Bryan Cave Leighton Paisner Sees Returns Dip in First Full Year After Combo

But firm leaders on both sides of the Atlantic said that factoring in BCLP's performance in the final nine months of 2018, the post-merger picture was more than encouraging.

March 18, 2020 at 05:00 AM

4 minute read

(Courtesy photo)

(Courtesy photo)

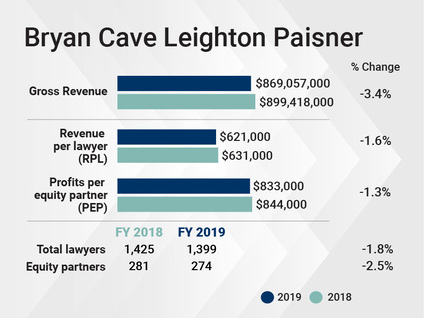

In its first full year since it was created via a trans-Atlantic merger, Bryan Cave Leighton Paisner saw revenues dip slightly to $869.1 million.

That's down 3.4% from the $899.4 million the firm reported for 2018, when the combination between St. Louis-based Bryan Cave and London-based Berwin Leighton Paisner was finalized April 1. The firm also saw a mild drop in net income, sagging 3.8% to $228 million.

But London-based co-chair Lisa Mayhew emphasized that the firm's performance in 21 months of combined operations offered a rosier picture, highlighting a 5% increase in combined profits from 2018, when compared to the two legacy firms in 2017, and a 1% increase in combined revenue. (The firm declined to detail its U.K. or U.S.-specific financial performance.)

"In all the literature you read concerning mergers, you would normally expect a short-term decline on those, from the inevitable disruption," she said. "This is a very encouraging result."

Head count was largely stable at BLCP, with the total number of lawyers ticking 1.8% downward to 1,399. The number of equity partners dropped 2.5% to 274, and profits per equity partner dipped 1.3% to $833,000.

Mayhew added that the firm finished 2019 with a positive cash balance of $86 million, and said the combined firm had seen growth in global antitrust work, mergers and acquisitions and real estate work, along with real estate and corporate finance.

Mayhew added that the firm finished 2019 with a positive cash balance of $86 million, and said the combined firm had seen growth in global antitrust work, mergers and acquisitions and real estate work, along with real estate and corporate finance.

The firm advised Pyatt Broadmark Management in its merger to form Broadmark Realty Capital, a $1.5 billion publicly traded Maryland mortgage REIT listed in the NYSE. Dealmakers represented XBiotech Inc. in its $750 million sale to Johnson & Johnson subsidiary Janssen Biotech. And the firm guided American Electric Power Co. in a subsidiary's purchase of Sempra Renewables, gaining $1.1 billion in wind generation and battery storage assets.

Mayhew gained a new co-chair at the start of 2020, St. Louis-based M&A specialist Steve Baumer. The firm also bolstered its leadership team in 2019 with the hire of former Ashurst London managing partner Simon Beddow, who is serving as the firm's new corporate deputy departmental managing partner.

"We're excited about the overall platform and what we've built," Baumer said. "Our one firm, single profit pool structure means there are absolutely no structural barriers to bringing the power of the full firm to our clients."

Speaking March 12, just before the wave of cancellations and closures late last week made a global recession appear inevitable, Baumer said that he was still bullish about M&A and corporate finance, along with real estate work for the rest of 2020.

"We're not at this point seeing an immediate impact on the level of productivity and business that the firm is transacting," Mayhew said at the time.

The firm added 22 laterals in 2019, led by six in the corporate practice in London, Paris and Kansas City, and seven in finance in London, Hong Kong, Paris and Washington, D.C. Four more partners joined in litigation and corporate risk, while five joined in real estate.

Prior to the global disruption, firm leaders had been eager to grow the M&A practice in London and Paris, while boosting the real estate practice in Chicago, New York and California.

And with 31 offices around the globe, there's currently no plans to expand the firm's footprint.

"That's not top of our mind," Mayhew said.

The firm also made a splash in 2019 with the launch of BCLP Cubed, a new division helmed by representatives from each of the two legacy firms, focusing on commodity work.

"We're always pressing the needle on innovation and how we serve our clients," said Baumer, calling BCLP Cubed a "seamless solution to high-volume legal needs."

And when it comes to pricing more conventional services, the firm's U.S. lawyers are open to taking lessons from their European counterparts who have been at the forefront of alternative financial arrangements.

"Part of the power of our combination is the ability for our colleagues across the platform to understand where the client base has gone in Europe and the ability to bring best practices to the forefront as we talk to clients in other jurisdictions like the U.S.," Baumer said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readLaw Firms Mentioned

Trending Stories

- 1New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 2No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 3Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 4Meet the New President of NY's Association of Trial Court Jurists

- 5Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250