For Those Knocking on the Door of the Am Law 200, Smaller Stature May Be an Asset

"When you have 1,000 or 2,000 lawyers, it's harder to turn and harder to make changes," says Max Crane, managing partner of Newark, New Jersey-based Sills Cummis & Gross, one of 11 firms on the cusp of the Am Law 200.

May 18, 2020 at 09:45 AM

4 minute read

Credit: cunaplus/Shutterstock.com

Credit: cunaplus/Shutterstock.com

Being big has its virtues, but in the present moment midsize law firms—many of which occupy the Am Law 200 or compose the group next in line for entry—are finding advantages in their smaller stature.

What data are you using to stand out in a crowded market? Get the interactive Am Law 200 Data exclusively with Legal Compass.

What data are you using to stand out in a crowded market? Get the interactive Am Law 200 Data exclusively with Legal Compass.

Industry observers and midsize law firm leaders, including two whose firms are among those knocking at the door of the Am Law 200, say that in a time of economic and social upheaval, bigger may not, in fact, be better.

"When you have 1,000 or 2,000 lawyers, it's harder to turn and harder to make changes," says Max Crane, managing partner of Newark, New Jersey-based Sills Cummis & Gross, which last year grew revenue 3.1% to $93 million. "We're big enough to handle the biggest matters but we're pretty nimble. We can change on a dime. We can make short-term changes as needed, and we can make long-term changes if needed."

At a time when changes are needed at nearly every firm, that could give firms such as Sills Cummis and others like it a leg up on some of the competition ahead of them on the Am Law 200.

Chris Gibson, president of Haddonfield, New Jersey-based Archer & Greiner, which was the last firm on the 2017 Am Law 200 and could rejoin if it manages another year of 7.1% revenue growth, as it did in 2019 to reach $95.5 million, shares Crane's perspective, even down to the wording.

"One of the differences between an Am Law 100 or 150 firm and those of us floating around the 200, one of the things I have is an opportunity to be a heck of a lot more nimble," Gibson says. "It's one of the few advantages you have of not having all these international offices and leases. … I have a cost structure that allows me to make modest changes in terms of saving money right now until we see what develops, but also being able to spend money to bring people on when we think it's a good fit and mix with our firm."

Both Crane and Gibson say their firms have made strategic hires even since the coronavirus crisis began, and that they plan to be opportunistic in the coming months.

"I haven't honestly changed our basic plans when it comes to trying to expand in practice areas or trying to expand in geographic areas," Gibson says. "It's just a little more daunting and difficult to achieve these days."

What data are you leveraging to sell strategy internally? Get the interactive Am Law 200 Data exclusively with Legal Compass.

What data are you leveraging to sell strategy internally? Get the interactive Am Law 200 Data exclusively with Legal Compass.

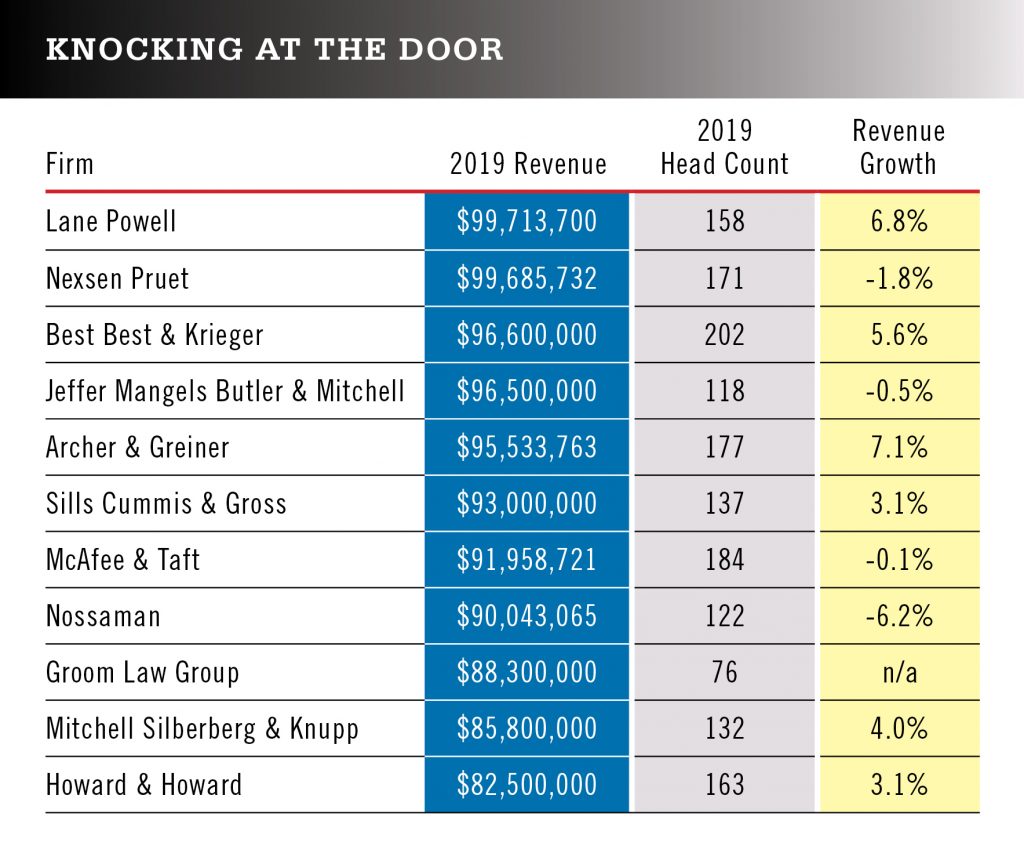

The American Lawyer tracked data for 11 firms that fell between $101 million in 2019 revenue—the cutoff for the Am Law 200—and $82.5 million. They range in head count from 202, at Riverside, California-based Best Best & Krieger, which had $96.5 million in revenue, to the Groom Law Group in Washington, D.C., a benefits, health and retirement firm that brought in $88.3 million with just 76 attorneys, a $1.16 million revenue per lawyer figure that was higher than all but 36 firms on the Am Law 100.

Veteran legal consultant Jeff Coburn says there are plenty of midsize firms that try to grow by "doing things that are crazy" and don't last, but those that are focused—"depth over breadth," he argues—can find a good home around the size of firms such as Sills Cummis and Archer & Greiner.

And for those that cater to the sort of midsize company that needs a trusted adviser now more than ever, this is the time to shine as clients come to them with questions about employment issues, government loans, banking, revenue losses and more.

"I think these law firms are going to have growth, frankly," Coburn says. "There are going to be opportunities for them."

Credit: Roberto Jimenez

Credit: Roberto Jimenez

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Greenberg Traurig Litigation Co-Chair Returning After Three Years as US Attorney

3 minute read

Blank Rome Snags Two Labor and Employment Partners From Stevens & Lee

4 minute read

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute read

After Breakaway From FisherBroyles, Pierson Ferdinand Bills $75M in First Year

5 minute readLaw Firms Mentioned

Trending Stories

- 1Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 2CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 3Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 4Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

- 5The Week in Data Jan. 21: A Look at Legal Industry Trends by the Numbers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250