Katten Sees Revenue Climb Despite 'Sluggish' Start and Partner Exits

Katten Muchin Rosenman chair Roger Furey said the firm bounced back from a slow start to 2019 to achieve a strong finish.

March 19, 2020 at 04:50 PM

5 minute read

Roger Furey of Katten Muchin Rosenman

Roger Furey of Katten Muchin Rosenman

Katten Muchin Rosenman overcame a slow start to 2019 to end the year on top.

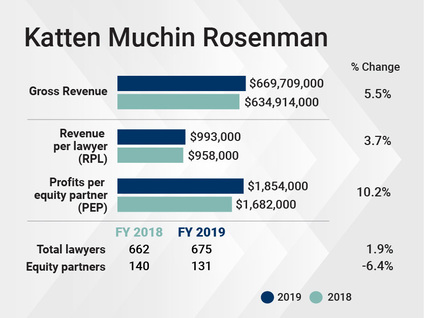

The firm's gross revenue increased to $669.7 million in 2019, up 5.5% from the prior year, with revenue per lawyer up 3.7% to $993,000. Profits per partner rose 10.2%, reaching $1.85 million, as a modest gain in net income was shared across a smaller equity tier.

Although the end of 2018 and the beginning of 2019 ushered in some economic uncertainty—namely due to the trade war with China and a market correction—firm chair Roger Furey said Katten bounced back from a "sluggish" first quarter.

"Given that slow start, we did exceptionally well for the year," he said, noting that deal volume at the firm was up substantially and that its corporate M&A and private equity practices' revenue increased by more than 10% from 2018 to 2019.

"We do pride ourselves on being a business-minded law firm," he said. "The word has gotten out. Kudos to our deal lawyers."

Katten's private wealth, insolvency and restructuring, and intellectual property litigation practices also drove business for the firm in 2019, with those practices enjoying revenue increases of more than 10% from the prior year, Furey said. Among the year's highlights, the firm successfully defended PepsiCo and Gatorade in a federal trademark case; represented Dallas-based private investment firm Highlander Partners in purchasing Evans Food Group and assisted fintech company Capify in a cross-border transaction to secure a multimillion-pound credit facility from Goldman Sachs.

Furey also pointed to the success of Katten's sports practice. The firm represented the owners of the new Seattle National Hockey League team and has been involved in every aspect of bringing the team to the city, from finance to arena development to sponsorship deals. The firm also represented the Kansas City Royals in the baseball team's sale to a group of local investors.

Furey also pointed to the success of Katten's sports practice. The firm represented the owners of the new Seattle National Hockey League team and has been involved in every aspect of bringing the team to the city, from finance to arena development to sponsorship deals. The firm also represented the Kansas City Royals in the baseball team's sale to a group of local investors.

Along the way, Katten's head count grew from 662 to 675 attorneys. Lateral partner exits helped shrink the equity partnership to 131 partners from 140 in 2018, however, while the nonequity partner tier grew from 179 to 190 partners.

Furey said that while last year's increase in profits per partner was partly a function of head count decline—he acknowledged the departures of nine environmental attorneys who left the firm and precipitated the closure of the firm's small Austin and Bay Area offices—the gains were mostly a result of Katten's success in bringing new business to the firm.

"The overriding and primary reason for that improvement has been executing a better plan to attract more deals and more good clients," he said. "We had a number of new private equity funds as well as a number of new family offices and sponsors last year. That grows the revenue, which improves [profits per equity partner and nonequity compensation]."

A group of financial services lawyers also left Katten last year, to open Blank Rome's Chicago office. But the firm made a handful of notable hires, mostly in New York. The firm has added multiple IP litigation attorneys, as well as a group of commercial litigators in New York that have integrated well with existing talent in the firm's Chicago headquarters, Furey said.

Among the firm's partner additions in 2019 were Carl Kennedy, a New York partner who formerly worked in the U.S. Commodity Futures Trading Commission, and Vikas Khanna, a litigator who was deputy chief of the criminal division of the U.S. Attorney's Office for the District of New Jersey.

Outside of New York, Furey pointed to the firm's new office in Dallas, which opened in 2018 with seven Hunton Andrews Kurth attorneys and has grown to 39 lawyers, as well as the addition of insolvency and restructuring partner Chuck Gibbs, who joined in April 2019 from Akin Gump Strauss Hauer & Feld.

Other new faces at the firm are on the business and development side. In the last two years, Furey said Katten has made a substantial investment in its C-suite, including a rebranding as well as hiring multiple executives, including a new chief talent officer, attorney development officer and a chief diversity officer.

"We brought in a chief operating officer a couple of years ago, which was a major investment that has been transformative for the firm," Furey said. "[They] organized the internal team and C-suite in a much more professional way than it has in the past. In 2019, we started to enjoy the fruits of that foundation."

While the Furey said Katten's new Dallas office has seen good growth, the firm isn't looking to open more offices in 2020 and will instead focus on building on its existing footprint. The firm recently signed a new lease in New York and will move to Rockefeller Plaza, and in other offices, Furey says the focus will be on lateral growth across the firm's financial services offerings.

Still, speaking in early March, as the coronavirus crisis was just beginning to deepen in the U.S., Furey said he's keeping the economy in mind when it comes to expectations for the year.

"We're going to be conservative in how we forecast, because I do see a real possibility and likelihood of a significant hiccup in the economy that will affect a lot of our clients this year," he said. He added that Katten was well-positioned in its restructuring and insolvency practice to help clients at every point in the business life cycle.

"We do expect more deals and we are continuing to grow, but we're still planning for our option '1A'," he said. "If there is a downturn, we want to make sure we're ready to go with that."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250