Buoyed by 2019 Growth in Profits, McGuireWoods Now Aims 'to Take Care of Our People'

The firm's conservative approach to growth and lack of reliance on rate increases have put it in a solid position amid the coronavirus pandemic, managing partner Tracy Walker said.

April 09, 2020 at 03:57 PM

5 minute read

McGuireWoods office in Washington, D.C. Photo: Diego M. Radzinschi/ALM

McGuireWoods office in Washington, D.C. Photo: Diego M. Radzinschi/ALM

In early March, around the time when the second U.S. death stemming from the novel coronavirus was announced in Washington state, the McGuireWoods executive team gathered to discuss what the pandemic would mean for the economy and, by extension, the firm.

The worst-case scenario, the team decided, was a 30% decrease in revenue through the third quarter of 2020, driven by softening demand and a liquidity crisis that would lengthen the turnaround time for client payments. More positive projections were informed by the consensus among many economists predicting a "V" shaped recovery: a sharp decline followed by a quick, intense rebound.

Today, managing partner Tracy Walker is no more certain about the contours of an economic recovery, and the firm has since instituted relatively mild cost-cutting measures. It has heavily cut down on discretionary spending and held back a portion of the smaller fraction of partner distributions it doles out in April—the majority is dispersed in January.

"In our view, our equity partners have enjoyed the benefit of great years we had in 2018 and 2019," Walker said. "To me, it was a no-brainer that the owners of this business have to take care of our people."

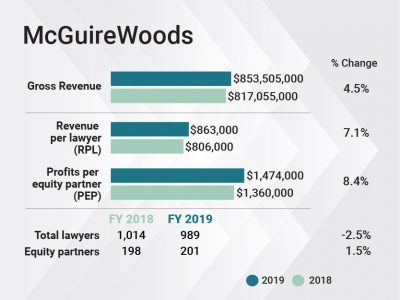

Last year, the firm saw a 4.5% increase in gross revenue, from $817 million to $854 million. Revenue per lawyer grew 7.1%, from $806,000 to $863,000. And profits per equity partner also saw growth of 8.4%, from $1.36 million to $1.47 million.

What Walker and the firm is watching closely now is demand: Sluggish demand in April will be an important factor in adjusting the firm's projections, as will the lengthening of collections. Some of the firm's practices, such as mass torts, have already seen a hit as clients turn away from discretionary litigation.

While Walker said he is prepared to institute broader cuts to other attorneys and staff, should the recession prove more stubborn, he does not anticipate introducing those austerity measures now. In fact, the firm's first quarter of 2020 outperformed the first quarter of 2019, and he anticipates that pre-crisis matters will drive revenue for the next couple months.

While Walker said he is prepared to institute broader cuts to other attorneys and staff, should the recession prove more stubborn, he does not anticipate introducing those austerity measures now. In fact, the firm's first quarter of 2020 outperformed the first quarter of 2019, and he anticipates that pre-crisis matters will drive revenue for the next couple months.

For now, the firm's private equity team is still busy as clients hunt for bargain deals and opportunities in a down market. The financial services team also remains strong. And, not surprisingly, the firm's labor and employment practice has stayed busy as businesses grapple with the implications of mass closures and layoffs.

"I am confident that when we come out of this lawyers will be more in-demand than ever, but the question now is bridging that gap," Walker said.

Walker said the firm's conservative spending and technological advancement in years past have put it in a good position to weather the storm. He said the firm is less reliant on rate growth to pay for overhead—it raised rates by 4% last year—and has benefited from a strong performance in 2019.

Walker said last year's growth was broad-based, though the litigation team had a particularly good year. The firm's most high-profile victory was a $500 million judgment against North Korea on behalf of the family of Otto Warmbier, who died shortly after being released from a North Korean prison in 2017.

Early last year, firm litigator George Terwilliger III successfully defended former Republican congressman Aaron Schock in what the Chicago Tribune dubbed as "virtually unheard of in a high-profile corruption case."

McGuireWoods achieved its financial growth last year even as lawyer head count contracted slightly. Total lawyer head count was down 2.5% in 2019, from 1,014 to 989. The firm added three equity partners, ending the year with 201. And the nonequity partnership shrank by 7%, from 225 to 209, leading to a nearly 5% drop in nonequity compensation. The firm's profit margins subsequently grew two percentage points to 35%.

The firm picked up several key laterals. In January last year, it picked up a life science litigation trio from Baker & Hostetler in New York. And in May, the firm brought on Stephen Foresta, a former litigation leader at Orrick, Herrington & Sutcliffe.

Walker said McGuireWoods is more conservative and careful than its peer firms when it comes to lateral hiring, and that's an asset in uncertain times.

"We've taken a conservative approach to growth and expenses that has served us well and will serve us in this crisis," Walker said.

Correction: A previous version of this article said the firm was holding back a small portion of partner draws, rather than distributions. The error has been corrected.

Read More

Partner Profits Spike at McGuireWoods as Equity Partnership Grows

Pay Cuts, Layoffs, and More: How Law Firms Are Managing the Pandemic

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

What Happens When Lateral Partners’ Guaranteed Compensation Ends?

Latham Adds Former Treasury Department Lawyer for Cross-Border Deal Guidance

2 minute read

Wachtell Partner Leaves to Chair Latham's Liability Management Practice

2 minute readLaw Firms Mentioned

Trending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250