For the First Time in Years, the Second Hundred Matched the Top Tier's Growth

The Am Law Second Hundred in 2019 kept pace with the Am Law 100 in nearly every key metric, buoyed by significant growth among those in the bottom half of the list. Will they be able to do it again in a year defined by uncertainty?

May 18, 2020 at 09:30 AM

11 minute read

Credit: art4all/Shutterstock.com

Credit: art4all/Shutterstock.com

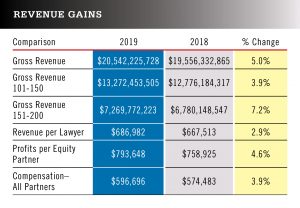

Keeping up with their counterparts in the Am Law 100, the Second Hundred in 2019 saw increases in every key financial metric—and even managed to match the growth of the top tier in gross revenue (5%), revenue per lawyer (2.9%) and profits per equity partner (4.6%).

What data are you using to stand out in a crowded market? Get the interactive Am Law 200 Data exclusively with Legal Compass.

What data are you using to stand out in a crowded market? Get the interactive Am Law 200 Data exclusively with Legal Compass.

Within those numbers, there were pronounced differences among different groups in the Second Hundred, as firms ranked 151 through 200 nearly doubled the growth of those ranked 101 through 150, posting a 7.2% revenue increase on average, compared with 3.9% for the top half of the list. The gap serves as a reminder that although firms may be grouped together, they are often competing in very different aspects of the same game, and operating in a more modest revenue range might just be a winning formula for staying power.

The Second Hundred's relative success in 2019 followed a year in which the group lagged behind the Am Law 100. In 2018, the top tier delivered 8% revenue growth, while the Second Hundred grew by just 3%.

More than in recent years, it wasn't just the behemoths that had success in 2019.

"Publications write that if you are not in the top 50 firms, then you aren't doing well," Brad Hildebrandt, founder of legal management consulting firm Hildebrandt Inc., says. "That is not the case."

The Second Hundred's 5% revenue growth pushed the group to $20.5 billion in total revenue, extending a positive stretch that began last year when the Second Hundred rebounded from a subpar 2017. In that year, the group's overall revenue contracted 0.2%, even while the Am Law 100 posted 5.5% growth.

The Second Hundred's 5% revenue growth pushed the group to $20.5 billion in total revenue, extending a positive stretch that began last year when the Second Hundred rebounded from a subpar 2017. In that year, the group's overall revenue contracted 0.2%, even while the Am Law 100 posted 5.5% growth.

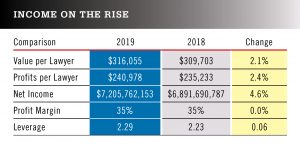

Head count, on the other hand, grew by 2.1% for the Second Hundred in 2019, suggesting these firms are getting more out of their existing attorney rotation. The group's equity partnership tier stayed almost completely flat, declining just two partners, from 9,081 in 2018 to 9,079 in 2019. Nonequity partners saw a slight uptick of 0.7%, which constituted a total of 46 additional attorneys in that band.

Revenue per lawyer increased from $667,513 in 2018 to $686,982 for an increase of 2.9%, while profits per equity partner saw a more substantial increase of 4.6%, from $758,925 in 2018 to $793,648 in 2019.

But not all are created equal within the Second Hundred. Profits per equity partner showed significant gaps among the group's four quartiles. Firms 101 through 125 boasted average partner profits of $915,862; the next 25 firms had an average PEP of $771,497; firms 151 through 175 averaged $742,400; and the bottom 25 on the list came in at $685,520 on average.

RPL was similarly stratified, ranging from $747,286 on average among the top 25 firms in the Second Hundred to $610,444 on average for those occupying the final 25 spots on the list.

Everything's Relative

Three years ago, The American Lawyer wrote about the concept of the "hollow middle" when contemplating the relative success of the Am Law 200. The idea, initially an economic concept, is that those at the top and bottom each have a strong niche they are able to maintain, while those in the middle are less likely to possess a well-defined go-to-market strategy—and thus could find themselves competing against both ends of the spectrum in ways that don't play to their strengths.

What data are you leveraging to sell strategy internally? Get the interactive Am Law 200 Data exclusively with Legal Compass.

What data are you leveraging to sell strategy internally? Get the interactive Am Law 200 Data exclusively with Legal Compass.

For the firms toward the top of the Second Hundred, that means (in some practices areas, not all) competing with Am Law 100 firms for complicated, high-priced work, such as billion-dollar mergers and acquisitions deals or bet-the-company litigation. For those toward the bottom, it means lower-fee, commoditized work, often on a regional level, or niche work performed by boutique firms.

That leaves many firms trying to figure out what they want to be.

"The top 25 or 30 firms [in the Am Law 100], they have the pricing power and the bench for the types of matters and the types of clients that can sustain five-figure billing rates and highly leveraged matters that require multiple lawyers on every project," Mark Silow, chair of Fox Rothschild (No. 69 on the list), says. "Unless you have a real niche and a secure client base and practice area, being a midsize firm is a pretty precarious place to be right now."

"The top 25 or 30 firms [in the Am Law 100], they have the pricing power and the bench for the types of matters and the types of clients that can sustain five-figure billing rates and highly leveraged matters that require multiple lawyers on every project," Mark Silow, chair of Fox Rothschild (No. 69 on the list), says. "Unless you have a real niche and a secure client base and practice area, being a midsize firm is a pretty precarious place to be right now."

He isn't wrong. Growth among the Second Hundred has consistently lagged behind that of the Am Law 100—at least until this year. That is partially because of the skewed strength of the elite firms that drive so much of that group's progress, but also because many of the Second Hundred are playing a game in which they are either outgunned by larger firms or forced to compete for business with smaller boutique firms that have specific industry expertise they can't match.

Bruce MacEwen and Janet Stanton, consultants at Adam Smith Esq., a legal consulting firm focused on law firm economics, find that while the middle is a tough place to be for growth, on the lower end of that tier there appears to be a sweet spot for maintaining comfortable profitability.

"My hypothesis is that there is a sweet spot in the market at about $100 million," MacEwen says. "There is room for very comfortable, $100-million-a-year firms in places like Nashville, Birmingham and Phoenix that serve a solid clientele who are very loyal."

To his point, eight of the firms that landed between No. 168 and No. 188 on this year's list, (whose revenues range from $118 million to $160 million), delivered double-digit revenue growth in 2019. The rest of the Second Hundred included 12 such firms.

MacEwen and Stanton are quick to point out that outgrowing that range isn't necessarily a bad thing. As Stanton quips, "Most partners never saw a revenue stream they didn't like." But the way they go about it and the strategy necessary to maintain consistent annual growth changes as a firm scales up.

MacEwen and Stanton are quick to point out that outgrowing that range isn't necessarily a bad thing. As Stanton quips, "Most partners never saw a revenue stream they didn't like." But the way they go about it and the strategy necessary to maintain consistent annual growth changes as a firm scales up.

"The firms that are a bit more businesslike are pulling away," Stanton says. "They are more cohesive and more intentional [in their strategy]."

MacEwen and Stanton don't think the Am Law 200 offers a perfect example of the "hollow middle" concept, but as stratification of firms into haves and have-nots continues, the industry could see a shift in that direction.

"There are firms that aren't particularly cheap or a destination for anything," MacEwen says. "They don't have a distinction, and we think those firms will be in a more difficult position in trying times."

The Crisis Is Here

And here we are. While the economic effects of COVID-19 are starting to manifest in high unemployment numbers, stock market roller coaster rides and devalued companies, firms have yet to fully grasp what this will ultimately mean for their business. And although the coronavirus doesn't distinguish between the Am Law 100 and the Second Hundred in focusing its economic wrath, the smaller firms might be in a more precarious position.

"I think COVID-19 will affect the Am Law 200 firms more," Hildebrandt says. "There is great advantage to being large and diversified. The bigger firms are generally better capitalized."

The relative impact of the virus on law firm economics could have more to do with just what is in a firm's war chest, though. Geographic factors, such as a regional firm practicing in an area of the country that hasn't been hit as hard by COVID-19, and client loyalty could also play a role in how well the Second Hundred are able to weather this viral storm.

Firms large and small have adopted austerity measures, with many announcing pay cuts and furloughs and some extending those measures to include layoffs.

"It is different than in 2008," Hildebrandt says. "Firms have furloughed staff and not used layoffs. One of the lessons learned [in 2008] was that the work came back quickly and firms were short-staffed."

While larger firms may have more of a buffer when it comes to finances, Marcie Borgal Shunk, president and founder of legal consulting firm The Tilt Institute, says smaller firms might have an advantage over the larger firms when it comes to continuity of culture as remote working continues.

"There is a distinct advantage to being a smaller firm right now—a cultural advantage," she says. "Those firms may not accept layoffs or furloughs and have changed their thinking around that. Larger firms may not have a choice."

Hildebrandt echoes the recent prevailing theory that although they operate in the same industry, comparing how the Second Hundred and their wealthier counterparts in the Am Law 100 will come out of this is to compare two different things.

"This is not one profession," he says. "The firms in the Second Hundred, with some exceptions, aren't competing in the same game."

Inside the Numbers

Although they comprise 50% of the Am Law 200 firms, the Second Hundred only made up 20% of the firms in the top 20 of RPL in 2019, with Irell & Manella (No. 2 in RPL), Kobre & Kim (No. 4), Choate, Hall & Stewart (No. 11) and Munger, Tolles & Olson (No. 12) joining 16 Am Law 100 firms in that grouping.

Irell (No. 170 in the Am Law 200) and Kobre & Kim (No. 160) are in the bottom half of the Second Hundred based on revenue, while Munger (No. 114) and Choate (No. 123) represented the top end of the Second Hundred in that category. Within that grouping, Kobre & Kim saw the largest percentage increase year-over-year, at 15.7%, while Irell managed to stay near the top in RPL even though it saw only a 0.2% increase.

In terms of revenue growth, only three firms between 101 and 125 managed a double-digit increase, with Lowenstein Sandler (11%), Arent Fox (15.4%) and Jackson Walker (10.3%) posting strong numbers.

The next 25 firms included five that exceeded 10%: Fisher & Phillips (10.9%), Knobbe Martens (12.1%), Patterson Belknap Webb & Tyler (10.4%), Brownstein Hyatt Farber Schreck (10.2%) and Ice Miller (10.3%) all grew at a double-digit clip.

There were 12 total firms in the bottom half of the list that grew by at least 10%, including seven in the group between 151 and 175. Burr & Forman (31.2%), Benesch (25.2%) and Buchalter (17.3%), the three Second Hundred firms with the biggest improvements in 2019, were all among that group.

The bottom 25 firms on the list included five that achieved double-digit growth, with Spencer Fane leading the way at 17.1%.

Coming and Going

There were five new entrants to the Second Hundred this year, with Cole, Scott & Kissane (No. 163), Pryor Cashman (No. 178) and Hanson Bridgett (No. 192) joining the fold, while Baker, Donelson, Bearman, Caldwell & Berkowitz (No. 101) and Williams & Connolly (No. 102) dropped down after being in the Am Law 100 last year.

LeClairRyan (now defunct), Jeffer Mangels Butler & Mitchell and Nexsen Pruett dropped out of the Am Law 200, while Husch Blackwell and Gordon Rees Scully Mansukhani elevated from the Second Hundred to the Am Law 100.

The largest gain in ranking was newcomer Cole, Scott & Kissane, which debuted at No. 163. For firms already on the list, Burr & Forman made the largest leap, moving 14 spots from No. 169 to No. 155.

The largest drop overall was that of LeClairRyan, which was ranked 179th on last year's list before dropping out of the rankings (and out of business). The steepest fall for any firm on the list currently was Williams & Connolly, which went from No. 86 to No. 101.

Email: [email protected]

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Hastings, Recruiting From Davis Polk, Adds Capital Markets Attorney

3 minute read

Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

5 minute read

Goodwin Procter Relocates to Renewable-Powered Office in San Francisco’s Financial District

Law Firms Mentioned

- Baker, Donelson, Bearman, Caldwell & Berkowitz, PC

- Choate, Hall & Stewart

- Gordon & Rees

- Fox Rothschild

- Benesch

- Spencer Fane Britt & Browne

- Burr & Forman

- Munger, Tolles & Olson

- Hanson Bridgett Marcus

- Kobre Kim

- Williams & Connolly

- Fisher Phillips

- Patterson Belknap Webb & Tyler LLP

- LeClairRyan

- Ice Miller

- Knobbe Martens Olson

- Husch Blackwell

- Irell & Manella

- Arent Fox

- Jeffer Mangels Butler & Marmaro

- Brownstein Hyatt Farber Schreck, LLP

- Lowenstein Sandler

- Jackson Walker L.L.P.

- Pryor Cashman Sherman & Flynn

- Cole Scott Kissane

Trending Stories

- 1US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 2Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 3African Law Firm Investigated Over ‘AI-Generated’ Case References

- 4Gen AI and Associate Legal Writing: Davis Wright Tremaine's New Training Model

- 5Departing Attorneys Sue Their Former Law Firm

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250