Paul Hastings Posts 4% Revenue Gain as Head Count Stays Flat

The firm's growth slowed last year after a particularly strong 2018.

March 11, 2020 at 04:07 PM

5 minute read

Photo: John Disney/ ALM

Photo: John Disney/ ALM

While it couldn't match its double-digit growth from 2018, Paul Hastings hiked its gross revenue and partner profits once again last year, continuing a decade-long run of increases for the firm.

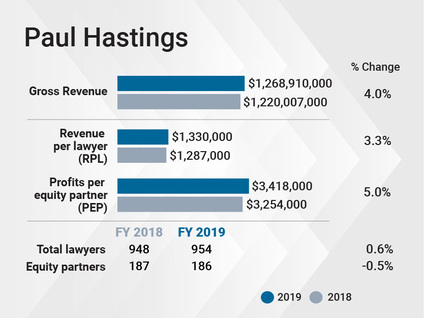

Total revenues were up 4%, reaching over $1.26 billion, with profits per equity partner rising 5% to more than $3.4 million. Revenue per lawyer grew 3.3% to $1.33 million.

Overall head count remained flat, inching up less than 1% to 956 lawyers in 2019, while the size of the firm's equity tier also held steady at 186 shareholders. The number of non-equity partners declined 7% to 78.

"Every year we are increasing the market share for the most mission critical work for the world's leading companies," said Seth Zachary, chairman of Paul Hastings since 2000. "It is that work and that strategy that continue to propel our growth."

Zachary said that while the firm has not been looking to make any fundamental changes to its approach, it has decided to "narrow our aperture" and deepen its focus on certain practice areas.

The firm cited three practice areas in that framework that performed particularly well during the 2019 fiscal year: finance and funds, private equity and investigations and white-collar. Zachary said doubling down in those areas has helped gain and retain clients' trust for their highest priority legal work.

The firm cited three practice areas in that framework that performed particularly well during the 2019 fiscal year: finance and funds, private equity and investigations and white-collar. Zachary said doubling down in those areas has helped gain and retain clients' trust for their highest priority legal work.

"This strategy is built upon the idea that every day we have to earn the confidence of our clients and demonstrate our ability to propel them onward in their journey," he said.

Paul Hastings had some wins across all the areas. In finance and funds, the firm was adviser to the lenders in KKR's acquisition of Campbell's Soup; helped Caithness Energy, a renewable energy/natural gas developer, finance $1.6 billion of a combined-cycle natural gas electric generating facility in Ohio; and advised multiple banks as arranger in Bain Capital's purchase of a majority stake in Kantar from WPP.

The firm handled a number of significant private equity matters. It advised private equity firm Francisco Partners on $7 billion worth of deals in 2019, including the company's purchase of LogMeIn for $4.7 billion. Paul Hastings also advised Francisco on its sale of ClickSoftware to SalesForce for $1.4 billion.

On the investigations front, the firm highlighted its work for Airbus in the aircraft manufacturer's overseas corruption case, negotiating a $4 billion settlement in what was one of the largest Foreign Corrupt Practices Act investigations of all time.

Geographically, Zachary said the firm saw strong results from its London, New York, Washington, D.C., and Northern California offices as well as its Asia practice.

London in particular was a hot spot for financing and private equity. The firm advised Credit Suisse, Goldman Sachs and Citibank on a £2.5 billion first/second-lien financing for private equity firm Advent International's public-to-private bid to acquire Cobham. The firm also advised Investindustrial as the group raised more than €3.75 billion through a number of vehicles for private equity buyout investments in Europe.

For the second year in a row, Paul Hastings had more lateral partner departures (17) than hires (11). The firm cited as highlights the additions of a private equity trio from Hogan Lovells, most of Shearman's Sao Paulo office back in August 2019, and a corporate practice pair from Baker Botts.

The firm said it was happy with strides it had made around diversity and inclusion over the course of the year. That includes a 2020 partner class that is 83% combined diverse and female and the ongoing process of becoming Mansfield certified. The firm also extended its parental leave program, making it one of the most progressive in the industry.

Zachary said the firm, as it does every year, reviews potential billing options with clients and is open to alternative fee strategies, but it comes down to client preferences.

"Every year, the substantial majority of our work is done on an hourly basis," Zachary said. "Every year clients ask us to work with them on their risk profile. We want to work with them on the best way to fuel their growth."

As far as 2020 is concerned, Zachary said the firm is off to a good start, reporting a record February in its initial fiscal month of 2020. He said there are some concerns that have emerged on the horizon—most obviously the coronavirus and its ever-expanding effects on global business—but nothing the firm can't withstand.

"I'm encouraged by the year ahead," Zachary said. "With that said, it is a very strange moment in our lives. We can't predict a pandemic's effect on our business, but we are extremely optimistic for 2020."

Read More:

How 5 Law Firms Helped Airbus Land Its Record Settlement

KWM, Weil, Simpson Thacher and Allens Advise on Campbell Soup Biscuit Sale to KKR

Virus Fears Prompt More Firms to Cancel Events, Partners Meetings

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250