As Salary Cuts Move to Higher-Profit Firms, What Happens Next?

Hugh A. Simons examines where firms might go now that many have taken shorter-term measures to cut compensation. Will layoffs or firm closures follow? What groups are at risk?

May 15, 2020 at 01:03 PM

4 minute read

Image: BigStock

Image: BigStock

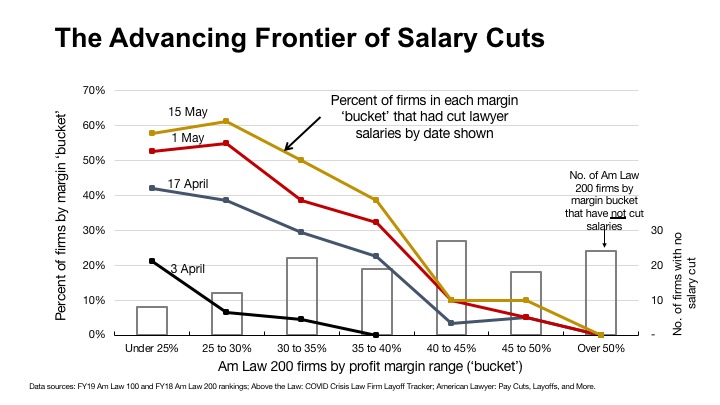

To date, 69 firms have announced cuts in lawyer salary (excluding changes to equity partner compensation). The cuts have advanced across the Am Law 200 as expected: they started out among firms in low profit margin buckets and then broadened to higher margin buckets and deepened within the buckets, as evidenced by the curves advancing rightward and upward over time in the below figure. The rate at which firms are cutting salaries has started to slow—11 firms in the last two weeks compared with 16 in the two weeks prior to that.

What does this suggest for what happens next? No one knows, but three thoughts. First, while the announcements of cuts have slowed, the number in the last two weeks is large enough to suggest they've not ended. Based simply on the shape of the curves on the chart, we might particularly expect more announcements from firms in the under 25% and 40-to-45% buckets.

A second thought is based on the observation that while salary cuts shore up a firm's finances, they don't fix the underlying problem: too many lawyers, specifically more lawyers than can be kept growing professionally at the required pace given the volume of work available to them. With the level of U.S. economic activity not expected to regain its Q4 2019 level until the first half of 2022, this is more than a short-term challenge. Unchecked, it creates a post-recession existential risk for firms: clients decamping to rivals to avoid being served by under-experienced associate cohorts. Hence, we should expect layoffs when lawyers return to their offices (you can't reasonably lay someone off over Zoom).

If you based an estimate of the scale of layoffs on the size of the salary cuts—these have typically been 15 to 20 percent and probably come after an assumed elimination of bonus pools (roughly 20 percent of salary)—you'd get some frightening numbers. It's comforting that the mindset when cutting salaries is that, if you're going to do it, you should go deeper than you could possibly need—you can always give the money back. That said, there's a new class of associates set to arrive (averaging 6-7 percent of lawyer headcount) and voluntary attrition has gone to zero (as it does in any recession). It will be ugly.

A third thought has to do with the prospect of firms folding. As I've argued previously, firms don't fail by having cash run out; they fail by having partners run out, and partners run out when they lose confidence in firm leadership. The leaders who have cut salaries have buttressed their firms' finances substantially in absolute terms and, importantly, relative to peers who have not made cuts. There's the risk of a tipping point developing: when few peers have cut salaries, not doing so projects strength; when most peers have cut salaries, not doing so projects weak leadership. Thus, by not cutting, firms may jeopardize their partners' confidence in leadership. There are 8, 12, and 22 firms that have not cut salaries in the Under 25%, 25-to-30%, and 30-to-35% margin buckets, respectively. If these dynamics took hold at, say, just a third of these firms then, in round numbers, we'd see 10 to 15 firms go under.

Hugh A. Simons is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer and policy committee member at Ropes & Gray. Early retired, he now researches and writes about the business side of law firms and does some consulting for old friends. He welcomes reader reactions at [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Saul Ewing Loses Two Partners to Fox Rothschild, Marking Four Fla. Partner Exits in Last 13 Months

3 minute read

Dentons Taps D.C. Capital Markets Attorney for New US Managing Partner

Exceptional Growth Becoming the Rule? Demand Drove Strong Year for Big Law

Eagles or Chiefs? At These Law Firms, Super Bowl Sunday Gets Complicated

3 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250