toward agency interpretations.

The firm added a net 55 partners in 2019—breaking the firm record of 46 set the previous year—and Coleman credited the firm's commitment to lateral integration for allowing it to make so many lateral hires while still growing its bottom line dramatically.

"Usually when you add [partners], you reduce your profits," Coleman said. "But we integrated them so quickly and so well. We had socially cohesive teams that super-performed."

Those hires included an eight-partner insurance group from Drinker Biddle & Reath and additional attorneys for the firm's restructuring group in Chicago.

The firm did see a drop of 10.5% in nonequity compensation, but Coleman attributed that to the firm promoting attorneys to partner as well as paying some bonuses for 2019 in 2018.

"I believe that the happiness of our income partners is one of the most important things leadership can tend to," Coleman said. "We want them very happy and very productive."

With regard to firm staff, Coleman said over the past several years the firm has taken a new direction in hiring for administrative positions at the firm.

"We basically changed out our entire C-suite to be non-lawyers," Coleman said. "They come from tech firms, marketing firms and have a background in innovation. We wanted to build a team of folks who are excited to go into the battle of disruption."

Embracing that change included hiring a chief of data and analytics, Tanvir Rahman, from Sidley Austin, who Coleman is hoping can help the firm make more evidence-based decisions.

"This is an industry ripe for disruption," Coleman said. "We have advanced, but we are still talking about the same problems. But the more data we have around things, the better our decisions will be."

Some of that data comes from the firm's usage of legal-specific modification in SalesForce called OnePlace. Coleman said they are seeing a 5x return on the technology, allowing them to better communicate client data across various areas of the firm such as marketing, business development and various practices.

Coleman said the firm is open to alternative legal fee strategies, but that it really boils down to what the client is comfortable with. With additional data around pricing structures, the firm is able to come up with pricing solutions that are flexible depending on the client.

Coleman said he is proud of the firm's efforts related to diversity and inclusion, such as holding a D&I summit and having summer class that was 60% female. But he is aware that the entire industry is still behind on that front.

"We recognize that diversity matters," Coleman said. "It is a focus of our leadership. We want to continue to exceed the industry standards like Mansfield. But we have a long way to go. The legal industry, the whole corporate environment, is abysmal [in that regard]."

Coleman said 2020 should see more growth in the firm's primary practice areas and hub locations like LA, New York and London. The firm is also banking on landing more high-profile laterals and feels confident it can do so.

"We added 20 new partners in the first two months of 2020," Coleman said. "I think we will continue to crush it on the lateral side. I think people are making the decision to say I want to be part of this firm and I want my teams to be happy in a more fertile environment."

Read More

McDermott Beefs Up Data Privacy Ranks With Akerman Practice Leader

McDermott Looks to Dentons and Baker McKenzie to Boost Global Employment Team

McDermott Boosts Restructuring Group, Banking on Recession

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

- 1How ‘Bilateral Tapping’ Can Help with Stress and Anxiety

- 2How Law Firms Can Make Business Services a Performance Champion

- 3'Digital Mindset': Hogan Lovells' New Global Managing Partner for Digitalization

- 4Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 5Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250