Lawrence L Bell

August 09, 2022 | Law.com

Congress and the Evolving SECURE ActThe SECURE Act aims to encourage Americans to save more for retirement, in part by making that process easier. Now that SECURE 2.0 has passed the House, it's on its way to the Senate.

By Lawrence L. Bell

13 minute read

January 25, 2022 | Law.com

Tax Implications of Budget Reconciliation BillIn this two-part article, we look at the proposed tax law changes in the budget reconciliation bill — the major legislation in 2021.

By Lawrence L. Bell

14 minute read

July 06, 2021 | Law.com

Biden Administration Budget 2022: Employer Sponsored Death Benefits a Forgotten Planning ToolWhile providing a current benefit for employees, an employer sponsored death benefit is an asset that may create needless taxation if not properly handled. Taking prudent steps will avoid the problems of loss of control and flexibility while minimizing income, estate, transfer and capital income taxes.

By Lawrence L. Bell

22 minute read

June 09, 2021 | Law.com

The CAA's Impact on Health and Welfare PlansIn addition to funding the government and further COVID-19 relief, the recently signed Consolidated Appropriations Act (CAA) included significant provisions impacting health benefit coverage.

By Lawrence L. Bell

15 minute read

November 09, 2020 | Law.com

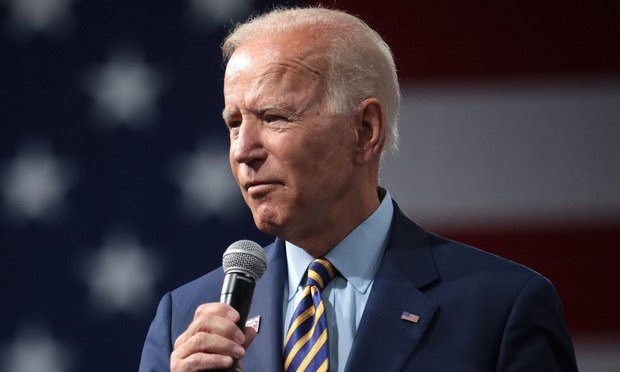

Retirement Planning Under a Biden AdministrationThe election of Joe Biden as President may clear the way for many changes in the retirement planning landscape.

By Lawrence L. Bell

12 minute read

October 21, 2020 | Law.com

COVID-19 and Benefit PlanningThe COVID 19/Pandemic/Shutdown has caused turmoil and upended benefit planning.

By Lawrence L. Bell

9 minute read

May 08, 2019 | Law.com

Executive Benefits at Nonprofits after the Tax Cuts and Jobs ActThe Tax Cuts and Jobs Act made significant changes to certain Internal Revenue Code provisions dealing with highly compensated employees. Among these are restrictions (in the form of excise taxes) on compensation of certain highly paid employees of “applicable tax-exempt organizations.”

By Lawrence L. Bell

10 minute read

March 27, 2017 | Corporate Counsel

Deferred Compensation and Safe Harbor PlansCompanies are constantly looking for ways to recruit, retain and reward valued employees. The Department of the Treasury issued final regulations addressing deferred compensation and safe harbor planning utilizing §§409A(d)(1), 457(e)11 and 31.3121(v)(2). These regulations set forth how plan sponsors can provide death benefits on a permissibly selective basis.

By Lawrence L. Bell, Accounting and Financial Planning for Law Firms

14 minute read

Trending Stories

- 1The Use of Psychologists as Coaches/Trial Consultants

- 2Could This Be the Era of Client-Centricity?

- 3New York Mayor Adams Attacks Fed Prosecutor's Independence, Appeals to Trump

- 4Law Firm Sued for $35 Million Over Alleged Role in Acquisition Deal Collapse

- 5The Public-Private Dichotomy in State-Created Insurance Entities