NAFTA Renegotiation: Fourth Round

This article appeared in The Corporate Counselor, an ALM publication covering the latest changes in business regulatory climates. For Corporate Counsel,…

November 01, 2017 at 03:09 PM

7 minute read

This article appeared in The Corporate Counselor, an ALM publication covering the latest changes in business regulatory climates. For Corporate Counsel, In-House Counsel, Managing Partners. Visit the website to learn more.

As the fourth round of the renegotiation of the North American Free Trade Agreement (NAFTA) with Canada and Mexico drew to a close on Oct.17, the parties opted to push back the starting date of the fifth round until mid-November to allow the negotiators more time to work on the most controversial issues that remain to be addressed. The parties appear to be worlds apart in terms of coming to an agreement on such issues as the rules of origin, a possible five-year sunset provision, the Chapter 19 dispute resolution mechanism, and key provisions involving the agriculture and textile provisions of the Agreement, to name a few. Corporate counsel for U.S. companies that are doing business in Canada and Mexico are urged to continue following these negotiations closely, and assess how proposed changes to the NAFTA could impact their products, operations and supply chains. This article provides a summary and timeline of the NAFTA renegotiation process to date, as well as a forecast for the developments that are likely to come.

How Did We Get Here?

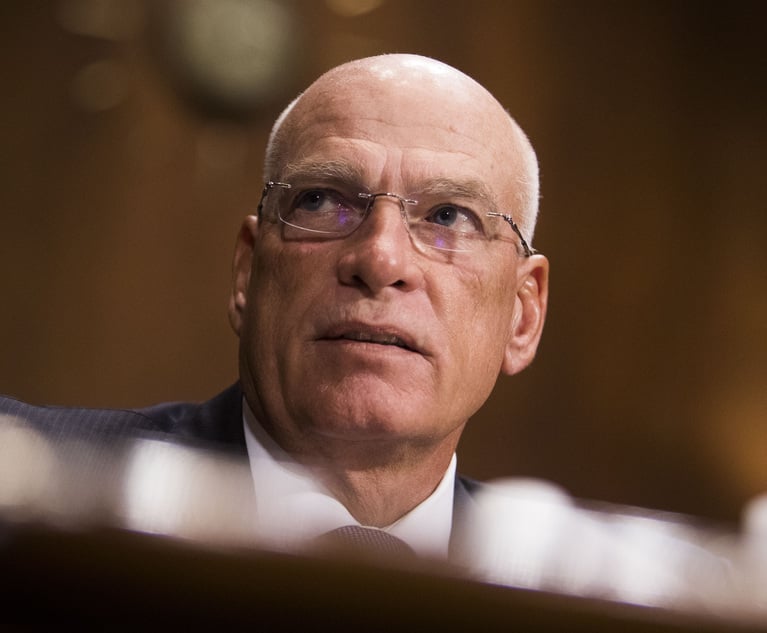

On May 18, 2017, the U.S. Trade Representative (USTR) Robert E. Lightizer submitted formal notification to Congress of the Trump Administration's intent to commence negotiations with Canada and Mexico to modernize the NAFTA, noting that renegotiation was warranted because many provisions of the agreement are outdated and do not reflect modern standards in areas such as digital trade, intellectual property rights and regulatory practices, among others. A few days later, the USTR published a request in the Federal Register for public comments on the negotiating objectives for modernizing the NAFTA.

The USTR also held a public hearing at the International Trade Commission at the end of June, inviting interested parties to testify on the modernization of the NAFTA. More than 12,000 written responses were submitted to the USTR, and more than 140 witnesses from various industry sectors testified during the hearing. Most of the opinions presented reflected U.S. industries' support of the NAFTA, and that the negotiations should not jeopardize existing market access gains by U.S. companies. Specifically, they urged the Trump Administration to adopt the key negotiating principle of “Do No Harm,” as suggested previously by USTR Lighthizer.

On July 17, 2017, the USTR published a summary of its specific objectives for the renegotiation of the NAFTA, which included the following:

- Removing barriers on U.S. goods exported to Canada and Mexico.

- Improving opportunities for U.S. agriculture and textiles.

- Implementing enforceable and transparent sanitary and phytosanitary measures.

- Providing for streamlined and expedited customs treatment for express delivery shipments.

- Providing for a de minimis shipment value like the U.S. de minimis shipment value of $800.

- Updating the rules of origin, and streamlining certification and verification of the origin rules.

- Preventing measures that restrict cross-border data flows.

- Eliminating non-discriminatory treatment of digital products transmitted electronically.

- Establishing rules that reduce or eliminate barriers to U.S. investment in all sectors.

- Promoting adequate and effective protection of intellectual property rights.

- Ensuring impartial regulation of SOEs, designated monopolies, and private companies.

- Bringing the labor provisions into the core of the Agreement rather than in a side agreement.

- Enacting laws on minimum wages, hours of work, and occupational safety and health.

- Bringing environment provisions into the core of the Agreement.

- Eliminating the NAFTA global safeguard exclusion.

- Eliminating the Chapter 19 dispute settlement mechanism.

- Enacting transparent, predictable, and non-discriminatory rules to govern government procurement.

These objectives reflected many (though not all) of the items on the wish lists of various U.S. industry sectors. Even though the USTR stated that it would maintain existing reciprocal duty-free market access for trade in goods (including agricultural products), there was no specific mention of the application of the “do no harm” principle in this list for the jobs, businesses and industries that currently depend upon that trade with Canada and Mexico. Many industry sectors urged the Administration to maintain current NAFTA benefits and to avoid disrupting the demand for U.S. exports.

Update on the First Four Rounds

The renegotiation of the NAFTA will be carried through seven rounds of talks, held in three-week intervals, in the hopes of completing the process before Mexico's 2018 presidential election is in full swing; however, it is likely that the negotiations will extend until at least the first quarter of 2018. The first round of talks took place in August in Washington, DC; the second round was held in Mexico City during the first week of September, and the third round occurred in Canada later that month. The first three rounds targeted less controversial issues, such as the NAFTA chapters dealing with small and medium-sized enterprises (SMEs), telecommunications, digital trade, sanitary and phytosanitary measures, state-owned enterprises, competition law, and customs and trade facilitation.

As mentioned herein, the fourth round was completed on Oct. 17 in Washington, DC, and the parties issued a joint statement announcing that the NAFTA chapter on competition had been closed, with agreements to provide increased procedural fairness and enforcement of the parties' competition laws. The U.S. negotiators, in a push to eliminate Chapter 19 from the NAFTA, introduced and later tabled a proposal for a non-binding dispute settlement mechanism that would allow parties to disregard panel decisions if they were “clearly erroneous.”

The U.S. also proposed conducting sunset reviews of the NAFTA every five years, and decided to table its proposal to increase the NAFTA rules of origin for automobiles (i.e., potentially eliminating the tariff shift rules, expanding tracing requirements to cover all components of a car, raising the regional value content requirement to 85%, and requiring that 50% of the overall content originate from the United States). The U.S., Mexico and Canada have decided to delay the fifth round of the negotiations until mid-November to give the parties more time to consider the new proposals that were introduced.

USTR Lighthizer, in his closing statement following the fourth round of talks, stated that he was “surprised and disappointed by the resistance to change” from Canada and Mexico, and he referred specifically to their rejection of certain proposals that were identical to provisions they had previously agreed to during the negotiation of the Trans Pacific Partnership (TPP) Agreement. From Canada and Mexico's point of view, Canada's Minister of Foreign Affairs stated that the U.S. proposals would “turn back the clock on 23 years of predictability, openness and collaboration,” and the Secretary of Economy of Mexico stated that “we must understand that we all have limits.”

Upon the conclusion of all seven rounds, if the parties can successfully reach a consensus on the modernization of the NAFTA, the resulting agreement will ultimately be submitted to Congress for approval. Because the President currently has what is known as “Trade Promotion Authority,” Congress must consider the renegotiated agreement, work with the Administration on drafting the implementing legislation, and vote without making any additional amendments to the agreement itself.

Concluding Thoughts

Corporate counsel advising U.S. companies operating in, sourcing from or marketing to customers in Canada and Mexico should continue to monitor the renegotiation of the NAFTA closely, consider reaching out to members of Congress and other key government decision-makers, assess how the proposed changes to the NAFTA may impact their supply chains, and ensure that their interests are considered and protected throughout this process.

Melissa Proctor is the founder of Miller Proctor Law PLLC, an international trade law firm located in Scottsdale, AZ. She advises companies on international trade issues, including export controls, embargoes and economic sanctions, customs laws, anti-corruption compliance, and other agency requirements that impact the cross-border movement of goods, information and services. She may be reached at 480-447-8986 or [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

Latham, Kirkland Alums Land the Top GC Posts—Here's What It Means for Business Generation

10 minute read

Sullivan & Cromwell Didn't Ignore FTX Red Flags, Second Examiner Report Concludes

Trending Stories

- 1Call for Nominations: Elite Trial Lawyers 2025

- 2Senate Judiciary Dems Release Report on Supreme Court Ethics

- 3Senate Confirms Last 2 of Biden's California Judicial Nominees

- 4Morrison & Foerster Doles Out Year-End and Special Bonuses, Raises Base Compensation for Associates

- 5Tom Girardi to Surrender to Federal Authorities on Jan. 7

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250