EY Outlines Its Strategy in Legal and Approach to Servicing Law Departments

EY's goal is to become an enterprise legal service provider to law departments, blending tech, law and consulting to serve clients' business needs.

May 01, 2020 at 10:29 AM

10 minute read

EY offices in Tysons, VA.

EY offices in Tysons, VA.

Editor's Note: This is part of an occasional series from consulting firms on their strategy in legal.

Most legal market observers have seen the EY investments in the legal industry over the past few years. The Riverview Law and Pangea3 acquisitions are the largest EY investments to date in the legal industry. Beyond those big announcements are a wide range of smaller, but equally important, investments into individuals and teams. Over the past several years EY member firms have added lawyers in a broad range of areas, including mergers and acquisitions, banking and finance, labor and employment and regulatory law. Additionally, they hired thought leaders, process engineers, client relationship managers, and a wide range of subject matter experts to help deepen and broaden the EY legal services offerings. These investments have prompted many questions about EY's strategy and how it is challenging the status quo in the legal industry.

The EY goal in the legal industry is straightforward: The organization aims to be a leader in enterprise legal services to large- and medium-sized corporations. What exactly does that mean?

Law departments need a new kind of service provider

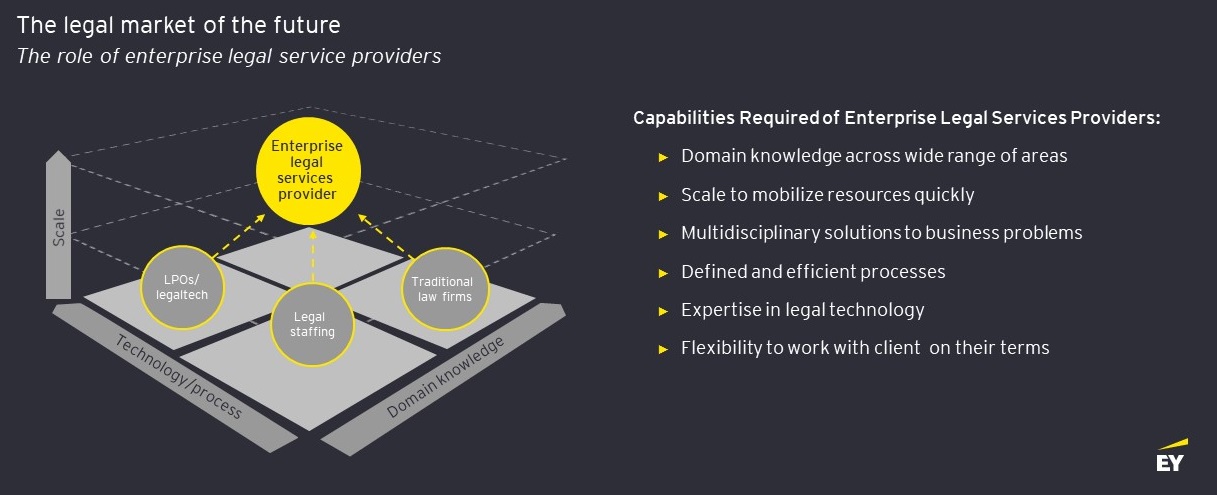

Over the past decade, it has become abundantly clear that there is a gap in the legal market. Since the 2008 downturn, the legal market has been dominated by three types of service providers: Law firms; legal process outsourcers, a group which includes many legal technology providers; and legal staffing agencies. Each deliver an essential service to the market. Many law firms provide excellent legal advice to their clients. Legal tech providers and legal process outsourcers excel in the areas of process and technology. Legal staffing agencies provide access to niche on-demand, project-based skills. What is missing from this vendor landscape? An integrator—or enterprise provider.

Why is an integrator needed? The most straightforward answer is that in-house counsel are juggling a number of challenges.

Over the past decade, the volume of work most law departments manage has increased significantly. On a day-to-day basis in-house counsel must ensure their businesses are compliant with a wide range of existing regulations across an equally wide range of developed and developing markets. Additionally, they must also manage sweeping regulatory changes, such as those currently happening in the Interbank Offered Rates (IBOR) and Base Erosion and Profit Shifting (BEPS) areas, that impact the businesses they serve across multiple fonts. At a larger level, general counsel must also guide the companies they serve through a period of heightened and quickly increasing risk that impacts supply chains, acquisition strategies, and almost everything their company does and aspires to do. The events of the past several weeks and the wide-ranging impacts the COVID-19 outbreak are having on businesses underline the important role general counsel play inside their organizations.

Complicating matters further is an additional portfolio of tasks general counsel must manage. Today's general counsel are being asked to think like business leaders, not just lawyers. It is widely known that most general counsel are under pressure to modernize the departments they lead. To accomplish this, they have launched a wide range of initiatives focused on increasing efficiency and cost cutting. They have been negotiating lower rates with their external law firms. They have also been hiring new lawyers to bring work previously done by outside counsel in-house. General counsel have also been managing the adoption of new technologies and new delivery models, provided by a wide range of alternative service providers, to help increase the efficiency of their departments. The end goal of this work is not just to reduce cost. It is also to transform law departments into proactive business partners capable of helping their organizations grow more quickly and become more resilient to external shocks like the ones we are experiencing today (see the EY Survey of Law Department Leaders for more on this topic).

Managing these internal changes alongside the day-to-day work of the legal department is a monumental task. This is particularly true in today's fast-moving environment where market conditions change on a daily or even hourly basis. To be successful, general counsel need a partner capable of simplifying the legal supply chain. They also need a partner capable of working vertically across other corporate functions to align the operations of the law department with the strategy of the broader organization. What capabilities would such a provider need to have? There are many.

Introducing the enterprise legal service provider

The most essential capability an enterprise legal service provider must have is the ability to see legal problems for what they are—business problems. This is no easy task. COVID-19 has exposed a truth that many general counsels already knew: the legal risks that large corporations face today are often complex and multifaceted. Solutions to these problems require more than just legal advice. They require an understanding of supply chains, tax systems, regulatory regimes, talent management strategies and operational models. Today's ideal legal service provider must have deep legal expertise—this is obvious. Importantly, they must also be able to resolve legal risks by designing and implementing multidisciplinary solutions. This requires capabilities across a broad range of professional services including legal, management consulting, financial transactions, people advisory and tax. Only a few organizations in the world have this capability.

The second most important characteristic of an enterprise legal service provider is the ability to bridge a gap which, until recently, separated the legal market into two distinct parts: Firms that gave legal advice—mostly law firms—and providers that delivered legal services through defined, technology-enhanced processes—typically LPOs. Enterprise Legal Service Providers break down this barrier by teaming lawyers, paralegals, process engineers and technologists together, under one roof.

Integrating lawyers into the delivery of legal services may not sound revolutionary—but in many respects it is. Over the past decade, technology and process have dominated the conversation in the legal industry. At times, it has felt as if the purpose of "New Law" is to remove as many lawyers as possible from the delivery of legal services. We believe this approach is misguided.

Technology is useful because it can enhance the work lawyers do by efficiently processing data and documents. Process, on the other hand, is important because it can help identify which resources are needed for each stage of delivery. What is important to recognize is that lawyers, and the expert advice they provide, are an essential component of the legal supply chain. They must be deeply integrated into the new delivery models being developed. Bridging the gap between legal advice and legal services, in this manner, is the primary function of the enterprise legal service provider. Its job is to integrate activities that were previously separate under one unified platform.

The next important capability an enterprise legal service provider must have is a skill set that is particularly important in times of uncertainly and volatility: the ability to work with a client on their terms. Some clients require 'point solutions' designed to solve a specific business problem. Other clients require a service provider which can seamlessly integrate with other third-party vendors. A third type needs holistic solutions. These clients need a service provider capable of bringing a broad range of coordinated skillsets together into a single seamless service. Enterprise legal service providers are able to work in any of these formats. They must be able to support one-time, project-based needs, while, at the same time, supporting larger initiatives focused on ongoing business challenges. This is no easy task. It requires scale and organizational flexibility—traits which, in many cases, are at odds in existing legal market players.

To summarize, enterprise legal service providers must have a wide range of capabilities. They require legal experts—lawyers capable of providing quality legal advice—across a wide range of practice areas and geographies. They must also have the scale necessary to mobilize resources quickly for large, urgent, client needs. They also need expertise in legal technology and legal operations. They must, for example, have strong working relationships with legal tech providers so they can work across platforms. Perhaps most importantly in today's complex quickly changing environment, they must also possess deep non-legal capabilities.

EY has the capabilities of a leading enterprise legal service provider. There are over 3,500 EY lawyers spread across more than 80 countries. The Riverview Law and Pangea3 acquisitions have bolstered EY capabilities in process engineering and legal managed services. EY teams also have leading legal technologists and strong working relationships with many of the biggest legal tech providers. Importantly, EY Law professionals also have strength in important practice areas which work hand-in-hand with traditional legal practice areas: people advisory services, transactions advisory, and corporate transformations. EY Law teams have spent significant time thinking how these services integrate and how EY clients can benefit from this approach to solving a wide range of complex multi-faceted business problems. Before the COVID-19 crisis we believed that the multi-disciplinary model—which teams lawyers, consultants and tax professionals—brought important benefits to clients. In today's environment we believe this way of working is essential.

How will enterprise legal service providers work with existing players in the legal ecosystem?

Will enterprise legal service providers offer every service within the legal market? This is a fair question and it's an important one to answer. Many legal market observers see the expansion of "alternative service providers" as a zero-sum game. They argue that alternative service providers can only win when law firms lose. We believe that this view is misguided and is not supported by recent history.

When document review and e-discovery services were first introduced to the legal market, many believed it would "ruin the law firm business model." It has not. Law firm revenues have continued to climb, and profitability is at all-time highs. Many law firm leaders privately admit that the adoption of document review and e-discovery have been beneficial. These innovations have allowed their firms to focus on the work they are best suited to deliver—high value legal advice. The emergence of enterprise legal service providers offers leading law firms the same opportunity.

We believe that the future of the legal market is clearly one of collaboration. Law firms, technology suppliers and enterprise legal service providers must work together to develop integrated solutions. Law firms will continue to be the premier provider of legal advice. Technology providers will continue to be a major source of innovation, developing much needed tools to enhance efficiency and quality. Enterprise legal service providers, on the other hand, will help integrate these services into a wider platform that stretches beyond the remits of traditional legal services providers. While this emerging collaboration will provide growth opportunities for the legal market as a whole, ultimately, we believe clients will be the biggest winners.

Dr. Cornelius Grossmann is the EY Global Law Leader with currently 3,500+ professionals in over 80 jurisdictions. His experience includes large domestic and international reorganization projects, post-merger integration and financial and operational management.

Nicholas Bruch is EY Global Lead analyst for Law and Tax. He has 10+ years of experience working in the legal industry as a consultant and industry analyst.

Read More

A detailed ALM Legal Intelligence report on EY's global strategy, growth and how its legal arm plays a role in that strategy.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG Law Seeks Alternative Business License, Shaking Up Legal Status Quo

3 minute read

With 'Fractional' C-Suite Advisers, Midsize Firms Balance Expertise With Expense

4 minute readTrending Stories

- 1The Week in Data Jan. 24: A Look at Legal Industry Trends by the Numbers

- 2The Use of Psychologists as Coaches/Trial Consultants

- 3Could This Be the Era of Client-Centricity?

- 4New York Mayor Adams Attacks Fed Prosecutor's Independence, Appeals to Trump

- 5Law Firm Sued for $35 Million Over Alleged Role in Acquisition Deal Collapse

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250