Revenue and Income Dip at Nixon Peabody After Record 2018

After a rare contingency case added $22 million to the firm's bottom line in 2018, CEO and managing partner Andrew Glincher says the firm's financial performance in 2019 actually exceeded expectations.

March 09, 2020 at 01:23 PM

4 minute read

Nixon Peabody's offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM

Nixon Peabody's offices in Washington, D.C. Photo: Diego M. Radzinschi/ALM

After multiple years of financial growth and a record-setting 2018, Nixon Peabody's financial performance declined in 2019, although firm management attributed the dip to a multimillion-dollar contingency fee in 2018 that added to its bottom line.

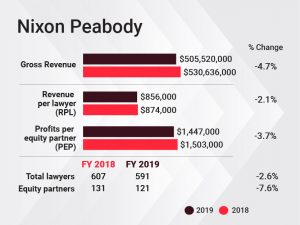

The firm's gross revenue of $505.5 million in 2019 was a 4.7% decline from its high-water mark of $530.6 million in 2018. Net income fell 11.1% to $175.1 million.

Revenue per lawyer, at $856,000, was down 2.1%, and profits per equity partner dropped by 3.7% to $1.447 million. Average compensation for all partners declined as well, to $756,000 in 2019.

Despite the decline, Andrew Glincher, Nixon Peabody's CEO and managing partner, said the firm exceeded financial expectations in 2019, citing a $22 million contingency fee in 2018 that rocketed the firm to its best financial year ever but couldn't be counted on for future years of financial success.

"We went into 2019 budgeting less money—our budget was $500 million [in gross revenue], and we exceeded that at $505.5 million," he said. Glincher added that excluding the contingency fee, the firm's 2018 profits per equity partner was $1,339 million, meaning 2019′s total increased 8% when comparing "apples to apples."

"If you take the contingency out of play, [2019] was essentially a repeat of last year," he said. "Across all cylinders, we are seeing great strength."

Glincher highlighted the firm's government investigations, white-collar, real estate and corporate mergers and acquisitions practices as the main drivers of success in 2019. The firm represented several parties involved in the Varsity Blues college admissions scandal, including former Stanford University sailing coach John Vandemoer. It is also representing the University of California in a direct patent enforcement campaign to protect the university's rights in the reinvention of the light bulb. The firm also advised TEGNA on $1.5 billion of M&A transactions.

Glincher highlighted the firm's government investigations, white-collar, real estate and corporate mergers and acquisitions practices as the main drivers of success in 2019. The firm represented several parties involved in the Varsity Blues college admissions scandal, including former Stanford University sailing coach John Vandemoer. It is also representing the University of California in a direct patent enforcement campaign to protect the university's rights in the reinvention of the light bulb. The firm also advised TEGNA on $1.5 billion of M&A transactions.

Nixon Peabody added eight new partners in 2019, and Glincher highlighted the government work of three high-profile hires: former Department of Justice attorney Adam Tarosky; John Sandweg, former acting director of Immigration and Customs Enforcement and Department of Homeland Security general counsel; and the former chief of the Narcotics and Money Laundering Section at the U.S. Attorney's Office for the Northern District of Illinois, Chris Hotaling.

Overall, the hires were offset by firm departures, including an M&A trio that left for Kilpatrick Townsend & Stockton in August and an aviation attorney's move to Locke Lord. Nixon Peabody ended 2019 with 591 attorneys, a 2.6% decrease from 607 in 2018. It had 121 equity partners in 2019, 10 fewer than in 2018, and had 181 nonequity partners in both years.

Glincher said much of the firm's investments have gone to its C-suite and business development opportunities. The firm hired a new chief marketing and growth officer, Danielle Paige, in October and is reworking its recruiting to be more aggressive and internally focused. The firm is also in the market for a new pro bono director.

"We wanted someone outside the legal industry this time around, an we hired [Paige] because she had never worked in a law firm," he said. "She looks at things differently and is building a different team, and I really like that."

Looking ahead to 2020, Glincher said Nixon Peabody will continue to search for great talent and look to expand strategically in areas with increasing client needs, such as M&A. He said he would "definitely consider" merger opportunities and regularly has conversations about potential combinations, but would only be interested if it involved the right group to add value for Nixon Peabody's clients.

"We've come off a series of years, over the last five years, where our profitability has been unheard of," he said. "That strong activity has come into 2020—our hours are already up."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

- 1How ‘Bilateral Tapping’ Can Help with Stress and Anxiety

- 2How Law Firms Can Make Business Services a Performance Champion

- 3'Digital Mindset': Hogan Lovells' New Global Managing Partner for Digitalization

- 4Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 5Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250