Lowenstein's Gross Revenue Up 5.5 Percent; PPP Jumps 12.9 Percent

Following incremental growth in fiscal year 2016, Lowenstein Sandler saw marked increases in its financial metrics last year, and did so without lawyer population growth.

February 13, 2018 at 02:53 PM

4 minute read

Following incremental growth in fiscal year 2016, Lowenstein Sandler saw marked increases in its financial metrics last year, and did so without lawyer population growth.

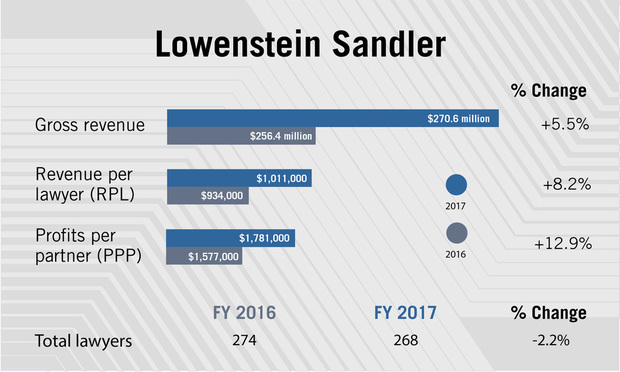

The firm's $270.6 million gross revenue figure represents a 5.5 percent climb from $256.4 million in 2016. Over a five-year period, revenue has climbed by roughly 26 percent, from $215 million in fiscal year 2012, according to historical data.

An increase of better than 5 percent is notable enough in an era where yearly revenue gains no longer can be taken for granted at law firms, though there were even greater gains in Lowenstein Sandler's profitability and per-lawyer metrics.

“There are a lot of models for success in the legal industry—still,” managing partner Gary Wingens said in an interview. “But there aren't a lot of firms that have been able to maintain our size and do the kind of work we're doing.”

Indeed, the size of the firm isn't huge: There was a year-over-year decline of 2.2 percent in attorney head count in 2017, to 268 from 274. And the firm has hovered around the 270-lawyer mark for several years now.

As for the work, Lowenstein Sandler—born in New Jersey and based in Roseland, but with a significant New York practice—has developed a reputation for getting a nice share of transactional work. In 2017, according to the firm, that included advising life sciences firm Altair Engineering Inc. in its $156 million initial public offering, in the capital markets practice; and representing a large number of unsecured creditors' committees in the bankruptcy practice, including in the Vitamin World and Gander Mountain cases.

In litigation, a challenge in recent years given demand and other factors, last year brought resolution of some notable securities matters, including on behalf of Appaloosa Management and Blue Mountain Capital, according to the firm.

The numbers seem to bear out the highlights. Revenue per lawyer (RPL) increased 8.2 percent in 2017, to $1.01 million from $934,000. Wingens said it's the first time Lowenstein Sandler's RPL figure crested above the $1 million mark. According to data from last year's Am Law 200 survey, that RPL figure puts the firm on par with Morgan, Lewis & Bockius ($1.01 million), as well as Cadwalader, Wickersham & Taft; Patterson Belknap Webb & Tyler; and Winston & Strawn ($1.03 million each).

The RPL increase, combined with a 3 percentage point improvement in profit margin, to 32 percent, helped bring a jump in profits per equity partner (PPP) of 12.9 percent, to $1.78 million from $1.58 million. Again going by last year's Am Law 200, the $1.78 million PPP figure places Lowenstein Sandler closest to Jenner & Block.

The largest metric increase by percentage (14.1 percent) came in firmwide profit, which increased to $85.5 million from $74.9 million.

Wingens credited the profit margin bump to improvements in expense management, even as the firm in 2016 joined the ranks of those ratcheting up associate pay: to $180,000 in New York, Washington, D.C., and Palo Alto, California; and to $160,000 in New Jersey and Salt Lake City.

The financial gains in 2017 came after what Wingens characterized as a sluggish start to the year.

“The year did start a little slowly,” he said. “The first two months were quite choppy in a number of our practices, but then we gained steam … including a very good fourth quarter.”

In the litigation practices, Wingens said continued use of alternative fee arrangements—fixed fees, blended rates and shared risk—has helped client and firm alike.

“It has made us better managers of cases, and we believe we're able to make money at it,” Wingens said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Election Law Spending Is on the Rise, but Big Firms Have Reasons Not to Cash In

6 minute read

Troutman Pepper Accused of Inattentive Case Management in $59M Malpractice Suit

7 minute readTrending Stories

- 1BOI Reports: What Business Owners and Attorneys Should Know

- 2SurePoint Acquires Legal Practice Management Company ZenCase

- 3Day Pitney Announces Partner Elevations

- 4The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 5Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250