Fish & Richardson Sees Revenue and Profits Jump as Head Count Slips

Outgoing CEO Peter Devlin acknowledged grappling with IP and litigation practice headwinds as a firm, but said Fish had "bucked those trends."

March 13, 2020 at 05:14 PM

5 minute read

Peter Devlin, president and chief executive officer of Fish & Richardson. Courtesy photo

Peter Devlin, president and chief executive officer of Fish & Richardson. Courtesy photo

Fueled by a mix of intellectual property work and commercial litigation, Fish & Richardson hit new highs in revenue and profits in 2019 as the size of the partnership and total lawyer head count dipped.

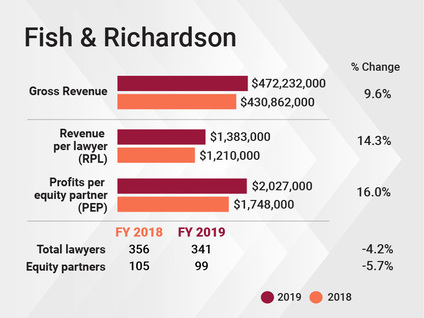

Gross revenue was up 9.6% to $472.2 million—marking a fifth straight year of revenue growth after several uneven or declining years, and the second year that revenue surpassed a previous high watermark set in 2009.

Rising net income and a contracting partnership produced a 16% increase in profits per equity partner, which surpassed $2 million for the first time. Revenue per lawyer grew 14% to $1.38 million.

Peter Devlin, Fish & Richardson's president and CEO, said the growth was a product of broad success across the firm's IP and litigation groups. "On the patent side, business really boomed last year. And our litigation side is the strongest in the country—we filed 200 appearances in district courts last year," he said.

Devlin said the firm had planned for a strong financial year but still exceeded its 2019 revenue projections by 15%.

Devlin said the firm had planned for a strong financial year but still exceeded its 2019 revenue projections by 15%.

Highlights of the firm's work in 2019 include securing a $175 million settlement for Power Integrations after 15 years of litigation; scoring patent wins for ResMed and Gilead Sciences at the U.S. Court of Appeals for the Federal Circuit; defending Illumina against Scripps Research Institute; and representing Mayo Collaborative in a key U.S. Supreme Court patent eligibility case.

Fish & Richardson's head count has fluctuated in the mid-300s ever since a notable decline in 2009, and it dipped again slightly last year—down about 4% to 341 total lawyers. The equity partnership shrank by about 6% to 99 equity partners, and the nonequity tier was down by a similar degree to 62. The firm lost five IP litigators to Orrick, Herrington & Sutcliffe's Boston office in February 2019.

Devlin said the firm's size is the right match for demand, and even before the coronavirus cast a big question mark over 2020, he said the firm was nimble and attuned to changing market conditions.

"As busy as we have been, we always have an eye on what's happening out there in the market," he said. "Like it or not, litigation and the patent industry is trending down. We have bucked those trends, but as a result of the overall market trend, we're careful of hiring and growth.

"We're a firm that has spread out over many offices, and no offices have over 100 attorneys," he said. "[Around 350 attorneys] fits well with the kind of work we do and the way we staff it."

Devlin said the firm has focused significantly on offering alternative fee arrangements and has also invested in staffing matters with professionals who aren't lawyers in order to bring better value to clients and increase efficiency.

"We've been able to price our work and grow our practice while keeping our clients happy with the cost," he said.

These innovations aren't the only change: Devlin recently stepped down as CEO of Fish & Richardsonafter two decades in leadership. He said that after sustained financial success, it made sense to pass along the reins to Minneapolis partner John Adkisson.

"This is something that has been in the works for about a year," he said. "Because of the performance of the firm the past several years, where we've never been stronger, it's the best time for the firm to undergo a leadership transition."

During the transition period, Devlin and Adkisson will look to several new additions to Fish & Richardson's C-suite to help guide the firm. Fish hired a new chief marketing and business development officer, Rachel Merrick Maggs, in November 2019, and chief information officer John Hinrichs joined in January 2019. Devlin noted that the firm has also grown its chief business professional development position, held by Kristine McKinney, into a role focusing on both talent and inclusion.

"Diversity and inclusion at the firm is something we've spent a lot of time developing internal programs on, and it's helped us with attracting and retaining diverse talent," Devlin said.

In 2020, Devlin said he expects the firm to continue growing in key areas. Geographically, the firm opened an outpost in Shenzhen, China, last year. While he said developing the office has been successful so far and has attracted local businesses inbound to the U.S., the firm is waiting to see how the coronavirus will impact the global economy.

In terms of practice areas, Devlin said the firm's life sciences practice is growing quickly, and there are additional opportunities in the 5G wireless data, patent litigation and transactional practice areas.

Read More:

Why Fish & Richardson's Peter Devlin Is Stepping Down After 20 Years as CEO

Most Innovative Legal Law Firm Operations Team of the Year: Fish & Richardson

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250