After a Record Year, Venable Cuts Pay, Furloughs Some Staff to 'Prudently Prepare'

"We have taken steps to tailor staffing needs to the current environment," the firm said in a statement.

April 13, 2020 at 07:36 PM

5 minute read

The original version of this story was published on National Law Journal

Venable offices, Washington, D.C. Photo: Diego Radzinschi.

Venable offices, Washington, D.C. Photo: Diego Radzinschi.

Even after a strong 2019 in which Venable's revenue soared, the firm said it has taken steps to respond to the economic uncertainty created by the coronavirus pandemic, including postponing partner distributions, reducing salaries and furloughing certain staff.

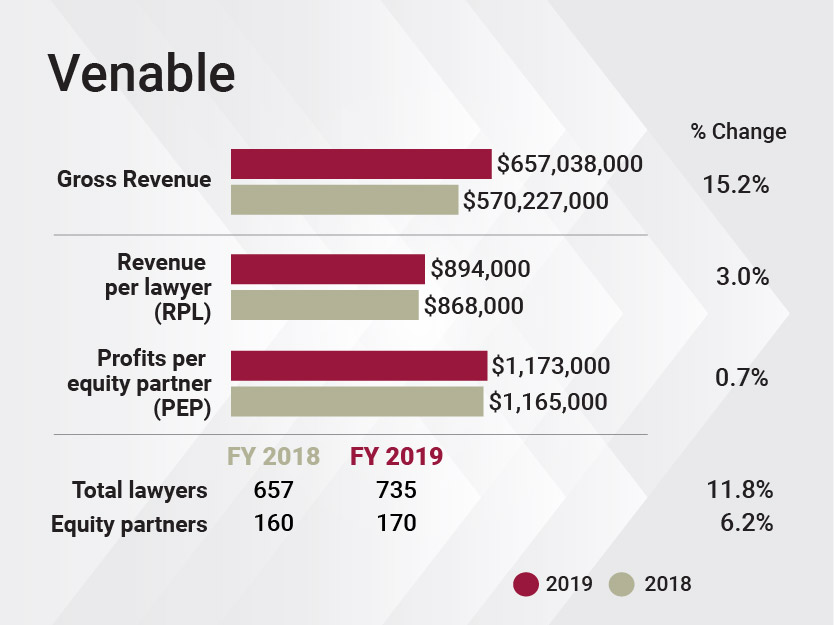

Venable's gross revenue shot up 15.2% to $657 million in 2019, its first full year after combining with 100-lawyer intellectual property boutique Fitzpatrick, Cella, Harper & Scinto. Its profits per equity partner inched up to $1.17 million, with a 30% profit margin.

But like other Am Law 200 firms that have responded to the pandemic, the Washington, D.C.-based firm said it had to adjust. "Our actions include postponing certain distributions to equity partners, implementing tiered compensation reductions for attorneys and staff, and temporarily furloughing certain staff in roles that primarily support office operations," the firm said in an April 10 statement to ALM.

"Because the extent and duration of the disruption and its impact remain uncertain, we have taken steps to tailor staffing needs to the current environment and prudently prepare the firm for the future," the statement added.

A firm spokeswoman could not immediately comment on the percentage reductions in compensation across attorney and staff tiers and how many staff members were furloughed.

As for its upcoming summer associates, Venable said it informed participants that it will not start the program May 18, nor will the firm have a 10-week program, as originally planned. The firm said it will contact participants when it has more information and it has made more concrete decisions about the summer program.

Venable added that it entered the period of economic and societal disruption "with a solid start to the year that continued through the first quarter" and that "the diversity of our practices, the quality of our attorneys and professionals, and our relationships with our clients are very strong."

Indeed, Venable's revenue growth last year made 2019 one of its strongest years ever. Even with a nearly 12% boost in head count to 735 lawyers after the merger, the firm's revenue-per-lawyer rose 3% to $894,000.

In March 19 interview, firm chairman Stu Ingis said it was too early to talk about cost-cutting measures and billings were strong at the beginning of the year, but he said the firm was modeling different scenarios and revenues.

"We're certainly expecting a very different world for at least a couple of months," he said at the time. "The world is just completely unknown right now."

Ingis said some of the firm's practices had kept busy with the response to the crisis, including its Food and Drug Administration practice, and the firm was representing major companies in response to legislation. He also saw a pick up in employment and restructuring work.

But Ingis said last month he has started to see a slow down in litigation, with courts closing, and some deals have paused.

Meanwhile, integrating with legacy Fitzpatrick lawyers will continue through video conferencing.

"We're integrated enough with them that culturally, they're already one of us. So if this had been a year ago, it might have been more challenging," Ingis said. To become fully remote, Ingis said, the firm conducted training and purchased more technology licenses.

Overall, he said the Fitzpatrick combination had been an "unequivocal success." Though the merger, Venable added a number of large client relationships that pay multiple millions of dollars in legal fees: 13 of the firm's top 100 clients are former Fitzpatrick clients, the firm noted.

Among major matters last year, the firm helped secure a nearly $90 million jury verdict for client Vectura Ltd. in a patent infringement case against GlaxoSmithKline LLC and Glaxo Group Ltd. The firm also represented the daughters of Tom Petty, through company Petty Unlimited LLC, in a dispute over his estate.

While 104 attorneys from Fitzpatrick planned to join the firm, the firm's head count only had a net gain of 78 attorneys last year. Ingis said there was a "small amount of attrition" after the merger due to conflicts, retirements and some people leaving for other firms. The firm's equity tier had a net gain of 10 lawyers last year to 170 partners.

Venable also added an entertainment and media group of nine lawyers from Kelley Drye & Warren, a group that kept busy, Ingis said.

Ingis said Venable was unique in having a high percentage of dollars funneled to charitable efforts. The firm, which provided nearly $4 million in grants to community organizations in 2019, last year hired Michael Bigley as director of the Venable Foundation, Inc., the firm's philanthropic arm funded by partners, he said.

Ingis said the firm was in discussions with pro bono clients about the best way to help this year. "2020 is going to be as much about helping and servicing clients as much as we can, as it is about helping the community," he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Law Firms Mentioned

Trending Stories

- 1Silk Road Founder Ross Ulbricht Has New York Sentence Commuted by Trump

- 2Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 3CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 4Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 5Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250