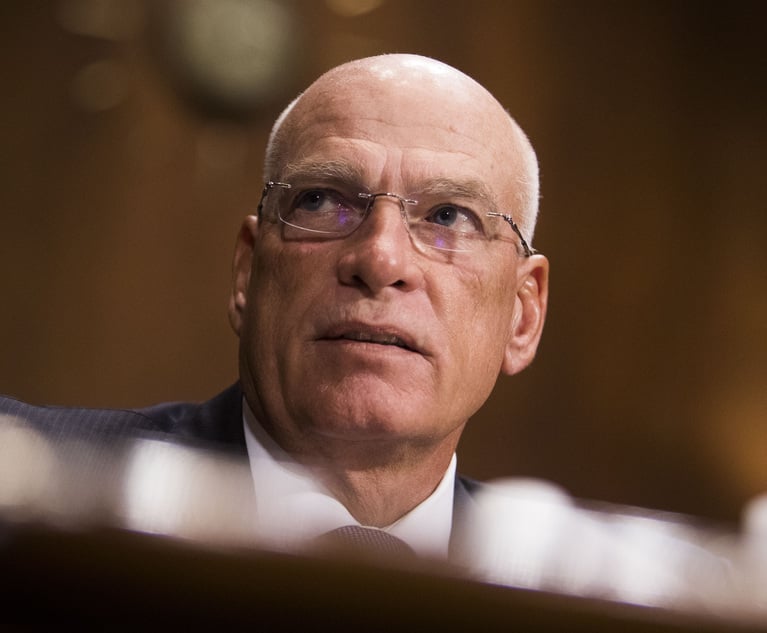

Target's Don Liu Talks Morale in Retail, Tax Reform and DACA

Don Liu, the chief legal officer for the Minneapolis-based retail chain, has done much work to familiarize himself with the industry and has worked on major legal and business decisions during his brief tenure.

December 29, 2017 at 11:14 AM

6 minute read

When Don Liu joined Target Corp. in the summer of 2016, he couldn't have imagined what he would be facing when he dove head first into the retail industry.

The chief legal officer for the Minneapolis-based retail chain has done much work to familiarize himself with the industry and has worked with the company on major legal and business decisions during his tenure.

Liu spoke to Corporate Counsel about what his job at Target has been like so far. The conversation was edited for length and clarity.

What do you consider to be some of your biggest milestones at Target so far?

Aside from learning a new industry, company and team, along with Minnesota's geography and culture, I'd point to integrating multiple functions into one legal affairs team as a top accomplishment this past year. This move brought the risk and compliance, employee and labor relations, and law teams together, centralizing Target's expertise and resources related to legal matters so we can best support the business. The benefits of a unified group were quickly apparent—both to our team, and to our partners across the company.

Several retail GCs have expressed that morale among retail in-house lawyers is low. Has that been felt at all in Target's legal department?

Right now, as Target is making huge investments in the business, there is a lot of great energy across the team. Results from our annual team survey showed the legal affairs group has high confidence in Target's strategy and strong optimism in our future. To be sure, making that progress is always a lot of work. And while the team is putting in a ton of effort to help the company during a transformative time, I hear from team members all the time that seeing it start to pay off is really fulfilling.

Timothy Baer, Target's longtime GC, stayed on for a yearlong transition after you arrived. What was that like for you?

Honestly, I had a little bit of concern. The issue was, “Will he truly allow me to truly take over the leadership role of the department when he'd been the leader for 10 years and he'd been here for 20 years?” The way it worked out was frankly better than I ever anticipated. He was an incredibly important adviser to me. But also when there were some tricky issues I had the benefit of getting a second perspective.

Frankly, one of the hardest things that he did, which I will be forever indebted to him for, is that he also got out of the way when there was a possibility for confusion. So every time someone came in and said “Hey Tim, you know, I need legal help.” He would say “I'm no longer the general counsel, go talk to Don.” And that took a tremendous amount of discipline and confidence to be able to hand over and say “Don's the guy you want to talk to.” He walked that fine line of being a great adviser to me but also being clear as to who took over the leadership role.

When Target's chief risk and compliance officer Jackie Rice left earlier this year, you inherited her team. Many companies, of course, are adding manpower for this function. Why did Target opt not to replace her?

During Jackie's time at Target, she stood up a strong team, developed close connections between the risk and compliance experts and company leaders, and elevated the role of Target's board of directors in the company's risk and reputation matters. When she made the decision to leave, we evaluated the role and decided that—given the work she and the team had done over the past few years to enhance Target's risk and compliance function—it was the right time to further integrate the team into the legal affairs organization so we could continue building on that strong foundation. We elevated one of my direct reports to SVP and put the risk work under his leadership. At the same time, I took on the responsibility of chief risk and compliance officer, and I can tell you that this area will always be a priority for me and the company.

Target has been involved in various public policy issues. When do you and your team get involved?

I'm probably involved in two or three ways. The [Deferred Action for Childhood Arrivals] DACA letter is a good example. First and foremost, we ask “should Target have a voice on the DACA issue?” That's a business question. That's when I get involved on the business level. And if we're going to have a voice externally, how should we get involved?

That's getting government affairs people involved and legal people as well. So there were immigration law issues that my lawyers were involved with, as well as getting comfortable in the way in which we're going to express reviewing a letter and making sure we're signatory to a letter we can be proud of.

How does Target evaluate whether it should be involved in an issue personally if one of the larger retail associations such as the National Retail Federation or the Retail Industry Leaders Association are already involved?

First and foremost is the issue we want to be involved externally in taking a position critical to our business: Is it important to its shareholders? Is it important to our guests? Is it important to our team members? Those are three different lenses to look into. That's just some of it. There's a much larger set of criteria that's utilized. There's a team here at Target who focus on this issue whether and how to engage externally.

A good example of that in addition to DACA would be the border adjustment tax [BAT] provision we were actively engaged in. My CEO [Brian Cornell] was personally involved. He testified before Congress and probably was viewed as the industry leader spokesman, if you will.

BAT was critical because it would have bumped up the tax that as a company we would have to pay by close to double the tax rate that we're in. So it obviously impacted our shareholders. It probably would have increased prices that the guests would have to pay.

The third we had some issues as a matter of principle of how this might impact the entire industry. So when you look through the different lenses it made sense that we should get involved. And because of the way in which I think Brian … was so articulate about [the subject]. He was able to persuade Congress not to go there. And I think it was a good decision not only for Target but the American consumers overall.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

GC With Deep GM Experience Takes Legal Reins of Power Management Giant

2 minute read

US Reviewer of Foreign Transactions Sees More Political, Policy Influence, Say Observers

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

Ex-Red Robin CLO Joins Norton Rose Fulbright After Helping Sell Latest Employer for $4.9 Billion

Trending Stories

- 1Call for Nominations: Elite Trial Lawyers 2025

- 2Senate Judiciary Dems Release Report on Supreme Court Ethics

- 3Senate Confirms Last 2 of Biden's California Judicial Nominees

- 4Morrison & Foerster Doles Out Year-End and Special Bonuses, Raises Base Compensation for Associates

- 5Tom Girardi to Surrender to Federal Authorities on Jan. 7

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250