Willkie's Revenue and Profits Grow Amid Nonequity Tier Expansion

Willkie retained "virtually all" of Gordon Caplan's clients, with his departure from the college admissions scandal having "no impact on the financial results of the firm," firm leaders said.

March 12, 2020 at 04:09 PM

5 minute read

The original version of this story was published on New York Law Journal

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

Willkie Farr & Gallagher saw solid growth in revenue and profits last year, as well as in its new nonequity partner ranks.

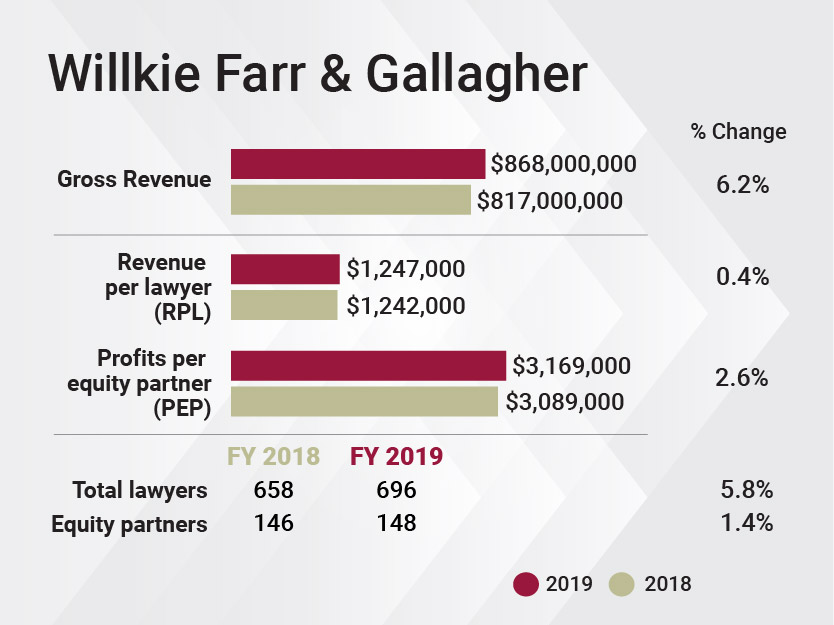

It was a busy year all around for Willkie. The firm's revenue rose 6.2% last year to $868 million, with the firm's chairmen saying a "double-digit" increase in litigation revenue helped the firm increase its top line. Meanwhile, Willkie grew its profits per equity partner by 2.6% to almost $3.17 million. The firm's growth came despite distracting headlines about a former Willkie co-chair pleading guilty last year in the college admissions scandal.

Willkie last year also continued to expand its new nonequity ranks, first created in 2018, according to American Lawyer reports. The nonequity tier grew from 10 to 22 lawyers last year, while the firm's equity ranks grew by two to 148.

Willkie chairman Thomas Cerabino said the firm created the nonequity tier to avoid losing talented associates to other firms, but he said it also gave Willkie more flexibility in talks with potential laterals.

Steven Gartner, also a Willkie chairman, said the firm looks at the role "as an up-to-three-year-term" to see how rising lawyers develop, though he added that the length isn't specifically enumerated.

"We view the granting of a nonequity partner title as a stepping stone to becoming an equity partner," Cerabino said. "[Nonequity headcount] may grow in the early years as we phase it in … but we're doing it with the idea that there will not be a big, permanent tier of nonequity partners."

Willkie's average attorney head count rose 5.8% last year, from 658 to 696, and revenue per lawyer rose only slightly, staying around $1.2 million.

The busy year played out as Willkie's name was tossed about in the press, when former co-chairman Gordan Caplan was arrested, pleaded guilty and served several weeks in prison for his role in the college admissions rigging scandal. But Gartner and Cerabino said the situation didn't impact the firm's business or ability to recruit.

"We retained virtually all of Gordon's clients," Gartner said. "The short answer is it had basically no impact on the financial results of the firm or the ongoing performance of the firm."

"We put it behind us," said Cerabino. "Gordon was a very good partner here, a good friend to many of us. [He] did a very unfortunate thing that was not related to our business, he paid a very steep price for it, but Gordon was also a very well-respected [colleague]."

While Caplan was a top dealmaker at the firm, the corporate practice stayed strong. The firm's leaders reported a good year for its private equity lawyers, noting the firm increased its market share among the 175 sponsors it represented and helped clients through major deals, including the fintech giant Fidelity National Information Services' $43 billion deal to acquire WorldPay.

But its litigators led the pack, said Gartner.

"While private equity is our biggest practice, and it was running really hard, and it's responsible for a large portion of our revenue and our profits," said Gartner, "last year, the needle really moved for litigation. … It was up double digits in terms of the activity levels." He said "activity levels" referred to both hours billed and revenue collected.

Every one of its 11 offices increased its revenue and head count last year, according to Willkie, adding several large bankruptcy, private equity and mergers and acquisitions matters kept lawyers in London and European offices busy.

The firm's litigators represented subsidiaries of Venezuela's national oil company in challenges to the legitimacy of their boards of directors that stemmed from ongoing disputes over whether Nicolas Maduro or Juan Guaido is Venezuela's head of state. They also won an acquittal in a major foreign corruption case, U.S. v. Boustani, and helped corporate clients like Hospira and Comcast prevail in commercial and regulatory disputes.

Restructuring lawyers at Willkie got a piece of the action in Puerto Rico's bankruptcy-like case, representing a government-owned financing corporation in an adversary proceeding; most of the work on that case was done before 2019, according to filed fee applications. They also represented a special committee of the board of directors of the struggling retailer Shopko, which closed all its locations, and worked for certain claim holders in PG&E Corp.'s bankruptcy.

The firm's private equity dealmakers represented at least 175 sponsors last year on deals that totaled over $50 billion, a record year in terms of deal volume. Its M&A practice clocked more than 200 deals worth over $110 billion, the biggest one being the FIS-WorldPay acquisition. It worked on two major real estate transactions for Colony Capital worth around $7 billion in total, and the firm helped HealthEquity buy WageWorks in a $2 billion deal. The firm also worked on several major insurance industry transactions.

Wiilkie said it had high hopes for 2020, going into the year with a 22% higher level of inventory than it had going into 2019 because of a busy fourth quarter. Its corporate lawyers have notched several major deals, representing investment manager Franklin Templeton in its purchase of Legg Mason, venture capital investor Insight Partners in two acquisitions totaling over $6 billion, and clients in other industries on major transactions.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250